Axon Partners Group, an international investment firm, has launched a new fund to invest in early stage Spanish companies in the digital economy sector in Andalusia. The ICT II Fund has approximately €10 million in assets from private investors and the JEREMIE (European Investment Fund) initiative in Andalusia managed by the Innovation and Development Agency of Andalusia (IDEA), a body attached to the Regional Ministry of Economy, Innovation, Science and Employment.

Wearable technology, driven by venture capital in 2013

Wearable technology raised $248M in venture capital funding in 2013, in a total of 49 deals. The number of rounds for wearable technology startups increased by 150% and the volume of investment by 80%.

Venture capital drives language learning apps

Among the companies for learning languages through apps, 5 stand out as having received several rounds of funding and topping the app store charts.

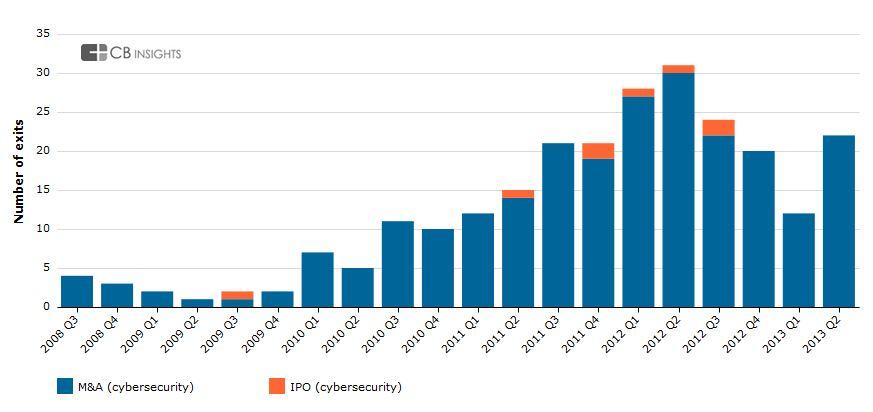

Venture capital sees cybersecurity as a source of opportunity

Since 2009 to date venture capital has invested $2.9B in Tics security and so far this year 26 rounds have been closed raising a total of $150M. The need for security has increased early stage rounds. In the first four months of 2013 16 seed capital companies raised $4.9M.

Resounding success of the Barcelona World Congress

Last week's Mobile World Congress in Barcelona was attended by more than 85,000 people from 201 different countries and attracted executives from the world's largest telephone operators, software, equipment suppliers, internet companies and industrial sectors such as automotive, finance and health, including Zuckerberg from Facebook, Korum from whatsapp and Rometty from IBM.

Top 10 Biggest Funding Rounds in the Education ICT Sector

The 10 largest funding rounds in the ICT sector raised a total of $600M in 2013, the majority of which were in early stage companies.

Venture capital participates in mobile BAAS

Venture capital has invested $150M since 2010 in Baas, the connection between mobile applications and cloud services. There have not yet been many sales in the sector, limited to smaller acquisitions.

The Media sector receives investment for "publishing".

The media sector is in the midst of a profound change brought about by a poor outlook for traditional publishing models such as newspapers and printed books. As a result, we are seeing the emergence of new models funded by venture capital.

Content "Curation" receives 18M from venture capital

With the growth of content marketing, the software market has created several tools for what is known as content curation. According to our research we have identified more than 30 tools, of which only 8 have received venture capital backing for a total amount of $18M.

74% of venture capital and private equity deals in 2013 were targeted at SMEs.

Private equity invested almost 40% of its investments in the "Other services" and "Other industrial products" sectors. Corporate investors grew by 29% in 2013, with very significant activity in the internet and technology sectors. Spain has one of the best Business Angels network infrastructures.

Cybersecurity: an opportunity for investors

In the past year venture capital firms invested $1.4MM in 239 American cybersecurity companies. 80% of which ended in acquisitions or IPOs, with an average return of 10 times the investment.

Digital content managers receive $230M of venture capital

Digital content is becoming king in entertainment and leisure as well as in business marketing. As proof of this, venture capital has invested $230M in 38 companies since 2012.