In 2014 it was time for Corporations to take a leading role in innovation investment. Moves are coming from the US for Corporations to bring their strategic input to the fore as an advantage over Venture Capital.

Emprendetur Internationalisation

The call for applications for the Emprendetur international programme opens on 9 January for companies operating in the tourism sector whose exports do not exceed 40% of their turnover at the time of application.

Good prospects for venture capital in Spain in 2015

KPMG's prospective report on private equity in Spain, based on a survey completed by 129 executives from 113 private equity firms, shows signs of optimism, reinforced by the good results obtained in 2014.

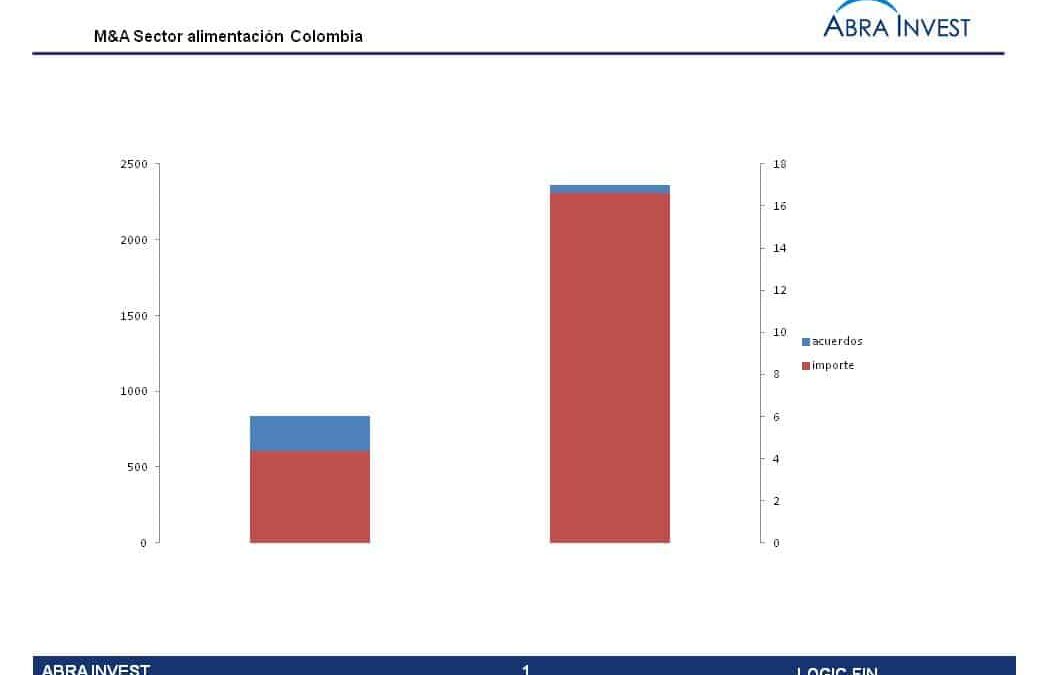

M&A news in Latin America

2014 has been a good year for M&A in Latin America, with our analysis highlighting the growth of activity in Colombia and Brazil.

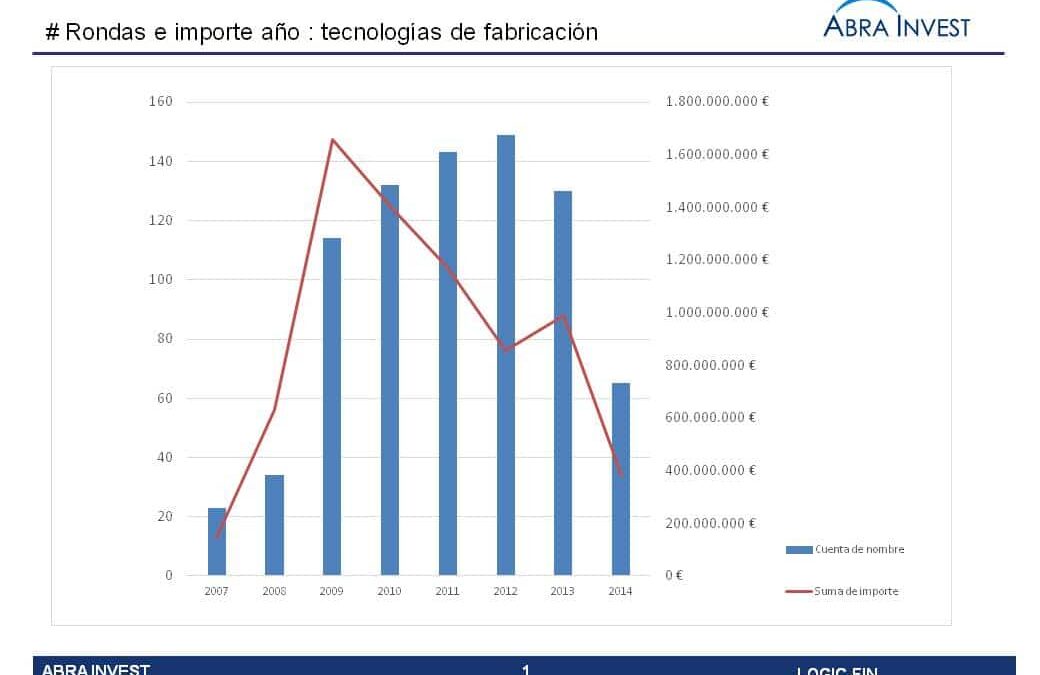

Investment analysis of the advanced manufacturing sector

Starting in 2009, the manufacturing technologies sector, which enables time- and cost-saving manufacturing, attracted many investors. A total of 790 rounds and an amount of $7.236M has been raised in the sector to date. In the following we will take a look at...

H2020 calls in Bioeconomy

Next February, the H2020 calls will close under the second societal challenge: Food Security, Sustainable Agriculture, Marine and Maritime Research and Bioeconomy. Its objective is to ensure a sufficient supply of safe and high quality food and other bio-products through the development of productive and efficient primary production systems.

Mergers and acquisitions analysis in October 2014

Las fusiones y fusiones y adquisiciones en nuestro país siguen creciendo llegando en Octubre a una cifra de 110 operaciones por un importe de €14868M. Esto supone un incremento del 5,77% en el número de operaciones y del 92,72% en el capital movilizado respecto al...

Mexican investors are interested in Spain

This year 2014 the number of mergers and acquisitions in Mexico has grown considerably thanks to the reforms carried out by the Mexican government. In addition, Spain is playing a leading role, having carried out 3 acquisitions of Mexican companies and 5 sales of Spanish companies to Mexico in the last quarter of 2013.

2014 SEES RECORD ICT INVESTMENT

2014 has been a good year for the ICT sector, with worldwide investments reaching the highest figures since the technology bubble of 2000. A good third quarter According to data from 451 Research, a consultancy and research company,...

Inveready makes several successful divestments in the last two years

The venture capital firm Inveready, winner of the 2014 ASCRI awards, is one of the most active funds in our country and has made several successful divestments in 2013 with some operations with a Tir exceeding 100%, which has allowed it to create a new fund and invest in more companies in 2014. In addition, this year he has also made highly profitable divestments.

Analysis of investments in Telemedicine

Telemedicine presents a framework of solutions in many fields such as diagnosis, monitoring and prevention, which can change the lives of people with chronic diseases, save healthcare costs and time for patients and doctors among others. According to a study carried out by Cap Gemini, $125B will be invested in Telemedicine in 2015 and Spain in particular will contribute 4000M to this figure, according to the technology consultancy CMC.

Beneficiaries Emprendetur I+D+I 2013

Emprendetur R&D&I is the programme that supports research, development and innovation applied to products and services in the tourism sector. The 2014-2015 call for applications will open soon, which is why we have decided to make an analysis of the beneficiaries in 2013.