SMEs have received good news in recent months as they have seen an increase in the alternatives for obtaining financing for their growth plans. The venture capital sector is developing funds specialising in this size segment of companies in Spain. Examples of this are the Sherpa, Investindustrial and Axon funds for technology companies.

New funds in March: Artá, Black Toro, Nekko, Benavent and Trea Direct Lending

We review the main funds launched by private equity firms in March 2018. Specifically, we analyse the new funds from Artá Capital, Black Toro Capital, Nekko Capital, the Benavent family and Trea Direct Lending.

New funds in February: Nexxus, Torreal, TowerBrook, Peninsula and Providence

Find out about the new funds and deals completed by the main private equity firms in February. We analyse the first closing of Nexxus Iberia, the purchase of Aernnova by Torreal, TowerBrook and Península, and the exit of Providence in MásMóvil.

New funds: Miura, Inveready, Capzanine.

Find out all the latest news on the new funds launched so far in 2018: Miura Private Equity closes its third fund after raising €330M, Inveready extends its alliance with the EIF to its new fund and Capzanine lands in Spain.

New funds in December: Charme, Aina II, Mediterrania, DCN, Mondragón

Find out about the new venture capital and venture capital funds that have emerged in the month of December and all related information: size, commitments, objective, promoters,...

Nauta leads a round in Cloud.IQ, a company that optimises the conversion of visits into actual sales.

The Spanish-based venture capital firm has made its first investment of 2017 in a London-based company that uses artificial intelligence for conversion rate optimisation (CRO) in the online retail sector.

New funds: Atomico , Intellectium and Mediterranea capital.

"We are very optimistic about the Spanish market and it is growing very fast; we see that many Spaniards with experience in technology are returning to Spain from other countries and that makes for a very promising future for the country" are the words of Brochado, partner at Atomico.

What is private equity investing in and what prospects do we expect for 2017?

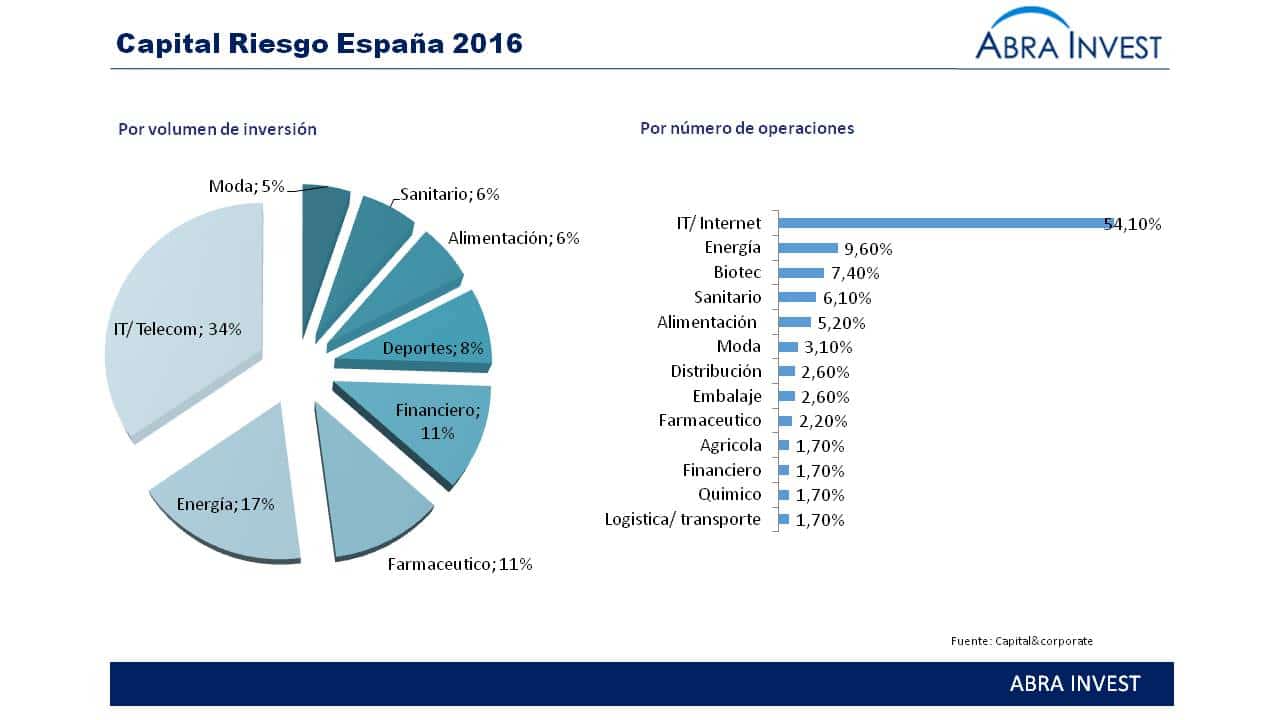

Venture capital investment in Spain in 2016 totalled €3,100M, an increase of 5% compared to 2015. Two deals (Hotelbeds and Renovalia) for more than €1,000M of deal value and 6 for more than €100M contributed to this result. In terms of the most active sectors, the IT/Telecom/Internet sector is in first place.

Cybersecurity is growing at a rate of 12% in Spain

The ciberemprende 2016 programme closed this week with the Venture Day, which was attended by a hundred investors, entrepreneurs and cybersecurity professionals. The winners of the programme were Techvolucion and Keynetic. But not only the acceleration programmes have been successful, this year we have detected large rounds in Spanish cybersecurity companies and acquisitions by international companies.

Shopnet Broker plans to increase capital and incorporates Preventiva's Afin2 product

Shopnet Broker is a Spanish company created in 2000 that offers technological services for the insurance sector. The company operates through two subsidiaries: Segurosbroker, to serve the end customer, and e-Correduría for the professional insurance market, as well as in Spain, Portugal and Mexico.

Diagnostic imaging company Affidea buys Q-Diagnostica to enter Spain

Dutch company Affidea, which offers diagnostic imaging solutions, continues to grow in Europe and has acquired Spanish company Q-Diagnostica to enter the Spanish market. About Affidea, a venture capital-driven company headquartered in the Netherlands, and...

Adsmurai, a Spanish company that optimises advertising campaigns, receives a €4M round of funding.

Axon partners has led the €4M round in which Banc Sabadell has also participated (the firm was a finalist in a BStartup 19 acceleration programme) and has also raised public funding from Enisa. About Adsmurai Founded in January 2014, Adsmurai...