Looking yo finance your next investment?

Find the best alternative financing outside the banking system

At Baker Tilly we are specialists in alternative financing in the technology sector, guaranteeing the best conditions.

The access to adequate financing

is essential for the growth and sustainability of your business

At Baker Tilly Tech M&A Advisors we help you find innovative options outside of traditional banking institutions that best suit yout needs, allowing you to obtain the capital to take your company to the next level.

We assess your financial situation to find the best financing

We identify the

type of financing suitable for your need

We advise on all the details

of the operation until closing

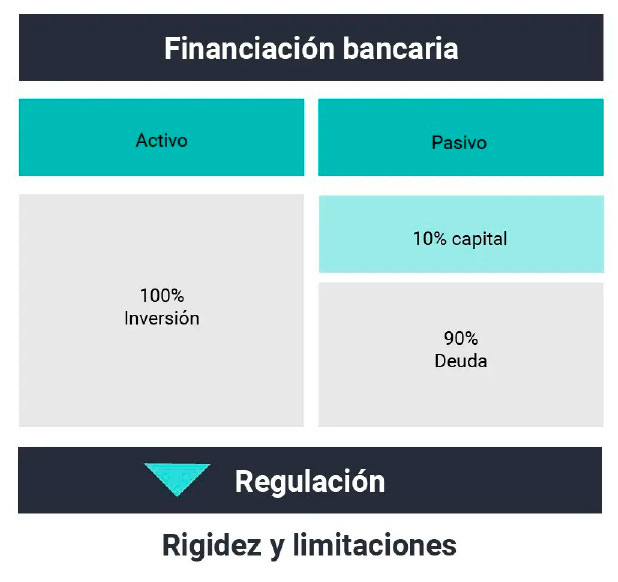

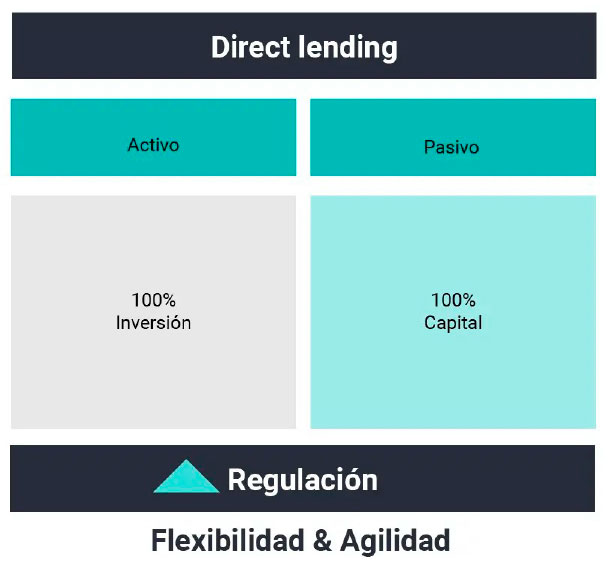

Advantages of alternative financing

compared to the traditional

Alternative financing offers some significant advantages over traditional sources such as bank financing. Access to a greater diversity of capital sources allows for diversified risks, offers greater flexibility, more agile processes and more accessible options.

Flexibility and variety

Access a wide range of financial options to suit your specific needs.

Speed of approval

Faster application processes with less bureaucracy.

Less restrictions

Greater ease of access for companies with different credit profiles.

Do you want to know your options of alternative financing?

At Baker Tilly, we offer you the best financing options for your company.

Our tailor-made financing solutions for companies and SMEs

At Baker Tilly Tech M&A Advisors, our team of alternative financing professionals work with you to identify and secure the best financing options for your business. From crowdfunding to peer-to-peer lending, we help you explore all available alternatives.

Venture Debt

It is a financing that combines venture capital and a traditional loan. In exchange for the loan, interest is paid and the company's capital is delivered. It is medium-term financing.

Cash Flow Lending

Medium and long-term financing based on the company's future cash flows. It is used for investments, asset purchases, and project execution.

Renting and Sale & Rentback on assets

Sale of an asset, usually a property, and then lease it for the long term. Long-term financing, with guarantee based on productive assets.

Loan to finance the purchase of companies

Financing for the purchase of other companies or business units. The terms are determined by the creditworthiness of the purchased company and the business plan.

Bridge loan

Loan for temporary and urgent financing needs, such as covering the treasury. It is flexible and agile.

Credit liquidity

Financing for cash flow needs, one-off or recurring, such as financing purchases or supplementing working capital.

Factoring without recourse

The company cedes the right to collect and risk its invoices in exchange for receiving the amount before the due date. It improves solvency, debt and liquidity ratios without appearing on the balance sheet.

We are the specialist technology area

of BT's global network

M&A transactions

advised by BT globally

operations

for technology companies

people

dedicated to M&A in EMEA

13

in the world ranking

of M&A companies in 2023

Own M&A Data Analytics: Intelfin

Our proprietary Intelfin platform provides us with comprehensive and up-to-date information on technology companies and the sector.

Tailor-made

Market Research

Our consultantsthrough our technology and sectoral analysis, examines data to understand opportunities and the competitive environment.

Methodology

The experience and expertise of the whole team is the result of advising on hundreds of transactions, leading sales with high quality standards.

Success cases

Successful transactions completed by Baker Tilly

Opinions about our work

Frequently Asked Questions of our clients on alternative financing

What is alternative financing?

Alternative financing encompasses a variety of ways to raise capital outside of traditional sources, such as banks and conventional financial institutions. It includes options such as crowdfunding, venture debt and peer-to-peer loans, among others.

How do I know if alternative financing is right for my company?

Alternative financing may be suitable if you are looking for speed in approval, flexibility in terms, or if you have difficulty accesing traditional financing. Our experts at Baker Tilly can help you assess your specific needs and recommend the best option.

What is the difference between Venture Debt and traditional financing?

Venture Debts combines elements of venture capital and traditional loans, offering capital in exchange for interest and a portion of the company's equity. It is a medium-term option that does not require collateral as strict as traditional loans.

How does Cash Flow Lending work?

Cash Flow Lending is based on the company's expected future cash flows as collateral for the loan. It is ideal for financing investments, asset purchases, and project execution, as it focuses on the ability to generate future income.

What benefits does non-recourse factoring offer?

Non-recourse factoring allows companies to assign their outstanding invoices to a third party, who assumes the risk of collection. In exchange, the company receives the amount of the invoices before they are due, improving its liquidity, solvency and indebtedness without affecting its balance sheet.

When is it advisable to use a bridge loan?

A bridge loan is recommended for temporary and urgent financial needs, such as covering a cash flow gap or financing a specific project until a larger final loan is obtained. Its main advantage is the speed and flexibility in obtaining capital.

What is Renting and Sale & Rentback on assets?

Renting and Sale & Rentback consists of selling a company asset, usually a property, and then leasing it for the long term. This allows the company to obtain immediate liquidity while still using the asset, being a long-term financing option based on productive assets.

What types of businesses can benefit from alternative financing?

Virtually any type of business can benefit from alternative financing, from startups and SMEs to large corporations. The key is to identify the financial solution that best suits your specific needs and goals.

How can I begin the alternative financing application process with Baker Tilly?

To get started, simply fill out our contact form on the website and one of our specialists will contact you to guide you through every step of the process, from assessing your needs to securing the right financing.

What are the benefits of working with Baker Tilly for alternative financing?

At Baker Tilly, we offer personalized advice, access to a wide network of investors and financing options, and a comprehensive approach that considers all the variables of your business. Our goal is to help you obtain the necessary capital in the most efficient and favorable way possible.

The first step to boosting your business starts here

If you want to buy or sell a company, or need more information about our services, do not hesitate to contact us through the form.

Or if you prefer, call us: