Technology start-ups receive the most support from venture capital. Of the 550 venture capital and private equity deals closed last year in Spain, 274 involved a technology company. Among the technology companies, e-commerce and collaborative consumption lead the way. In March 2015, 8 technology companies received funding rounds.

Investment opportunities in Spain: IT

The IT investment sector remains the most active sector in terms of deals. But there are aspects that are changing: new segments, other types of investors, etc.

Europe's cloud computing receives 30% more investment each year

Investors have seen European cloud computing companies as a source of opportunity. As a result, investment rounds are growing by 30% each year and since 2009 they have established themselves as one of the preferred sectors for investment.

The role of corporations as investors in Startups

In 2014 it was time for Corporations to take a leading role in innovation investment. Moves are coming from the US for Corporations to bring their strategic input to the fore as an advantage over Venture Capital.

Good prospects for venture capital in Spain in 2015

KPMG's prospective report on private equity in Spain, based on a survey completed by 129 executives from 113 private equity firms, shows signs of optimism, reinforced by the good results obtained in 2014.

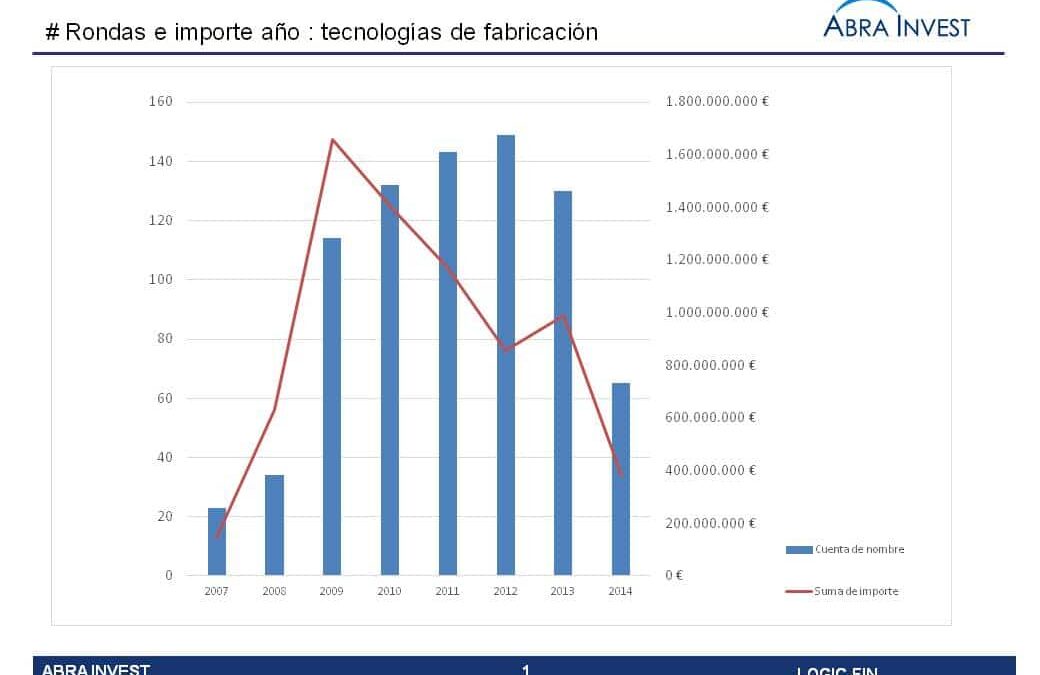

Investment analysis of the advanced manufacturing sector

Starting in 2009, the manufacturing technologies sector, which enables time- and cost-saving manufacturing, attracted many investors. A total of 790 rounds and an amount of $7.236M has been raised in the sector to date. In the following we will take a look at...

Venture capital analysis at CapCorp 2014

Esta semana desde ABRA INVEST hemos asistido en Madrid al congreso anual de capital riesgo organizado por Capital & Corporate. Una de las conclusiones ha sido el crecimiento del ecosistema español del venture capital que todavía tiene mucho que hacer para llegar...

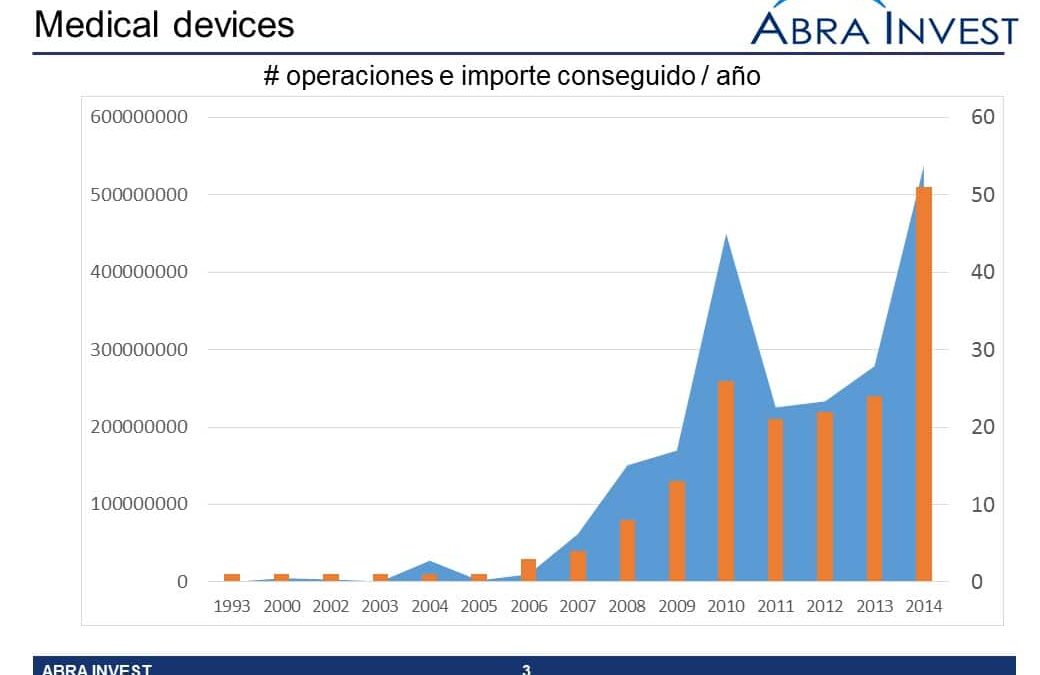

Investment in medical devices has a long way to go

The development of devices applied to healthcare received double the number of financing rounds in 2014, with 51 deals, compared to 21 in 2013. The sector is taking shape and there is still a long way to go before it reaches maturity. Proof of this is the small but growing number of acquisitions by corporations.

The technologies that make energy efficiency possible

The technologies that make energy efficiency possible A recent study by McKinsey states that, over the next 20 years, at least $37 billion will be invested annually in energy efficiency, using the new technologies available. American investors have been investing in the sector for some years now, with very good results, such as Hannon Armstrong, which last year made its debut on the New York stock exchange, with notable success. In Spain, the first funds focused on this sector are already being created.

Most active VC investors in Europe in the first half of 2014

Index Ventures leads the list of the most active investors in the first half of 2014 with 11 venture capital deals, and has also completed five more deals in early-stage companies.

H1 2014, How is VC evolving in Europe?

En el 1S 2014, la inversión del Venture capital en Europa ha crecido un 27% en el número de operaciones y un 70% en el volumen invertido respecto al mismo semestre del 2013. Después del incremento de actividad de Venture Capital en el último trimestre del 2013, el...

E-COMMERCE IN CLOTHING IS IN TREND AND INVESTORS KNOW IT.

According to data from the prestigious Kantar Worldpanel, online fashion sales in Spain grew at a dizzying rate of 32% in 2013, increasing its customer base by 600,000 new buyers. Last year, 3,100,000 Spaniards bought fashion online. Corporate investors know this and have not wanted to miss the opportunity.