In the first quarter of 2017, European startups in the fintech sector received 667M from venture capital, which is now almost 60% of the amount raised in the whole of 2016. Among the reasons for this growth are the support being given to early-stage fintech companies in the UK and changes to online payments across the EU.

Barcelona-based FinTech ID Finance raises $50M to grow in Latin America

The company will use the funding raised for its expansion programme in Latin America following the launch of its online financing service MoneyMan last year in Brazil.

BBVA continues its commitment to Fintech, invests in Hixme Inc.

BBVA continues to believe that a technological renovation of the banking industry is necessary to be able to face the new business models in the financial sector, although for the moment the results of its investees are not being satisfactory. Proof of this is that in February this year it expanded its fund to invest in fintech to $250M, has carried out 4 operations so far this year and has announced that it intends to invest in Latin America in a short period of time.

Venture capital invests in Fintech: Santander innoventures, Propel Venture Partners

Technology in the financial sector is gaining strength and banks do not want to be left behind, proof of this is that we have recently learned that Santander has increased its fintech fund and BBVA has made a new investment through Propel.

BBVA increases its fintech fund to $250M

BBVA had already invested in the Fintech sector in recent years as part of its transformation strategy to become the world's leading international digital bank. It has started 2016 strongly and has expanded its BBVA Ventures fund from $100M to $250M and has reached a management agreement with the US firm Propel Venture Partners.

Spain-based Spocat Fintech receives €31M

By 2016, investment in Spanish fintech companies is expected to triple and the number of companies operating in the sector is expected to double. 2015, with 78 companies operating in our country and funding of around €200M, has been the take-off of this sector in Spain, which according to Venture Watch was the protagonist of 9.6% of venture capital operations in Spain.

Fintech boom prompts banks to make a move

Crowdlending platforms that offer easier access to loans, in a fast way and without the need to compute in the CIRBE and other fintech business models are posing a risk for banks, which have already begun to take steps towards fintech in order to compete in this new market. The growth forecasts are very positive and it is expected that in 2015 the European Fintech market will move a volume of €7,000 M, a 237% more than in 2014. In 2014, alternative finance platforms moved €2,957M.

The fintech sector of choice for investors in Spain

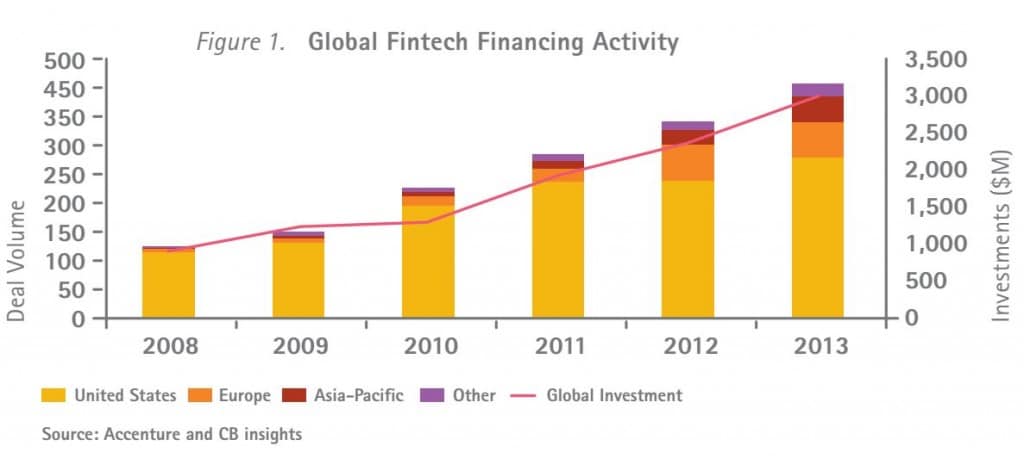

The growth of fintech seems to be unstoppable: since 2008, global investment in fintech has tripled from $928M to $3,000M in 2014 and is expected to reach $8,000M in 2018. Although the countries leading the sector in Europe are the United Kingdom and Ireland, Spain is also seeing significant operations such as those carried out in Digital Origin and Peertransfer.

Growing investment in the Fintech sector

In the last 5 years, investment in the Fintech sector worldwide has tripled, reaching an investment of $3B in 2013. In Europe, the UK tops the list of major investors.

What is Spanish venture capital investing in Fintech?

In the United States, a global benchmark in technology investment, the financing of companies in the Fintech sector grew by more than 20% in terms of both the number of transactions and capital invested. In Spain, there are also some good startups setting a good example.

Growing investment in financial technologies (FINTECH)

Investment in financial technologies (FinTech) by venture capital and venture capital has increased steadily since 2008 and has eclipsed $ 9 B. 2013 is shaping up to be an exceptional year for FinTech surpassing the high levels seen in 2012.