In recent years, concern for the environment and the use of alternative energies have led to the emergence of investors specialising in this sector, and these investors have been increasing their portfolios as new start-ups focused on this sector appear. In addition, other venture capital firms not focused solely on this sector are increasing their operations in the sector.

ICTs applied to the Cleantech with the approval of investors

The introduction of new technologies in the Cleantech sector, such as home automation, the internet of things and big data, has made it possible for investors and companies that were reluctant to invest in this type of sector to invest recently, such as Google, which has acquired Nets for $3,200M. Nets is a manufacturer of home devices such as thermostats and smoke alarms.

Cabiedes and Partners' investment activity in 2013

Cabiedes, which began as a pioneering business angel in the Spanish internet market, has grown and evolved to become one of the most recognised venture capital firms for technology startups in our country. The three issues...

Investors in software that connects doctors with patients

New technologies applied to connect with professional experts present a wide range of opportunities, even in sectors where it seemed impossible, as in the case of medical care. In recent years, numerous companies have emerged that use new technologies to carry out patient monitoring, thus saving time and costs and providing a more personalised service. Venture capital has not wanted to be left behind and has decided to invest in the sector.

Strong growth in the e-health sector

Numerous companies have taken advantage of the concern for health and wellbeing and the increased use of new technologies to create innovative companies in this field. Investors have not been left behind and are betting heavily on the sector. Proof of this is that the number of Series A and B rounds in the health sector has increased by 179% from 2010 to 2013, from 24 deals in 2011 to 67 in 2013.

Latest investments in HR technology

The use of new technologies for hr management is a great source of opportunities such as task efficiency, cost reduction, increased productivity or improved internal communication and coordination, which have not gone unnoticed by investors. This is why in recent years we have witnessed a large number of operations, first at international level, and little by little at national level.

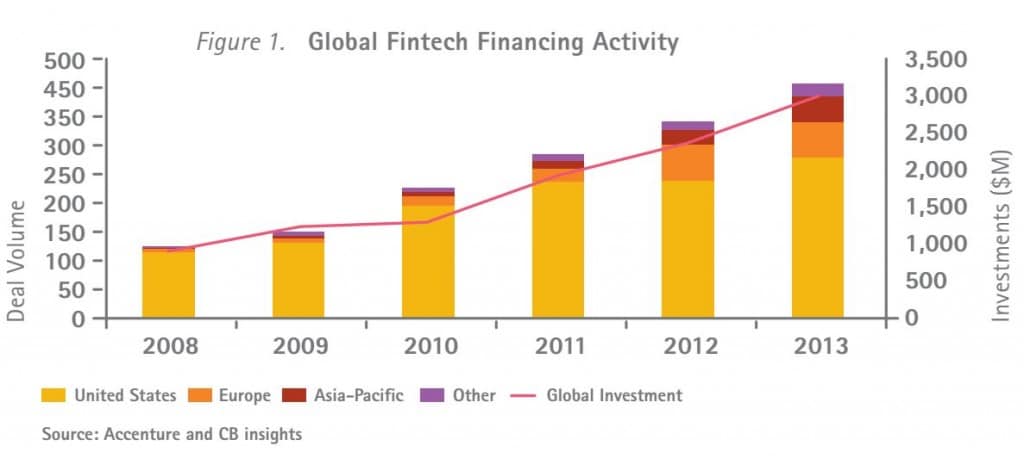

Growing investment in the Fintech sector

In the last 5 years, investment in the Fintech sector worldwide has tripled, reaching an investment of $3B in 2013. In Europe, the UK tops the list of major investors.

Venture capital takes advantage of the opportunity that natural language provides.

In recent years, several natural language processing companies have been created that offer advantages for day-to-day business. Venture capital and large corporations have wanted to take advantage of this opportunity, as Inversur Capital has just invested in Inbenta.

Strong activity in the E-learning sector.

Due to the rise of new technologies, learning has become much easier and more fun. Investors have realised that e-learning presents an opportunity for their portfolios and have been very active in this sector, especially in the last 3 years.

Healthcare does not feel the impact of the crisis

Healthcare is one of the few sectors that has not been affected by the crisis; in recent years Venture Capital investment in this sector has grown considerably, from 28 deals in 2009 to 37 in 2013.

Media Sector USA: VCs Invest $331M in 60 Startups

Media startups raise $33M in 60 deals in 2013, an increase of 117% in funding over the previous year and 30% in the number of deals.

Venture Capital and Venture Capital in Ireland

2014 looks like a promising year for venture capital and Venture Capital in Ireland, Enterprise Ireland, the government agency responsible for supporting Irish companies has done 11 deals in the last 6 months.