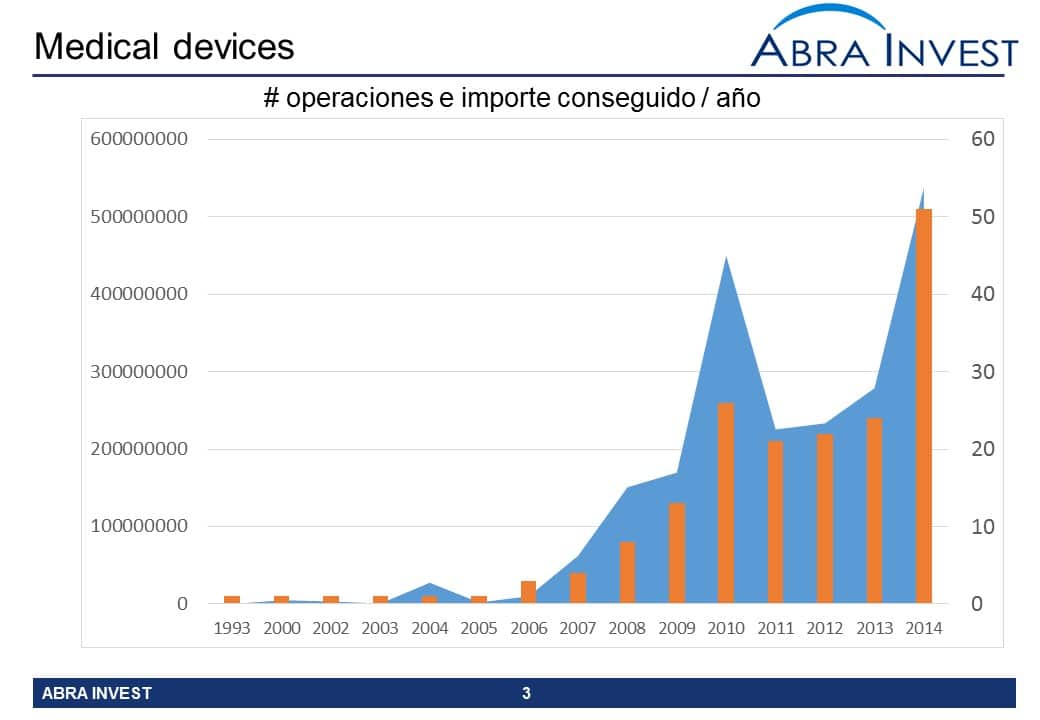

In 2014, 51 rounds were conducted for a total amount of $538M, far exceeding the 24 transactions for a total amount of $200M conducted the previous year.

"In addition, this year the weight of venture rounds in the total number of rounds has also increased compared to last year, which shows us that the medical devices sector is a sector in expansion, in which companies are making great efforts to grow and introduce new products to the market, in a market that is characterised by strong regulation that requires a large amount of resources" says Diego Gutierrez from Abra Invest.

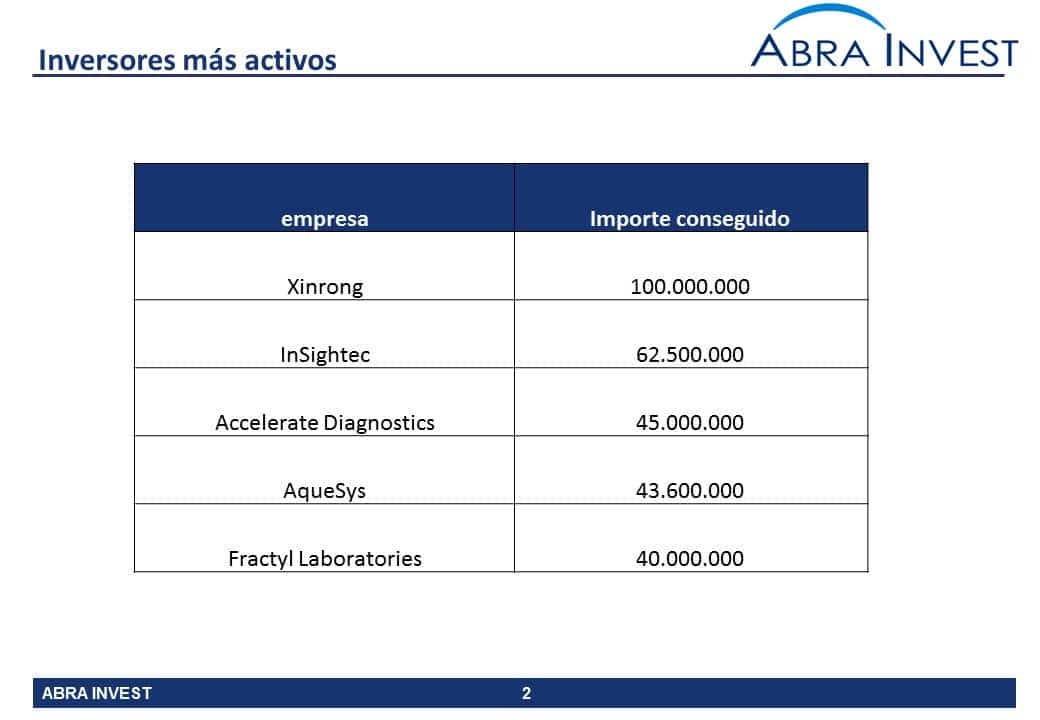

There are several companies that have received a large amount of funding this year alone, leading the list is Xinrong, the Chinese company that sells medical devices has received a $100M round of funding. Blackstone Group. This is a sign of the effort that Asian companies are making to grow in this market, which is led by large American companies.

Second on the list is InSightecIsrael-based company that develops advanced MRI-guided Focused Ultrasound technology. This company has closed 2 rounds of financing in the last year 2014, for a total of $62M.

The third company that has raised the most money is Accelerate Diagnostics. Based in Arizona, an in vitro diagnostics company providing solutions to drug-resistant organisms and hospital-acquired infections, founded in 2004, it has already closed 4 rounds of funding, the latest being $45M.

Sector Funding IT Sector

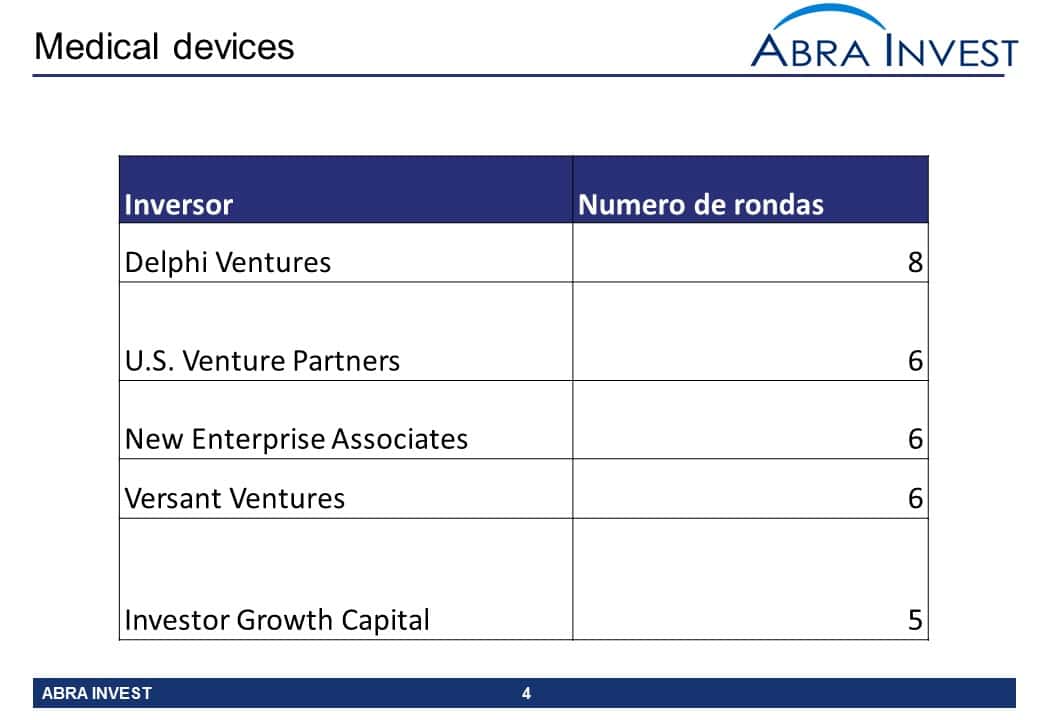

Among the investors who have bet on the sector, there are several who have made several investments in the sector, leading the list. Delphi Ventureswhich has invested in 6 medical device technology companies. The Californian firm, founded in 1988, has invested more than 1.1Bn$ in more than 170 companies and is focused on biotech and medical device companies.

Acquisitions in the sector

In the last year, the number of mergers and acquisitions in the sector, although it is true that the number of mergers and acquisitions is still low. It is worth noting that half of the 8 operations performed are in the field of cardiovascular medicine.

Other posts that may interest you

Juan Diego Cuenca, partner of Abra-invest, analyses the biotechnology sector on Gestionaradio

Biotechnology in Spain finds investors

We are currently preparing a report on the current state of crowdfunding as an alternative means of financing. If you are interested in receiving this report, please leave us your email address.