Of the total 40 rounds of financing in the manufacturing sector, 9(25%) have gone to companies involved in the production of IT-related devices, raising a total of 61.3$M. These deals have been mainly in US companies, but also emerging markets, such as China and India, are getting venture capital backing.

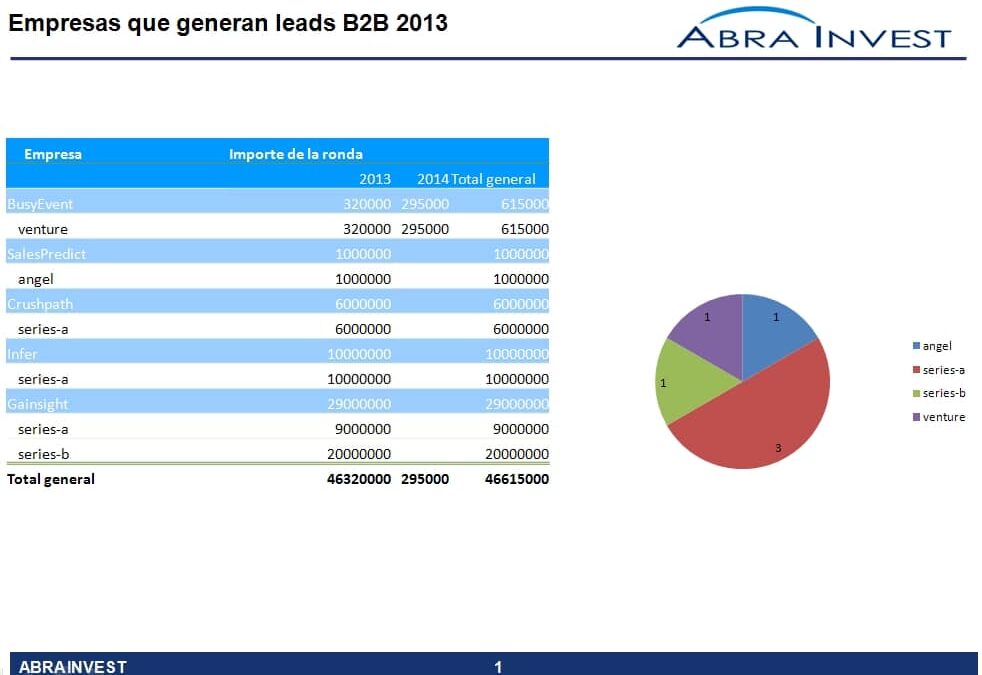

Investments in B2B lead generating companies

Companies working in B2B have several challenges to face in order to reach their audience, getting leads is more difficult than in B2C due to the lower volume of customers and the complexity of reaching the target. More and more companies are taking advantage of these difficulties to offer services aimed at increasing leads. Some of them have received venture capital funding in 2013.

El venture capital en «empresas de predicción»

Today, companies not only need to know what happened in the past to understand the present, but also to anticipate the needs of their customers. The "Predictive Enterprise" involves the use of advanced technological tools that make it possible to move from product-focused to customer-focused companies. These types of companies, which are currently growing considerably, have applications in numerous sectors of activity and have received great support from venture capital; in 2013 and so far in 2014 alone, this sector has raised $531M.

Venture capital drives digital marketing tools

The elimination of geographical barriers, as well as new technologies applied to production processes and increased competition, are creating an increasingly demanding customer. Companies face two challenges: to know what their customers' real needs are and to reach them. In order to help in this task, numerous online marketing companies have appeared, many of them driven by venture capital.

Venture capital in the health IT world

Venture capital in the world of health-focused information technology. The concern for fitness and new technologies have led to the emergence of numerous applications and software that help people to lead a healthier life. Venture capital has seen the potential of such companies and has decided to invest in them. Of the 95 A and B rounds raised in 2013 and 2014 in the health sector, 23 were in this niche market (ICT-wellness).

Strong growth in the e-health sector

Numerous companies have taken advantage of the concern for health and wellbeing and the increased use of new technologies to create innovative companies in this field. Investors have not been left behind and are betting heavily on the sector. Proof of this is that the number of Series A and B rounds in the health sector has increased by 179% from 2010 to 2013, from 24 deals in 2011 to 67 in 2013.

Top 10 Biggest Funding Rounds in the Education ICT Sector

The 10 largest funding rounds in the ICT sector raised a total of $600M in 2013, the majority of which were in early stage companies.

Venture capital invests in new advertising models

The world of advertising has been one of the hardest hit by the crisis, as it is one of the activities with the most reduced business budgets. Despite this, venture capital has opted for new advertising models, almost all of which are based on mobility.

China breaks record for investment in US technology

Emerging countries, led by China and India, are increasingly investing in developed country companies. In 2013, China invested $855M in 36 investment deals. The acquisition of cutting-edge technologies to apply in their domestic markets is one of the reasons why Chinese investors are acquiring technology startups in the US.

Investors for "Marketing software" will remain active in 2013.

In recent years, venture capital funds have made a big splash in the marketing software sector, both in terms of number of deals and capital invested.

Investors for "Marketing software" will remain active in 2013.

In recent years, venture capital funds have made a big splash in the marketing software sector, both in terms of number of deals and capital invested.