What is the "Industrial Automation" sector?

The Industrial Automation sector represents the whole industry concerning the use of control systems, such as computers or robots, and the use of information technologies, in order to modify the operation of different machinery and processes in order to automate them without direct human intervention. It is arguably the second step beyond mechanisation in the field of industrialisation.

A very clear example of Industrial Automation can be found in the automotive industry. The assembly line of vehicles is covered by different machines that ultimately perform the work faster, safer, more efficiently and with higher quality. An example of the improved efficiency in the automotive industry is the decrease of the error rate in the nut assembly process from 1.5% (human error) to 0.00001%.

There are three types of Industrial Automation; fixed, programmable and flexibleThe first of these refers to the most repetitive tasks and consists of rigid machines, i.e. they are difficult to reprogramme, although they avoid human risks and achieve greater efficiency.

Secondly, there are programmable machines. These, unlike the former, are easier to reprogram and can be used for different tasks. For example, they can be configured for the production of one batch of products, and then be dedicated to a second batch with different characteristics, with a different configuration.

Finally, the so-called flexible machines. The main advantage of these machines is that they are not continuously reprogrammed for each task, but, thanks to their flexible control system, they can act automatically and immediately. An example of this type is the milling machine.

Having introduced the sector, we continue with an overview of the sector through the study carried out by the specialists at Baker Tilly.

Scope and coverage of the study

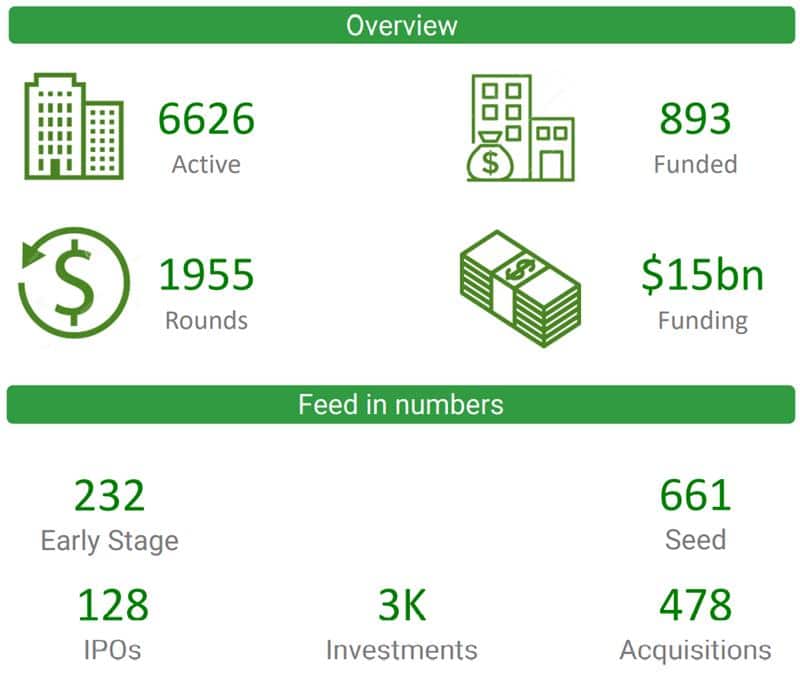

This study covers 6,651 companies worldwide labelled within the category "Industrial Automation" according to Crunchbase.

All data on companies, acquisitions and rounds were extracted on 1 June 2021. Deals, rounds and companies founded after this date have not been included.

Principal investment trends

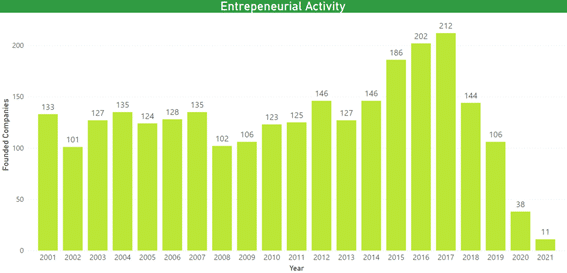

Analysing the creation of companies in the last 30 years categorised as Industrial Automation, we can observe a certain stability maintaining around 125 companies created each year. Although it is true that in the last 8 years this number has increased considerably, reaching a peak of 212 companies founded in 2018. This marks an upward trend for the coming years, bearing in mind that the data for the last two years are less real as the companies should be incorporated into the BC database.

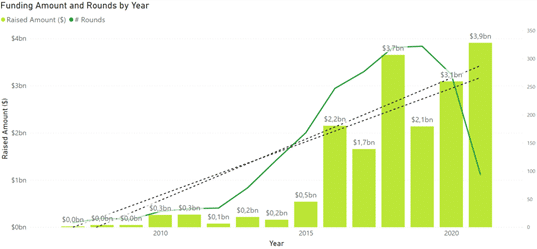

On the other hand, analysing the funding received from the Industrial Automation sector, we come to the same conclusion as before: the sector is in full growth. The fact that in the last 5 years the amount raised through the different funding rounds has increased by 800% is a good indication of growth. It is worth noting that not only the amount raised has grown, but also the number of rounds, indicating that the sector is not stagnating in maturity but is still young. It is worth highlighting 2018 and the current 2021, years in which the most money has been raised.

The former raised a total of 3.7 billion dollars through 320 rounds. And in this current year, after only 6 months, the most money has been raised of all the years, almost 4 billion dollars. This is due to a massive round by the Norwegian company AutoStore, which raised 2.8 billion dollars in a single day through the Japanese investor: Softbank.

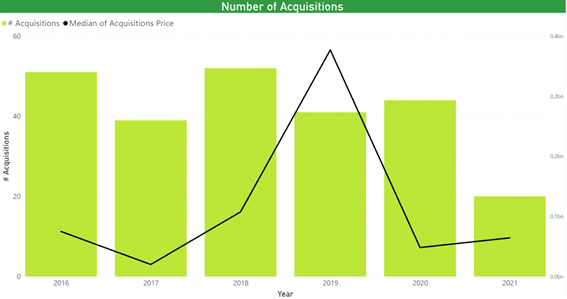

As for the acquisitions made in the Industrial Automation market shows a fairly stable trend. The number of acquisitions by companies in the sector is around 40 deals per year, with an average and median acquisition price of $50 million, with 2019 being a special year, thanks to the acquisitions of Milacron, which acquired Hillenbrand for $2 billion, IMA Group, which bought Atop for €380 million, and Kaman Coroporation, which acquired Bal Seal Engineering for $330 million. All of these transactions are not very common in the sector given their high price.

Finally, the table below shows the most recent IPOs. Only a few companies have been listed on the stock exchange, a total of 128, and in the last 20 years only 6 companies have made an IPO.