According to Javier Ulecia, president of Ascri, investment by venture capital funds in start-ups is increasing steadily. We will reach the weight that this sector should have, because there are an increasing number of interesting projects...

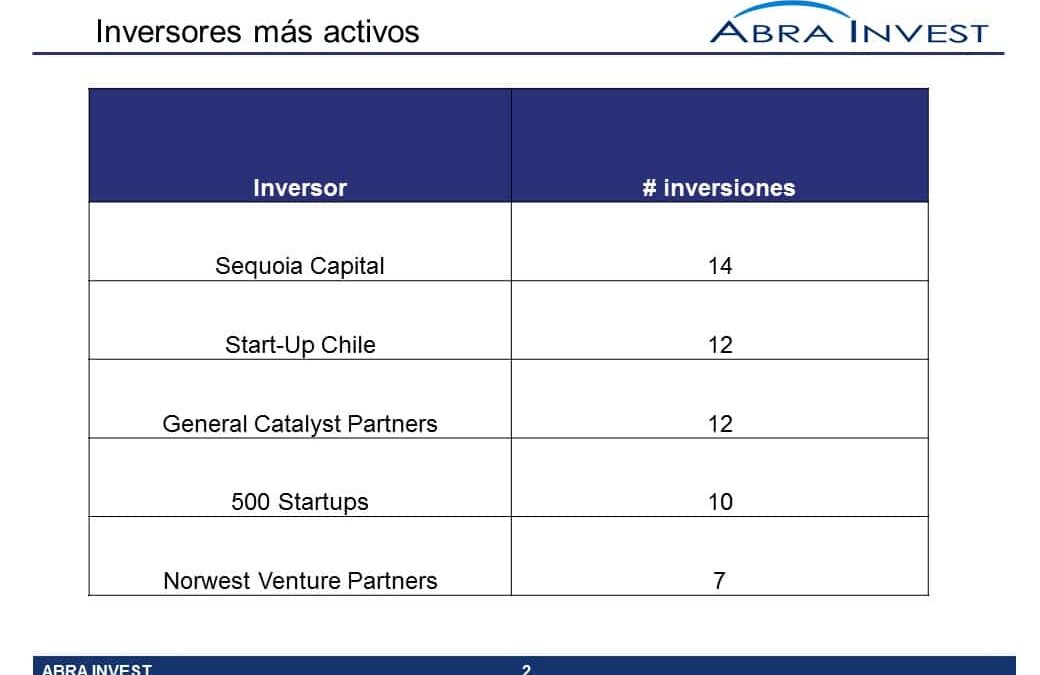

Most active investors in the ICT sector in 2015

Looking for investors for your tech startup? Here are the most active investors in 2015.

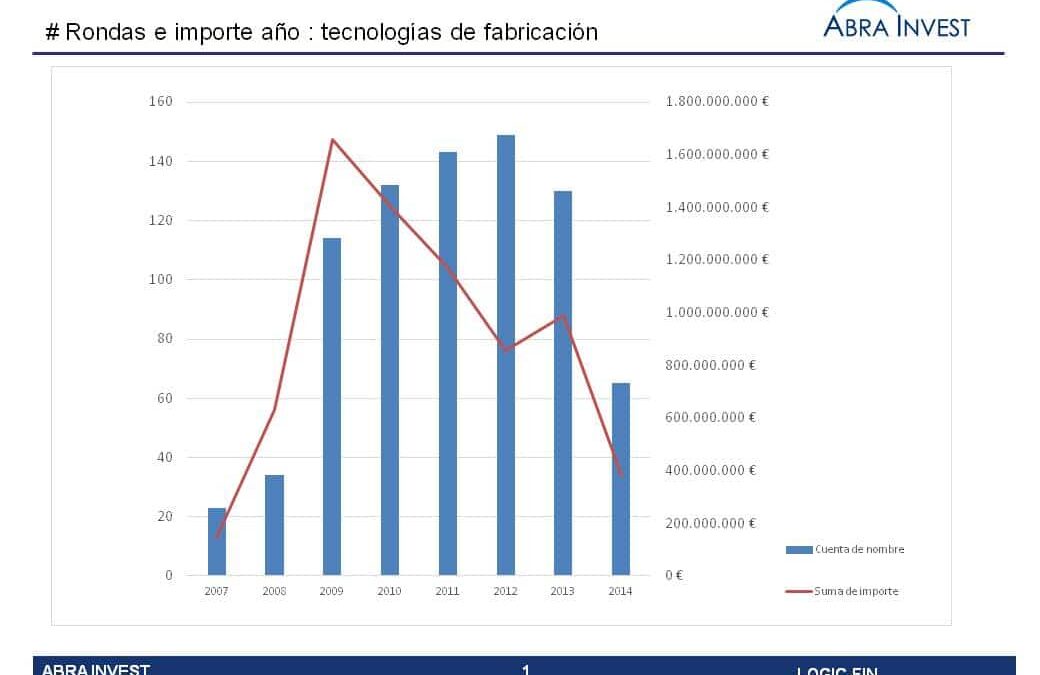

Investment analysis of the advanced manufacturing sector

Starting in 2009, the manufacturing technologies sector, which enables time- and cost-saving manufacturing, attracted many investors. A total of 790 rounds and an amount of $7.236M has been raised in the sector to date. In the following we will take a look at...

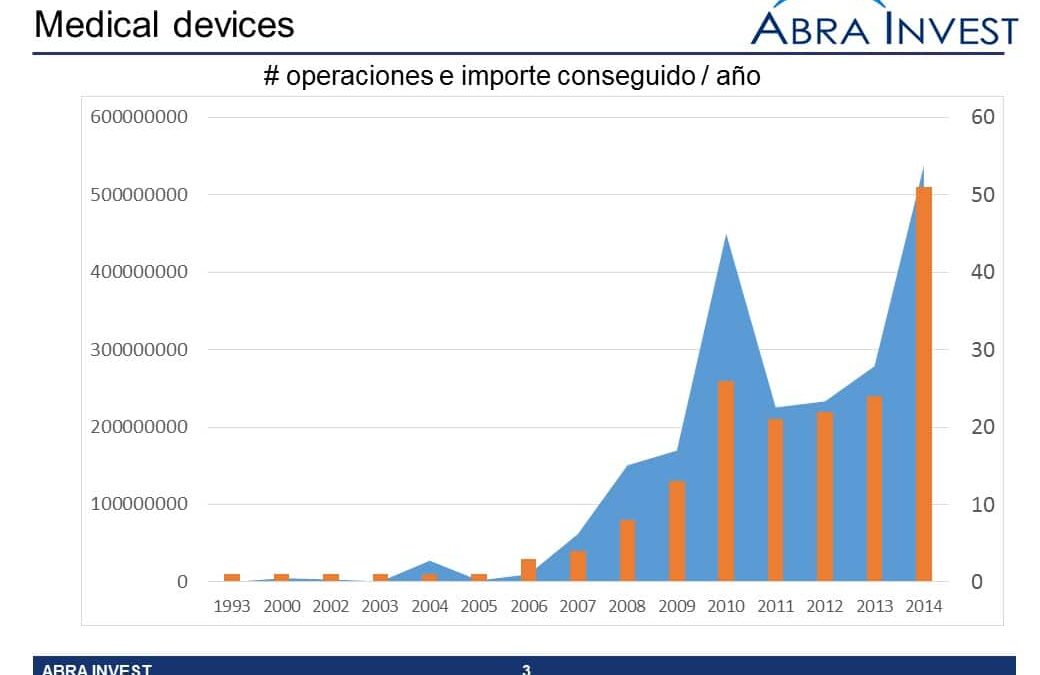

Investment in medical devices has a long way to go

The development of devices applied to healthcare received double the number of financing rounds in 2014, with 51 deals, compared to 21 in 2013. The sector is taking shape and there is still a long way to go before it reaches maturity. Proof of this is the small but growing number of acquisitions by corporations.

We take a look at private equity investment in the energy sector

According to a study by Abra Invest, after years in which venture capital investments in the energy sector in Spain were scarce, activity is picking up again. In 2013, a total of 22 operations were carried out, 60% more than in 2012 and it seems that 2014 will follow this trend.

Strong growth of technologies in the tourism sector.

The use of new technologies in the tourism sector has many advantages when it comes to saving costs and reaching end customers. In recent years, several companies have been created in the sector that have been able to grow thanks to the support of investors who have seen an opportunity in the sector, and it is expected that this trend will continue to grow in the coming years.

The US market is interested in Latin America

According to TTR Record data, American investors are increasingly active in Latin America. Since 2012, the number of US investments in the country has gradually increased from 109 deals in 2012 to 140 in 2014. The number of divestments has also grown by 53% in the last two years, from 28 deals in the first half of 2012 to 60 in the first half of 2014.

Biotechnology in Spain finds investors

One of the main barriers to the growth of Spanish biotech companies is their small size (>95% less than 250 employees), which prevents them from accelerating their entry into foreign markets, for example. The main cause of this small size is due to the scarcity of funding or private investment. Although a specialised national biotech venture capital ecosystem is being generated and more and more deals are being closed with foreign investors, there is still much room for improvement.

Investment analysis in the Machine Learning sector

"Machine learning is attracting a lot of interest from tech giants, who are spending a lot of money and effort to hire the best machine learning researchers. Companies in the sector are aware of this and are making a...

Investment analysis of the natural language industry

Natural language processing (NLP) is a field of ICT that studies the interactions between computers and human language. The level of performance has improved substantially in recent years. As an effect of this phenomenon, during the last few...

Venture capital makes Spanish IT competitiveness possible

Spanish venture capital has been investing in the information technology sector in recent years. In 2013 and the first half of 2014, 187 operations were carried out in the sector, involving more than 280 investors.

Investors in biomarker development companies

The use of genetically-derived biomarkers is becoming a fundamental practice in hospitals because of their cost-effectiveness. Since 2005, 95 investors have invested in companies developing biomarkers, raising a total of $1,911M. The average amount invested by each investor is $22M, although there are large differences between investors. Some investors have invested more than $100M, while others have invested less than $150,000.