What is the "SaaS sector"?

Software as a Service, known as SaaS, is a software distribution model in which a third-party provider hosts the applications and makes them available to customers over the Internet. SaaS, in other words, involves third-party providers hosting, maintaining and supporting software requirements with lower upfront costs and eliminates the need for organizations to install and run applications in their own environment or data centers.

The difference between the other similar sectors, such as PaaS and IaaS, lies in the degree of control and access between them, with IaaS having much greater control and access than SaaS, for example.

Scope and coverage of the study

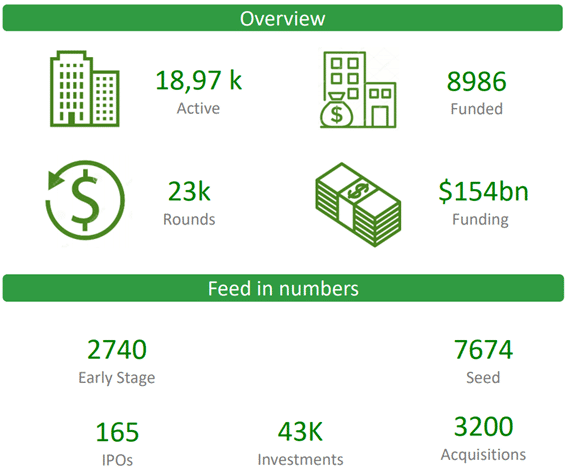

This study covers 15,358 companies worldwide labelled within the "SaaS" category.

All data on companies, acquisitions and financing rounds were extracted on 23 March 2021. Deals, rounds and companies founded after this date have not been included.

Pain investment trends

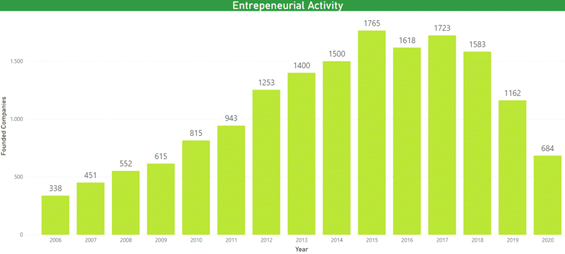

Firstly, the following table shows the evolution of the creation of companies in the sector from 2006 to 2020. It can be seen that from 2006 to 2015 there was a lot of activity in terms of company creation, reaching a number of 1,765 companies founded in 2015, with the exception of 2016, when there was a slight drop to be taken into account.

In the following years there has been a considerable drop, decreasing radically, returning to the 2009 figures. This may mean that the sector is becoming a mature sector, leaving behind the growth stage.

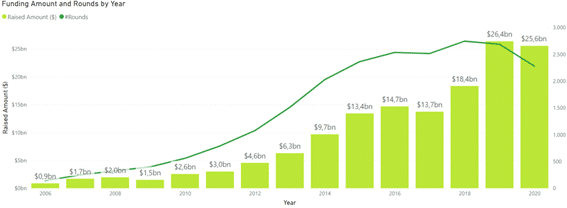

On the other hand, in terms of the funding raised in recent years, a much more stable growth can be observed. In 2019, there was a large increase, 8 billion dollars to be exact, in terms of fundraising, as the number of rounds decreased slightly.

Finally, the last year, in contrast to the table mentioned above, has been maintained despite the reduction in the number of rounds. For the coming years, it is expected that the values will remain the same and even continue to grow, reaching a revenue of around 20 billion dollars by 2023, indicating the maturation and growth of the sector that we have previously mentioned.

Analysis of the acquisition activity

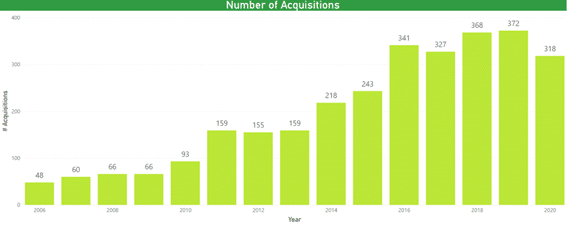

Regarding the activity of acquisitions in the past years, the same increase is shown as those mentioned above, with a very positive progression. This increase has been consolidated since 2015. The years after this, the values are around 340 operations, keeping it fairly constant. The last three years have been dominated by acquisitions of large companies in the sector, such as Oracle (13 acquisitions) or Salesforce (17 acquisitions) and others that are not so large, such as ASG (19 acquisitions).

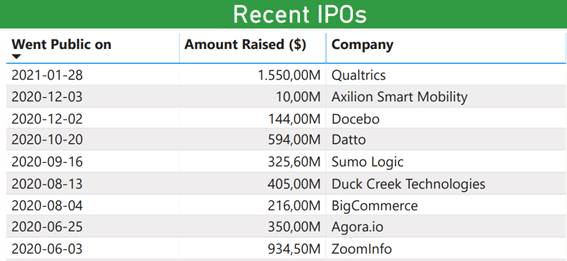

On the other hand, in terms of stock market activity, there have been several IPOs, including a very recent one on 28 January 2021 by Qualtrics, a US company acquired by one of the leading companies in the sector, SAP, in November 2018. Qualitrics is a company that specialises in managing customer, product, employee and brand experiences on a single platform. It went public for just over $1.5 billion, the highest price of any IPO in 2020.

Analysis of investment activity by sub-segments:

This report focuses on segmenting by type of application: banking and finance, telecommunications and IT, consumer goods and retail, and logistics and transportation.

According to Statista, the segments most linked to SaaS are the sectors:

- Analytics and BI

- Collaboration

- Content Management

- Customer Relationship Management (CRM)

- E-Commerce

- Enterprise Resource Planning (ERP)

- Human Capital Management (HCM)

- IT Service Management (ITSM)

- Product LifeCycle Management (PLM)/Engineering

- Project Portfolio Management

- Procurement

- Sales Performance Management

- Supply Chain Management (SCM)

- Treasury and Risk Management

[services_shortcode]