Thinking of growing by acquiring companies?

Increasing your competitive advantage through buyouts

En Baker Tilly somos asesores especialistas en la compra de empresas del sector tecnológico optimizando la probabilidad de éxito y las condiciones de la transacción

We find the best investment for your growth.

Y te acompañamos en todo el proceso de compra

At Baker Tilly Tech M&A Advisors we have a team of professionals in M&A for companies in the technology sector, with the necessary experience to carry out the important process of finding the right buyer for the sale of your company.

Specialists in the technology sector

Advanced understanding of technology trends, business models and sector-specific valuations.

Continuous contact with technology SMEs

We know the companies willing to be part of a growth project.

Successful

negotiation

We advise the investment agent on how to be competitive in their offers with minimum risk.

Our method to acquire a successful business

How can I find the right investment that creates the best synergies to make my company grow? We make sure we find a company that understands the differential values of your project and has the necessary synergies to make your company's investment successful.

1. Preparation

Preparing for the acquisition of a company involves organising all resources and defining key objectives. This ensures that the acquisition process is efficient and aligned with the strategic goals of the acquiring company. This includes clarifying the objectives of the acquisition, such as market expansion, product diversification or integration of new technologies. It is essential to organise the financial, human and operational resources needed to carry out the acquisition, ensuring that everything is in place for an effective integration.

2. M&A Strategy

The mergers and acquisitions (M&A) strategy defines the approach and criteria for selecting companies to acquire. The strategy should consider the long-term vision of the company, such as its growth and expansion objectives, and use specific criteria to evaluate and select target companies. These criteria may include financial, operational, strategic and cultural factors.

3. Target analysis

Target analysis involves identifying and evaluating companies that could be acquired. This analysis considers financial, operational and strategic factors. This analysis begins with the identification of candidate companies that align with the strategic objectives of the acquiring company. Criteria used to evaluate these companies include their financial health, operational capability, market position and growth potential.

4. Business valuation

Valuing the potential business is crucial to determine a fair purchase price. Different methods are used to estimate the economic value of target companies. This process must consider factors such as current and projected revenues, assets and liabilities, and growth potential. Accurate estimation of the economic value of target companies allows the acquiring company to negotiate in an informed manner and ensure that the acquisition is financially viable and strategic.

5. Negotiation & LOI

Negotiation and the letter of intent (LOI) are critical steps in the procurement process. During negotiation, the terms of the acquisition are discussed and agreed, covering aspects such as the purchase price, payment terms, and any contingencies or warranties. The LOI formalises the buyer's interest and sets the basis for the final agreement, detailing the preliminary terms and conditions agreed.

6. Due Diligence

Due diligence is a thorough review of the target company to confirm its financial, legal and operational status. This process is crucial to identify risks and opportunities. During due diligence, all aspects of the company are reviewed, including its financial statements, contracts, intellectual property, and any other relevant factors.

7. Closure and contracts

In the closing phase, the contracts necessary to formalise the acquisition are finalised and signed. This step concludes with the transfer of ownership and the fulfilment of the agreed conditions. It is essential to ensure that all legal documents are in order and that all necessary steps are followed to formalise the deal, including the signing of confidentiality agreements and the transfer of assets.

8. Integration / Post-closure

Post-closing integration involves combining the operations and cultures of both companies to maximise synergies and value. It is an ongoing process that requires effective planning and management. This process is ongoing and requires effective planning and management to ensure a smooth transition. Integration can include operational process alignment, technology systems integration, and cultural change management. It is crucial to establish a detailed integration plan, assign clear responsibilities and maintain open and transparent communication with all employees and stakeholders.

Do you want to to know about relevant acquisition opportunities

in the technology sector?

At Baker Tilly we analyse the market with the latest Market Intel technology, providing financial and strategic investors with the necessary knowledge to evaluate investment opportunities.

Key aspects in the purchase of companies

It is a process that requires in-depth knowledge of the sector in which you want to invest and the negotiating skills of an experienced professional to increase the chances of closing and improving conditions.

We are the specialist technology area

of BT's global network

M&A transactions

advised by BT globally

operations

for technology companies

people

dedicated to M&A in EMEA

13

in the world ranking

of M&A companies in 2023

Own M&A Data Analytics: Intelfin

Our proprietary Intelfin platform provides us with comprehensive and up-to-date information on technology companies and the sector.

Tailor-made

Market Research

Our consultantsthrough our technology and sectoral analysis, examines data to understand opportunities and the competitive environment.

Methodology

The experience and expertise of the whole team is the result of advising on hundreds of transactions, leading sales with high quality standards.

Success cases

Successful business sale transactions completed by Baker Tilly

Opinions about our work

Frequently Asked Questions of our clients on the buy-side advisory services

What is buyouts?

The purchase or acquisition of companies is the process by which one entity acquires part or all of another company. This process can involve companies of any size and in any sector, and can be carried out for a variety of strategic or financial reasons: market expansion, capacity building, search for synergies, product diversification, elimination of competition, etc.

Baker Tilly's expert M&A advisors help you navigate the complex acquisition process, ensuring that the benefits are maximised and the risks associated with buying companies are minimised.

What are the advantages of growing by acquiring a company?

Growing by acquiring a company offers a number of strategic and operational advantages that can accelerate growth and improve competitiveness, for example:

- Rapid access to new markets and customers

- Increased capacity and production

- Synergies and economies of scale

- Diversification of products and services

- Increasing competitiveness and eliminating competition

- Accelerating growth

- Access to new technologies and skills

- Improved financial position

- Strengthening brand and reputation

Working with specialist M&A advisors can help you identify the most strategic acquisition opportunities, assess the potential benefits and plan effective integration to maximise the advantages of growth through acquisitions.

What are the keys to a successful buyout?

A successful buyout process depends on careful planning, precise execution and effective integration. For us, some of the keys to success in a corporate takeover include:

- Developing a clear strategy with defined objectives, aligned with your company's vision and long-term strategy, will enable us to more clearly identify target companies.

- Exhaustive Due Diligence: Conduct an in-depth analysis of some of the most important aspects of the target companies (financial statements, revenue projections, debts, outstanding legal issues, regulatory compliance, intellectual property, etc.).

- Appropriate valuation and price structuring, using appropriate valuation methods and considering different payment possibilities.

- Secured financing: It is important to develop a financing plan, specifying the terms and conditions of lenders or investors to ensure a sustainable financing structure.

- Detailed Integration Plan, developed on a team basis by members of both companies, through clear and effective communication, identifying opportunities for synergies and operational efficiencies to maximise the value of the acquisition.

- Identification and management of potential risks and development of a mitigation plan.

- Continuous monitoring and evaluation of integration progress and post-acquisition performance.

- Professional advice:M&A expert advice is important, at Baker Tilly we help you to implement these keys in your buyout process, with a strategic approach that will significantly increase your chances of success.

What aspects can ruin an acquisition?

Acquiring a company can be a complex and challenging process, with multiple factors that can potentially ruin it. Some of the most critical aspects that can lead to the failure of the sale process are:

- Inadequate or incomplete Due Diligence

- Incorrect valuation of the target company

- Problems in the financing structure

- Poor integration

- Lack of synergies

- Talent Retention

- Legal and regulatory issues

- Change in market conditions

- Corporate Governance Issues

- Lack of Long Term Vision

To minimise these risks, it is essential to have an experienced, multidisciplinary team overseeing every stage of the acquisition process, from due diligence to post-acquisition integration.

What is due diligence in acquisitions?

Due diligence is the process of conducting a thorough investigation and analysis of a target company before completing and acquisition of a company. The purpose of due diligence is to evaluate the target company's financial, legal, operational, and strategic aspects to identify potential risks, opportunities, and synergies in detail - mainly to confirm all the issues.

The due diligence process is a critical component of the M&A process, and its thoroughness and quality can significantly impact the success of the transaction. The process can be time-consuming and resource-intensive, but it is essential to ensure that the acquiring company has a complete understanding of the target company's business and risks.

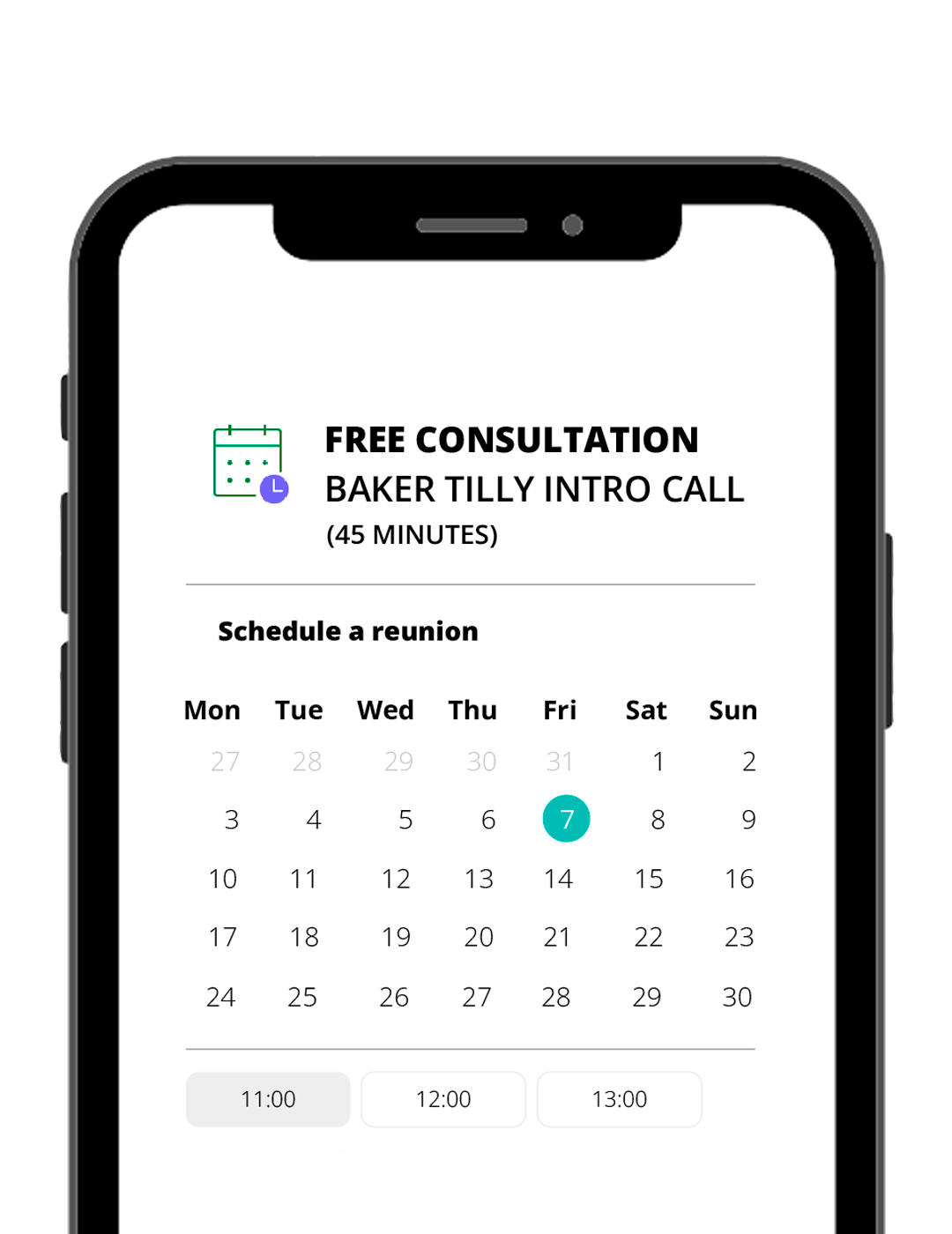

Talk to our specialist M&A advisors

If you're looking to acquire a technology company, our M&A advisors will guide you through every step of the process. From identifying opportunities to negotiating and closing, we optimize your investment to ensure the growth of your business. Schedule a free consultation and take the first step towards a strategic purchase.

Ready to grow by buying companies?

If you want to buy or sell a company, or need more information about our services, do not hesitate to contact us through the form.

Or if you prefer, call us: