In recent years, alternative financing has grown considerably, with P2P Lending in the US attracting large amounts of money through companies such as Lending Club, Prosper Marketplace and Funding Circle.

The Media sector receives investment for "publishing".

The media sector is in the midst of a profound change brought about by a poor outlook for traditional publishing models such as newspapers and printed books. As a result, we are seeing the emergence of new models funded by venture capital.

Content "Curation" receives 18M from venture capital

With the growth of content marketing, the software market has created several tools for what is known as content curation. According to our research we have identified more than 30 tools, of which only 8 have received venture capital backing for a total amount of $18M.

74% of venture capital and private equity deals in 2013 were targeted at SMEs.

Private equity invested almost 40% of its investments in the "Other services" and "Other industrial products" sectors. Corporate investors grew by 29% in 2013, with very significant activity in the internet and technology sectors. Spain has one of the best Business Angels network infrastructures.

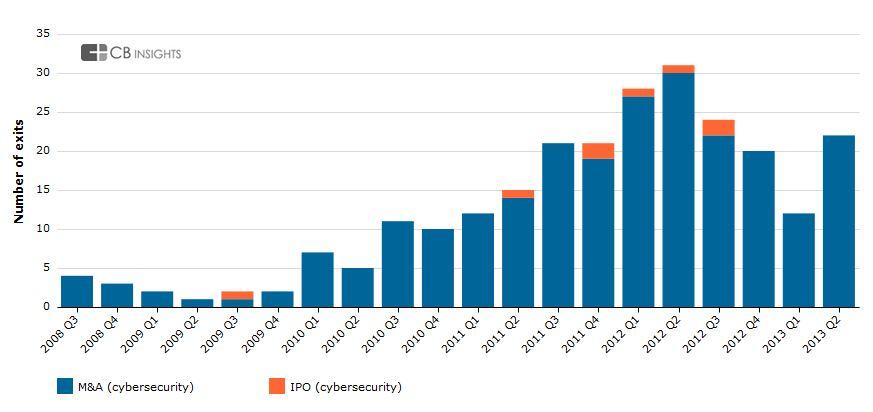

Cybersecurity: an opportunity for investors

In the past year venture capital firms invested $1.4MM in 239 American cybersecurity companies. 80% of which ended in acquisitions or IPOs, with an average return of 10 times the investment.

Digital content managers receive $230M of venture capital

Digital content is becoming king in entertainment and leisure as well as in business marketing. As proof of this, venture capital has invested $230M in 38 companies since 2012.

Increase in large and Series A funding rounds in the technology sector.

According to a study by Cb Insight, there has been a significant increase in Series A funding rounds larger than $10M in the technology sector in recent years, while small and medium-sized rounds have remained constant.

Enterprise content managers get venture capital backing

Enterprise content management platforms have been around for years, but since 2013 seven companies have received funding from investors to accelerate their growth, not only in the US but also in India and Europe.

"American Venture Capital bets on mobility".

In 2013 Venture Capital invested $$3.7B in mobility, consecutively raising investments in excess of $1 billion over the last two quarters of 2013.

Lleida, Andalusia and Castile: growth in local entrepreneur funds

Faced with the lack of bank credit, the entrepreneurs themselves and their associations are promoting new funds to circulate the existing liquidity among the entrepreneurs themselves. Lleida, Andalusia and Castile are examples of this.

Big data in education appeals to investors

Technologies for capturing and managing large volumes of data, known as big data, are being applied to a multitude of business sectors. One of these is the education sector, which has seen approximately $150M from early 2013 to date from 30 companies.

Springwater, the most active foreign fund investing in Spanish SMEs

Since mid-2013, the Geneva-based fund opened an office in Spain and has been the most active foreign fund investing in Spanish SMEs, having invested more than €50M. The firm has announced that it has more than €100M available for 2014.