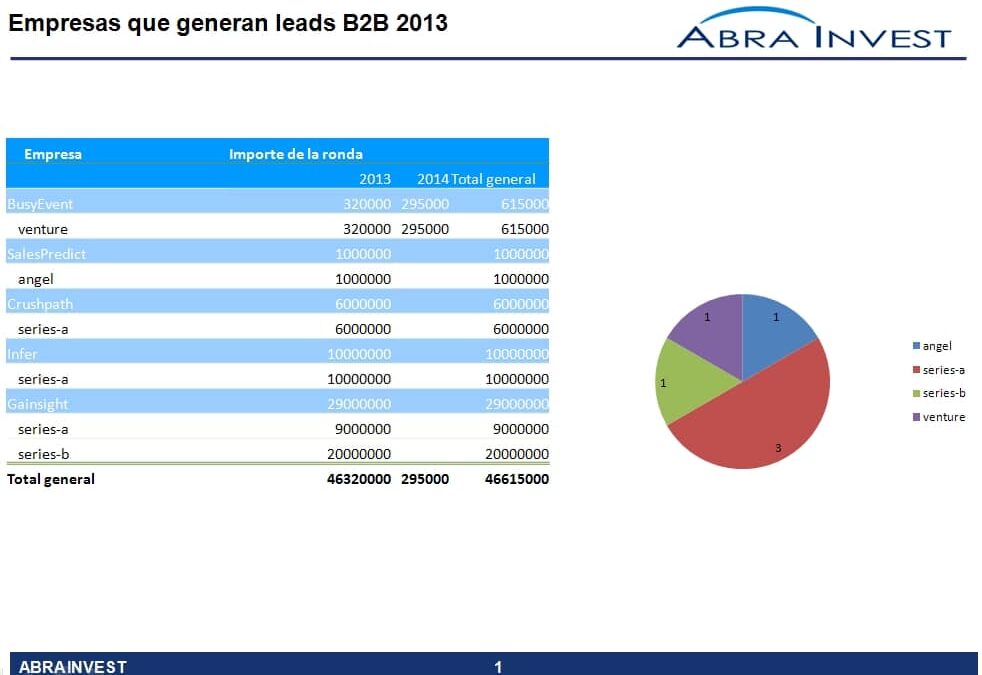

Companies working in B2B have several challenges to face in order to reach their audience, getting leads is more difficult than in B2C due to the lower volume of customers and the complexity of reaching the target. More and more companies are taking advantage of these difficulties to offer services aimed at increasing leads. Some of them have received venture capital funding in 2013.