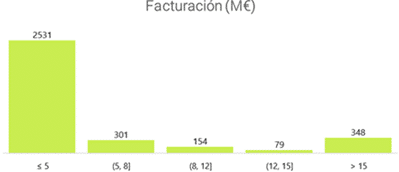

Spanish companies sold from the sector IT are mainly SMEs, with more than 90% having a turnover of less than €15m, and at the same time it is a very active sector from an investment point of view. Specifically, in Spain in 2020, a total of 120 mergers and acquisitions.

Below, 5 transactions that we have highlighted because of the attractiveness of the spanish companies sold:

1. Tink buys Eurobits for 15.5M€ (Fintech and Information Technology)

Territorial Tax Management (GTT) was founded in Alicante more than three decades ago and has become a reference in municipal tax collection, providing its services to more than 3,300 institutions throughout Spain and Latin America.

AnaCap Financial Partners is an English private equity firm founded in 2005.

The transaction was announced in July 2020 and the agreed price is close to €120m.

This operation has allowed Anacap to break into Spain, where it had so far participated in several sales processes related to the financial sector such as Caser or the mortgage servicing subsidiary of Unicajaamong others.

One of the great attractions of GTT is the great technological potential of the company and the type of business in which it operates. This attracted different funds, such as Carlyle or Oakley Capital.

2. Acquisition of fintech company Eurobits by Tink

Eurobits, founded in 2004 and headquartered in Madrid, provides account aggregation services to international banking and fintech customers, including BBVA, Santander or Bankia.

Tinkfounded in 2012, serves some of the world's leading banks and fintechs including PayPal, Klarna, NatWest, ABN AMRO and BNP Paribas. The open banking platform is also used by more than 5,000 developers.

The transaction was announced in March 2020 and the price paid amounted to €15.5 million.

Through the transaction, Eurobits takes advantage of the opportunity to help Tink expand its service offering in Europe and Latin America.

3. Gamma buys 94% of Voztelecom for 19.2M€ (Software and Telecommunications) 19.2M€.

Founded in 2003, VozTelecomis a communications operator with thousands of customers throughout Spain and a leader in the cloud telephony sector for SMEs.

Gamma is a company listed on AIM (London's Alternative Investment Market), since 2014.

The transaction was closed in February 2020, Gamma acquired 94.90% of VozTelecom's share capital and the transaction price was a total of €19.25M.

Through the transaction, VozTelecom benefits from synergies with Gamma while Gamma achieves an important milestone in its European expansion strategy.

Indra buys SIA for 70M€ (Financial Services)

Founded in 2000 in Madrid, SIA has a diversified and stable customer base with more than 10,000 security projects and is the national leader in identity and e-signature solutions.

Indrais one of the leading global technology and consulting companies in Spain and Latin America.

The sale was announced in early 2020 and the transaction price was closed at €70m.

Thanks to the transaction, Indra consolidates its leading position in the information security market in Spain and Portugal and SIA benefits from Indra's customer base.

5. EQT buys a majority share of Freepik (Enterprise Software)

Founded in 2012 in Malaga, Freepik is one of the platforms online leaders in the supply of graphic resources (photos, vectors and icons) that have transformed the visual content and graphic design market. online thanks to its innovative business model freemium.

EQT's investment is a Stockholm-based venture capital firm.

In May 2020, the EQT fund entered into an acquisition agreement in which a majority position was agreed.

EQT will contribute to the acceleration of Freepik's international growth, leveraging Freepik's digital expertise and international presence.

In the meantime, Freepik aims to boost its penetration in existing markets such as the United States and Asia, with the goal of becoming the leading reference platform in the market.

The five selected companies stand out for the innovative solutions they provide in the IT sector. This is precisely what has attracted the attention of different types of investors, from strategic investors such as Indra to financial investors such as AnaCap.