KPMG's prospective report on private equity in Spain, based on a survey completed by 129 executives from 113 private equity firms, shows signs of optimism, reinforced by the good results obtained in 2014.

KPMG's prospective report on private equity in Spain, based on a survey completed by 129 executives from 113 private equity firms, shows signs of optimism, reinforced by the good results obtained in 2014.

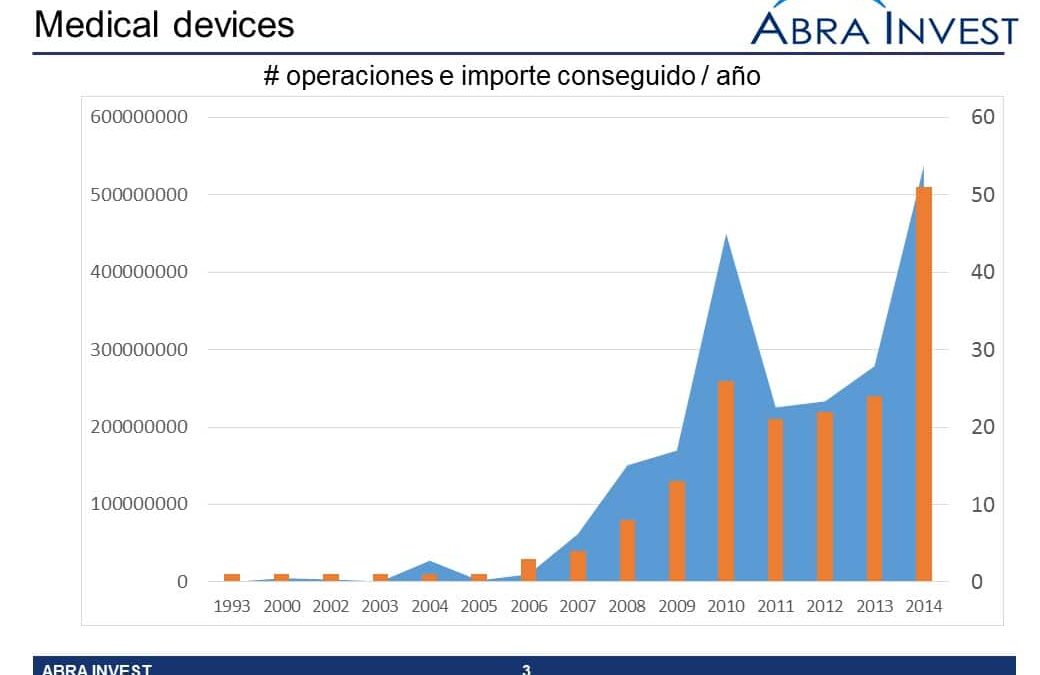

The development of devices applied to healthcare received double the number of financing rounds in 2014, with 51 deals, compared to 21 in 2013. The sector is taking shape and there is still a long way to go before it reaches maturity. Proof of this is the small but growing number of acquisitions by corporations.

According to a study by Abra Invest, after years in which venture capital investments in the energy sector in Spain were scarce, activity is picking up again. In 2013, a total of 22 operations were carried out, 60% more than in 2012 and it seems that 2014 will follow this trend.

The difficulty of finding work in times of crisis has boosted freelance work and has led to the development of new ideas, such as freelance platforms, where freelancers and independent professionals present their services. In Spain, there are several companies dedicated to this activity that have been very well received, such as Geniuzz and Nubelo.

According to data from the prestigious Kantar Worldpanel, online fashion sales in Spain grew at a dizzying rate of 32% in 2013, increasing its customer base by 600,000 new buyers. Last year, 3,100,000 Spaniards bought fashion online. Corporate investors know this and have not wanted to miss the opportunity.

After a period of drought suffered in the logistics sector in 2012, it seems that venture capital in the logistics sector in Spain is beginning to recover, and although the number of operations carried out is still small, during the first half of 2014 there have already been 5 operations, the same as in the whole of the previous year, which seems to indicate the growth of venture capital in this sector.

2014 shows a growth of VC deals in the textile sector, after 5 years of constant decline. While in 2012 there were 13 deals in the sector, year after year they have been decreasing until reaching 1 deal in 2012, but it seems that this year is going to be a good year for the sector. So far this year there have been 6 transactions, 50% more than all the transactions in 2013.

Spanish venture capital has been investing in the information technology sector in recent years. In 2013 and the first half of 2014, 187 operations were carried out in the sector, involving more than 280 investors.

Venture capital is picking up again in 2014, with a total of 76 deals so far this year, amounting to €12,207M, which is more than the €9,423M raised in the 138 deals made in the whole of 2013.

The Basque venture capital company Talde is opening a new fund to support investments from Europe to Latin America and vice versa.

Venture capital once again placed its trust in Spain in the first half of 2014, doubling investments from €310M in the first quarter of 2013 to €618M. This increase in investments has been due to the average increase in the amount of each deal, as the number of deals has remained practically the same, at around 100.

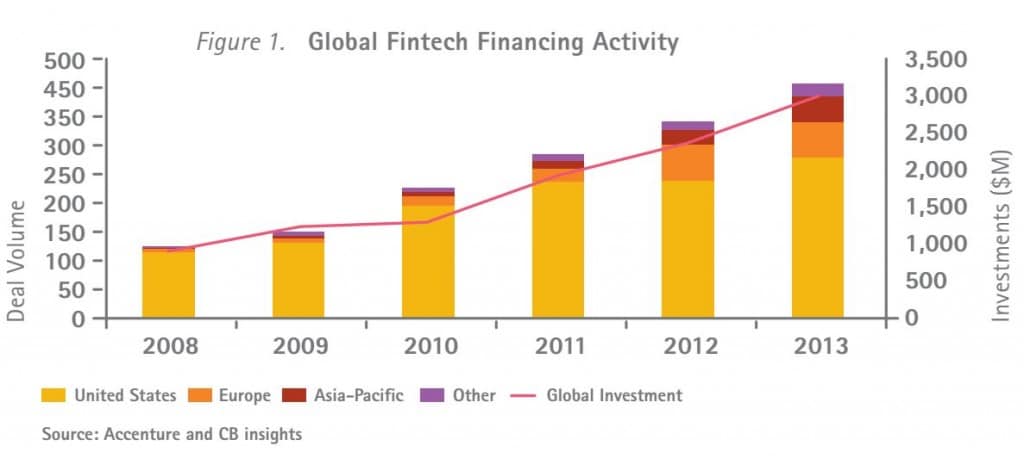

In the last 5 years, investment in the Fintech sector worldwide has tripled, reaching an investment of $3B in 2013. In Europe, the UK tops the list of major investors.