Enertika, the Spanish company specialising in energy services, has raised €20M in funds to accelerate its growth plans. It will invest €15M in projects with Susi fund and closes a €5M capital increase led by Caixa Capital Risc.

Energy House, HolaLuz, Vagalume and Cactus: energy efficiency and renewable energy SMEs to receive funding in March

In the last month we see several energy efficiency and renewable energy companies have received funding both from venture capital firms such as Axon Partners and Collins and from crowdfunding such as Crowdcube.

Cerberus buys four renewable energy assets from Sinia renovables, Esif and Comsa emte.

According to a global report by PwC, renewables now account for 28% of all mergers and acquisitions in the energy sector, reaching a value of $55.300M. This figure is almost double the volume recorded in 2014. The renewables market is expected to remain active in 2016, and just this week we have learned of the purchase of four renewable energy assets by Cerberus.

The use of technologies in the energy sector opens up a wide range of possibilities

According to a study by Price, the energy and power sector will see unprecedented change in the coming years. 97% of executives from the industry's leading companies expect the market to be significantly transformed by 2020. In this process of change, technology will play a major role. Today we want to highlight Spanish projects that are making innovations in the field of energy such as Vortex, Green Momit, Eolgreen or Challengers 15.

Crowdlending for renewable energy and energy efficiency projects gets financing

The Spanish crowdlending platform for energy efficiency projects Ecrowd has just received its first round of funding of €156,000, joining the wave of platforms specialising in the renewables sector that have received funding in the last year. It seems that energy efficiency and renewables are finding in crowdlending a new funding opportunity.

ECONOVA closes investment round with the help of ABRA INVEST

The Econova group has closed a financing round with private investors. The funds raised will allow the group to complete the biomass supply project to a German energy group. Econova has been advised by ABRA INVEST for the successful completion of the operation.

Spain leads European energy M&A market in the second quarter of 2015

According to a report by EY, in the second quarter of the year Spain is at the forefront of M&A deals in energy, with 7 deals worth $3,100M, and of the 5 largest European deals by volume in the quarter, three are Spanish. The largest deal involved Madrileña Red Gas, which was sold by Morgan Stanley to the consortium of companies formed by Gingko, PGGM and EDF.

Venture capital bets on energy: Cerberus, ArgoCapital and Magnum Capital.

As we mentioned in a post a few weeks ago, the energy reform is attracting energy investors in our country. Large investors such as Cerverus are betting on our wind farms. On the other hand, large Spanish corporations see this situation as an opportunity and are looking for buyers such as Isolus.

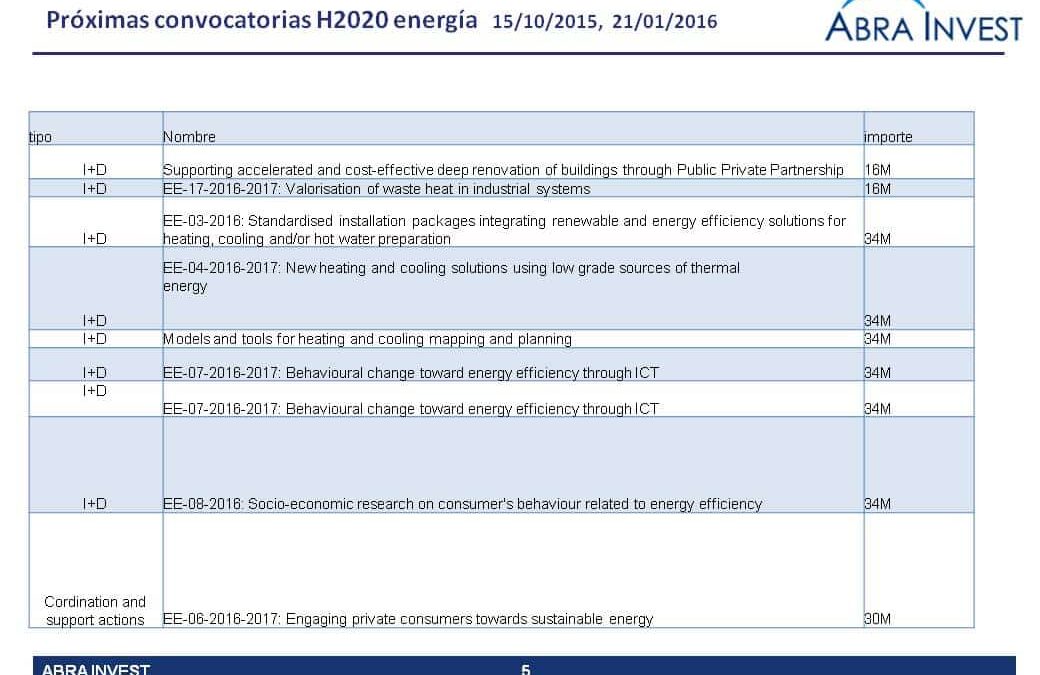

H2020 Energy Calendar 2016-2017

The draft of the H2020 calls for proposals in energy for the 2016/2017 academic year has been published. Energy is one of the challenges in which a greater return has been achieved in Spain in the two years that the H2020 programme has been in force. Below you will find the calendar.

Major financing rounds in the energy sector in 2015

So far in 2015 there have been more than 126 financing rounds in the energy sector. Within this sector, renewable energies have had a lot of weight for some years now, but in the last two years we have seen that investment in energy efficiency is gaining ground. From 2013 to 2014, investments in energy efficiency grew by 42%.

Energy sector M&A : Gestamp solar, Galenova and Warwick Capital Partners' plants

The end of the energy reform is encouraging some of the main companies to look for partners and to increase the level of integration thanks to the high levels of liquidity in the market. The purchase of solar and wind installations so far this year has already exceeded 1,000M and experts agree that the sector will see new operations in the coming months.

Boosting renewable energy: Cerberus and Repsol

Despite the fact that Spain has slowed down investment in renewables due to the energy reform, there is still movement in the sector. This week, Cerberus, one of the world's largest venture capital firms, has backed a Spanish company, Renovalia Energy. In addition, Repsol has announced the finalists of its incubation programme.