What is Artificial Intelligence?

Artificial intelligence is the science and engineering involved in the creation of intelligent machines, especially intelligent software. It is related to the similar task of using computers to understand human intelligence. Another way to define Artificial Intelligence is to say that it is an area of computer science that focuses on developing and managing technology that can learn to make decisions and carry out transactions autonomously instead of humans.

There are three main types of Artificial Intelligence, explained in the report:

- Weak AI

- Strong IA

- Super IA

In terms of the sector, there are often doubts about what represents the Machine Learning or Deep Learning sub-sectors, as they are not the same but complementary. In conclusion, the report shows that Deep Learning is part of Machine Learning, both being part of Artificial Intelligence.

Sector opportunities

As is already known, the Artificial Intelligence sector has marked the development of technology in companies over the last 10 years, if not more. But the report reflects the huge growth that will be reflected in the coming years and the major trends that exist in this market. Specialisation in new AI-driven technologies, such as NLP (Natural Language Processing) or the development of cybersecurity, for example, will be a trend in the sector.

On the other hand, the pandemic has boosted the use of these technologies even further, improving the outlook for the future. This is one of the opportunities offered by the sector in terms of trends, but there are also new investments or the growth of M&A transactions in 2021, reaching historic highs.

Sector segmentation

Component

- Solution

- Service

Technology

- Deep learning

- Automatic learning

- NLP

- Artificial vision

Implementation analysis

- Cloud

- On site

Key players

- Amazon

- Apple

- OpenAI

- Quealcomm Tech

- IBM Corpo

- Microsoft Corp

- Salesforce

- Alphabet

- NVIDIA Corp

Region

- North America

- Europe

- Asia-Pacific

- Middle East and Africa

- Latin America

Final user

- IT and telecommunications

- Retail

- Advertising and media

- e-commerce

- BSFI

- Healthcare

- Manufacturing

- Automotive

- Other

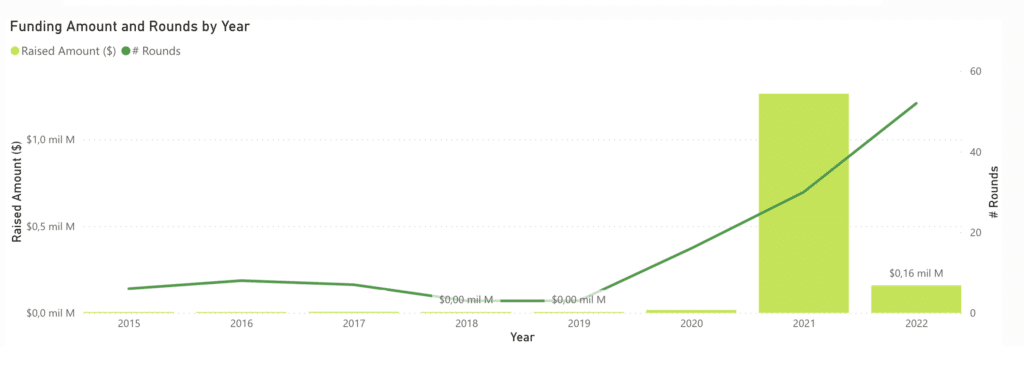

Funding received

Financing has shot up in the last year 2021, thanks to the greater relevance and specialisation of this sector, as explained in the section on opportunities in the sector. Financing has more than doubled in 2020, showing an increasingly consolidated sector, but with a promising future ahead, as we have been saying.

The report shows the financing operations carried out by companies at different stages (innovation, growth, consolidation), analysing the type of company at each stage.

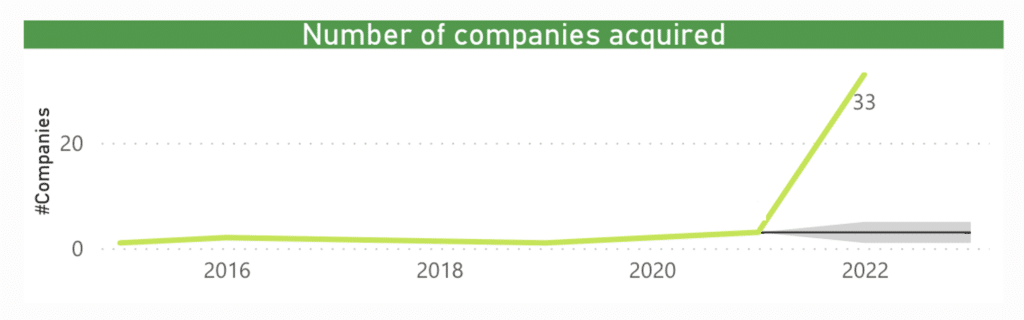

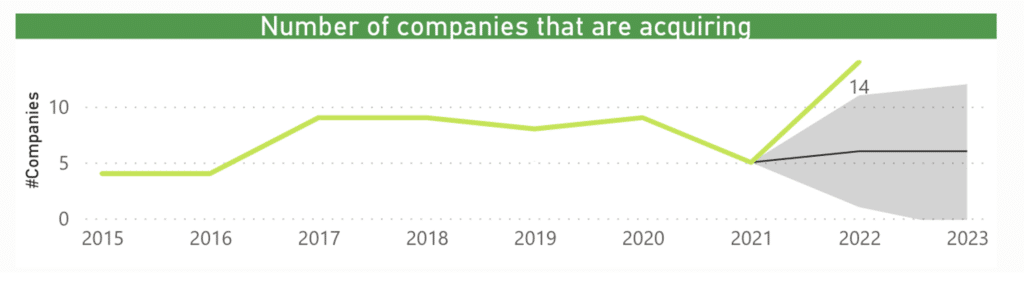

M&A Operations

In terms of acquisitions, 2021 was also a record year, almost doubling the previous year's figure, with 50% of all acquisitions in the sector's history, by both buyers and sellers, taking place in 2020 and 2021. The number of deals has soared in more established companies buying more specialised companies in certain technologies, such as those mentioned in NLP or cybersecurity.

The report breaks down the activities carried out by dividing them into the buyers' and sellers' side. Both sides have a more than positive trend, although in 2022 they will not reach the numbers of the historic 2021.

Public companies

Finally, the report shows the latest IPOs that have taken place in recent years. 2021 was also a record year in terms of the number of IPOs with a total of 39 companies. In 2022 there have already been two; Core Scientific and Abcence, US and Indian companies respectively.