The Helpdesk encompasses numerous tasks that are indispensable for companies to make the most of the introduction of new technologies. These tasks range from providing technical support for computer programmes, software updates, to personalised attention to customers for any problems they may have in this field. In recent years investors have bet more strongly on the sector, 2013 has raised a total of 94M, a 56% more than in 2009 which raised 60M, although the number of operations have been lower, from 13 operations in 2009 to 9 in 2013.

Investors in biomarker development companies

The use of genetically-derived biomarkers is becoming a fundamental practice in hospitals because of their cost-effectiveness. Since 2005, 95 investors have invested in companies developing biomarkers, raising a total of $1,911M. The average amount invested by each investor is $22M, although there are large differences between investors. Some investors have invested more than $100M, while others have invested less than $150,000.

In the US, new technologies in the oil industry are boosting financial operations in the sector.

In recent years, the entry of new technology in the oil and gas sector and the recovery of the US as the leading oil and gas producer has encouraged venture capital to invest in the sector, which in the last half of 2013 reached its highest investment figure, with a total of $149M in 10 deals. Moreover, thanks to foreign buyers, and the use of new technologies to extract shale gas, the M&A market reached its highest volume in the first quarter of 2014 in the last decade.

Funding rounds in the mobile payments industry

Companies offering mobile payments have grown in popularity in recent years, with a study in the US claiming that 48% of the population is interested in this form of payment, up from 27% last year. This is one of the reasons why this sector is very active in terms of investment and corporate transactions. In the last few years, 290 investors have completed 172 rounds worth 739M$.

How is the Venture Capital model evolving?

May saw 26 Venture Capital deals, the highest number so far this year according to data provided by TTR. Despite this, the total amount invested was €31m, almost half the amount invested in April 2014.

How is the Venture Capital model evolving?

May saw 26 Venture Capital deals, the highest number so far this year according to data provided by TTR. Despite this, the total amount invested was €31m, almost half the amount invested in April 2014.

Investments in the IT manufacturing sector

Of the total 40 rounds of financing in the manufacturing sector, 9(25%) have gone to companies involved in the production of IT-related devices, raising a total of 61.3$M. These deals have been mainly in US companies, but also emerging markets, such as China and India, are getting venture capital backing.

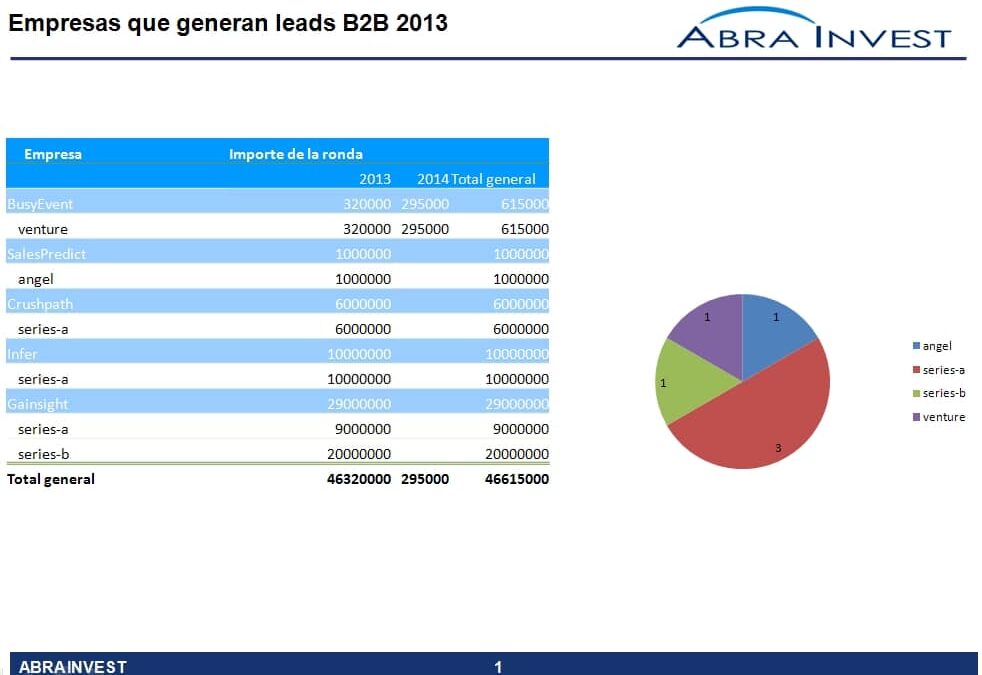

Investments in B2B lead generating companies

Companies working in B2B have several challenges to face in order to reach their audience, getting leads is more difficult than in B2C due to the lower volume of customers and the complexity of reaching the target. More and more companies are taking advantage of these difficulties to offer services aimed at increasing leads. Some of them have received venture capital funding in 2013.

El venture capital en «empresas de predicción»

Today, companies not only need to know what happened in the past to understand the present, but also to anticipate the needs of their customers. The "Predictive Enterprise" involves the use of advanced technological tools that make it possible to move from product-focused to customer-focused companies. These types of companies, which are currently growing considerably, have applications in numerous sectors of activity and have received great support from venture capital; in 2013 and so far in 2014 alone, this sector has raised $531M.

Investors in mobile marketing to access consumers

New technologies are changing the consumer's behaviour when it comes to making a purchase decision, the mobile phone, for example, is one of the tools that have been incorporated into the decision making process. The customer at the point of sale can compare prices, ask for opinions, look for offers. That is why in recent years companies have been created that provide mobile marketing services for large brands that see the mobile phone as an opportunity to interact with their customers. It seems that the trend for this type of company is on the rise as their effectiveness becomes clearer and investors do not hesitate to bet on them.

Venture capital drives digital marketing tools

The elimination of geographical barriers, as well as new technologies applied to production processes and increased competition, are creating an increasingly demanding customer. Companies face two challenges: to know what their customers' real needs are and to reach them. In order to help in this task, numerous online marketing companies have appeared, many of them driven by venture capital.

Venture capital in the health IT world

Venture capital in the world of health-focused information technology. The concern for fitness and new technologies have led to the emergence of numerous applications and software that help people to lead a healthier life. Venture capital has seen the potential of such companies and has decided to invest in them. Of the 95 A and B rounds raised in 2013 and 2014 in the health sector, 23 were in this niche market (ICT-wellness).