Michelin is betting on E-commerce. In the last two years it has bought 4 companies to grow its online sales in both the tyre and passenger experience sectors.

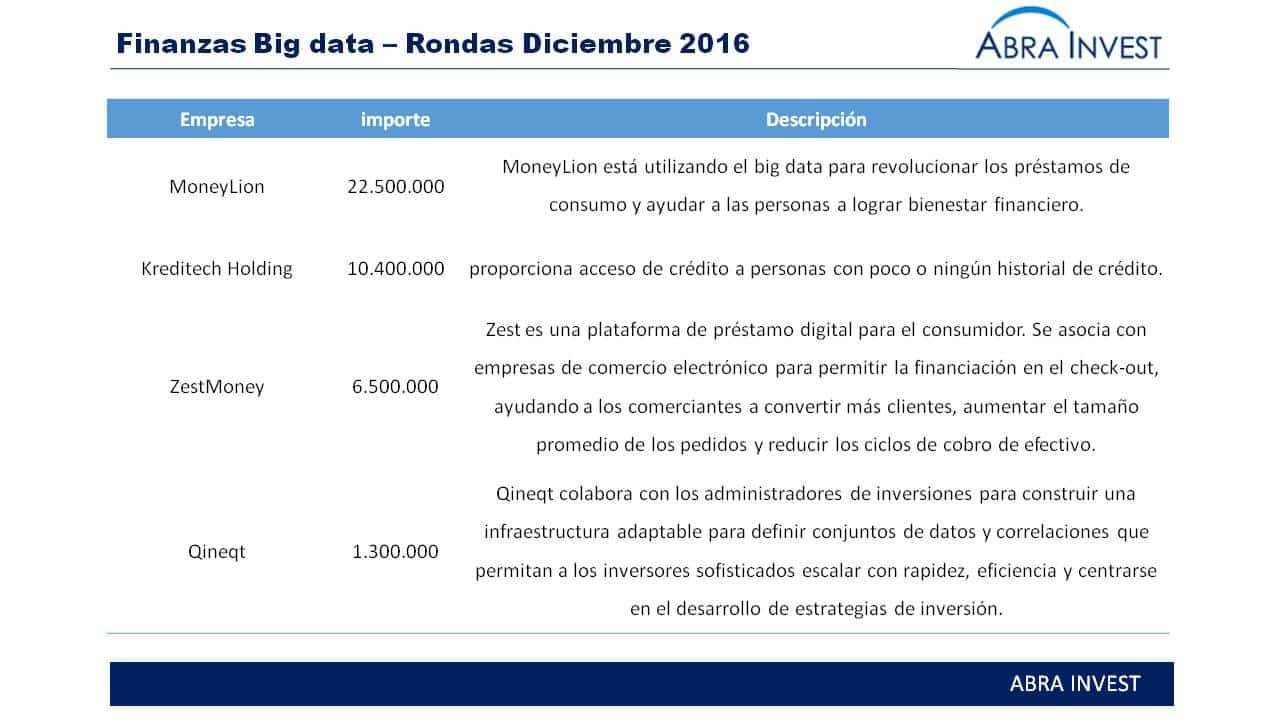

Datio, a joint venture between BBVA and Stratio to lead big data in the financial sector, is born

The use of big data in the banking sector has numerous applications, such as being able to offer customers solutions that adapt to their needs, predict customer behaviour, detect the possibility of fraud, etc. BBVA has realised the importance of big data for its sector and is investing in this area.

ClinicPoint welcomes Ona Capital into its shareholding structure

ClinicPoint, the marketplace to find doctors online at the best price, has received a new round of €800,000, giving entry to Ona Capital.

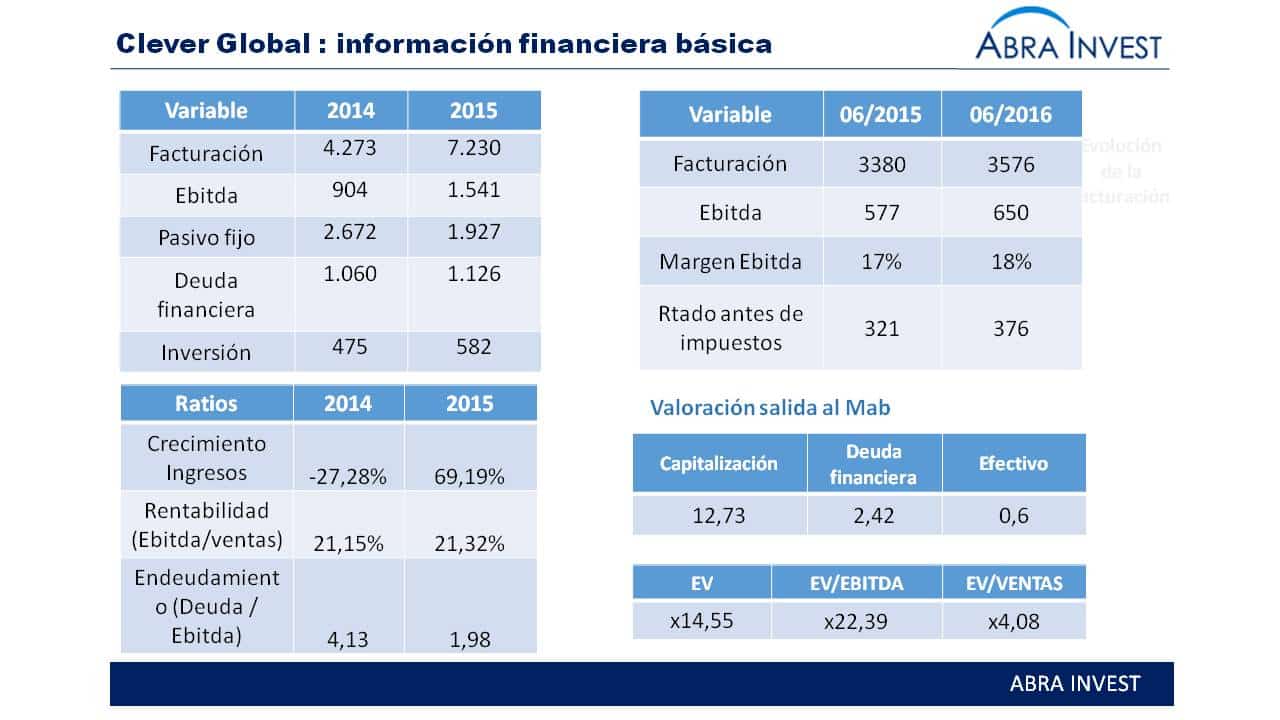

Clever global exits on Mab and grows 11% on its first day

CLEVER Global is a technology services and outsourcing company specialising in global management of suppliers and contractors, coordinating in real time all the elements (companies, workers, vehicles and machinery) involved. This company has gone public on the Mab with the aim of making its growth strategy a reality.

What operations have there been in cybersecurity in December 2016?

Cybersecurity companies need to grow both in innovative technology and in new markets if they are to be competitive in an industry that is constantly innovating. One of the ways to grow is through acquisitions. Akami, for example, has made 17 acquisitions in the sector in order to position itself as one of the leading companies. In addition, private equity is also making acquisitions with the aim of growing companies and then being able to sell. Golden Gate Capital, for example, invested this month in Neustar.

CornerJob, one year old and $35M lifted.

Cornerjob, a Spanish job search app, lets you know within 24 hours if your CV has been selected for an interview. This app, which was launched in the French and Italian market in 2015, has already received a total of $35M and the support of international investors.

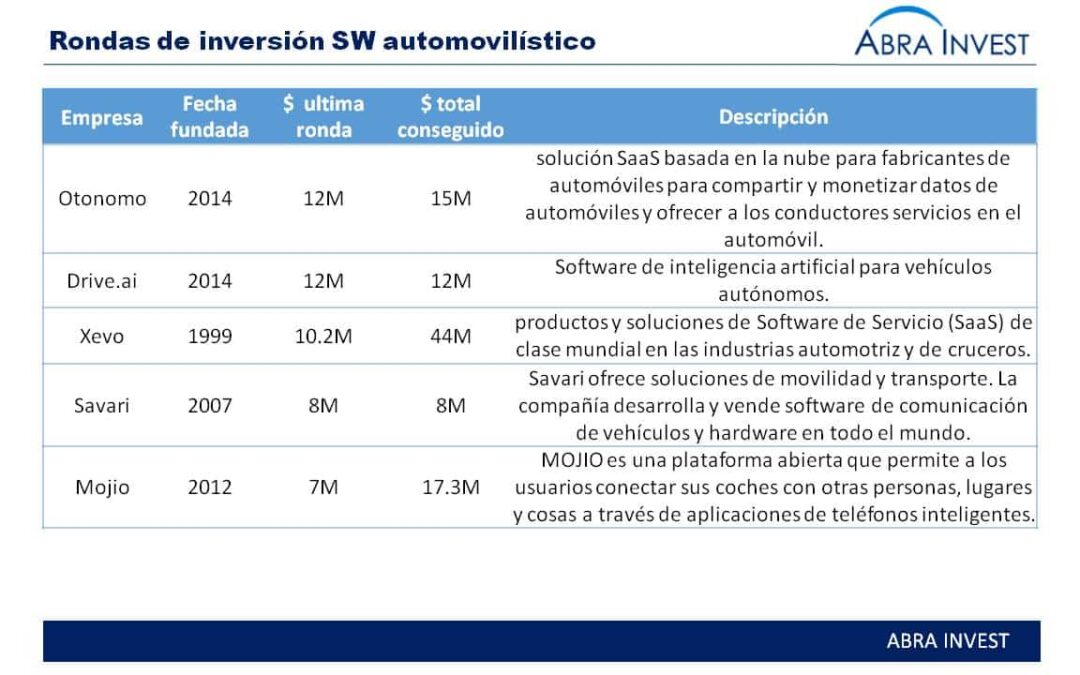

Thundersoft acquires Rightware to strengthen its position in connected car software market

The Shenzhen-listed Chinese company, backed by investors such as Intel Capital and Qualcomm Ventures, has bought Helsinki-based Rightware to strengthen its position in the automotive software market and enter new geographic markets.

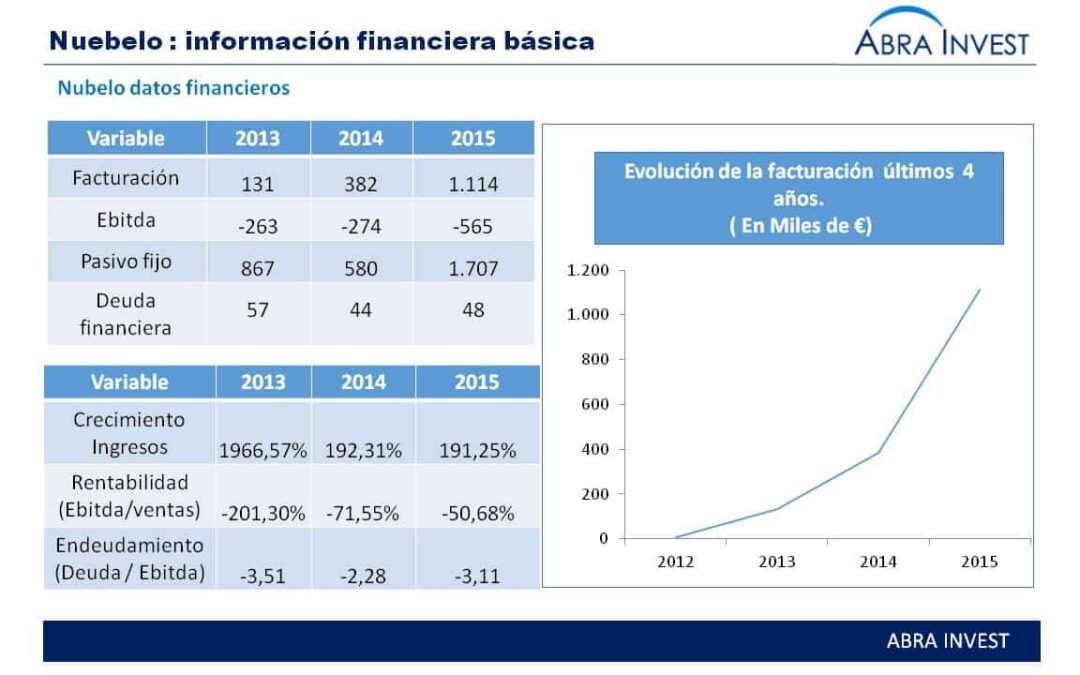

Freelancer.com buys Spanish startup Nubelo

Freelancer, the world's leading Freelancer recruitment platform, is buying Nubelo to grow in the Spanish-speaking market.

One Of The Main Reputable Mobile Affiliate Program

Internet marketing is a substantial business. Process a small fortune. It has advantages and cons too. Purchase deal with this you will in a right way, celebrate you a huge success. Also, if you don’t can see this business, this could eat up all of the money you invested into it. Internet marketing and affiliate marketing are undergo many cpa affiliate networks mobile affiliate marketing http://adwool.com/ market risks and problems. Most likely it’s not products along with the services you are offering meant for clients that having problem. The most common problem I have noticed is with those marketers who realize their valued clientele.

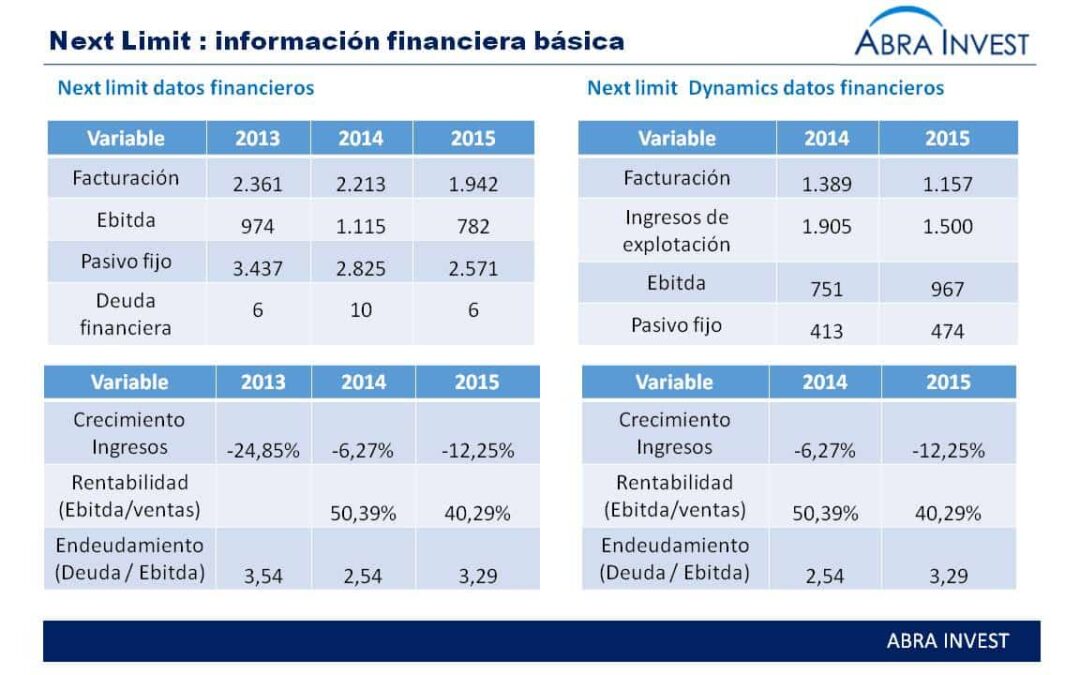

Dassault system, a virtualisation software company, acquires Spain's Next Limit Dynamics.

Next Limit Dynamics is the fluid simulation division of Next Limit. This technology is used in sectors such as aerospace, defence, transport and mobility, high-tech and energy.

Ezentis buys Chile's Tecnet to grow in the energy market

Ezentis, a Spanish listed company, has acquired Mexico's Tecnet, an industrial services company for electricity distributors, for €9M.

IT wholesaler Infortisa buys X-one to boost mobile business.

Infortisa, the leading IT company in the Valencian Community and one of the Top 5 in Spain, has acquired X-ONE, a company specialising in mobile accessories.