Venture capital is picking up again in 2014, with a total of 76 deals so far this year, amounting to €12,207M, which is more than the €9,423M raised in the 138 deals made in the whole of 2013.

Venture capital is picking up again in 2014, with a total of 76 deals so far this year, amounting to €12,207M, which is more than the €9,423M raised in the 138 deals made in the whole of 2013.

May saw 26 Venture Capital deals, the highest number so far this year according to data provided by TTR. Despite this, the total amount invested was €31m, almost half the amount invested in April 2014.

May saw 26 Venture Capital deals, the highest number so far this year according to data provided by TTR. Despite this, the total amount invested was €31m, almost half the amount invested in April 2014.

The Basque venture capital company Talde is opening a new fund to support investments from Europe to Latin America and vice versa.

Crowdfunding has grown a lot in recent years, according to a study by the agency Massolution, in 2012 this type of funding grew by 81% compared to the previous year, raising a total of $2,700M worldwide and in 2013 the figure doubled to more than $5,000M.

The limitation on the amount of investment, the main fear of all platforms in the first draft of the bill, has been overcome. Although the draft bill states that by default all investors will have a limit on their investments (maximum €3,000/transaction and €6,000/year), the door is left open for professional investors who are used to analysing the risks of investments to invest without limits per project or per year.

Venture capital once again placed its trust in Spain in the first half of 2014, doubling investments from €310M in the first quarter of 2013 to €618M. This increase in investments has been due to the average increase in the amount of each deal, as the number of deals has remained practically the same, at around 100.

Of the total 40 rounds of financing in the manufacturing sector, 9(25%) have gone to companies involved in the production of IT-related devices, raising a total of 61.3$M. These deals have been mainly in US companies, but also emerging markets, such as China and India, are getting venture capital backing.

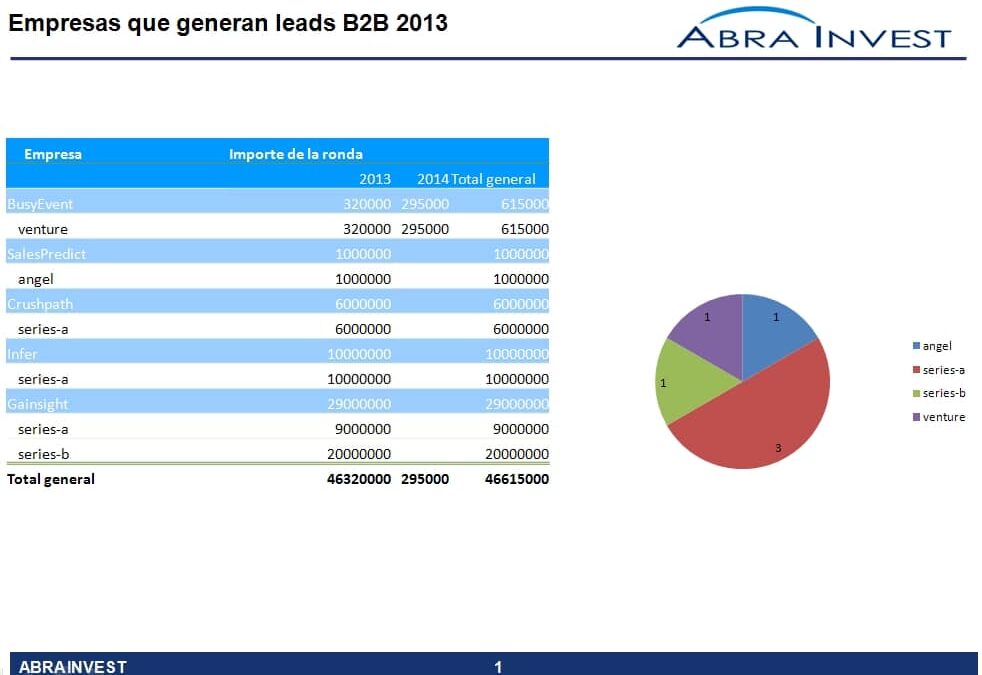

Companies working in B2B have several challenges to face in order to reach their audience, getting leads is more difficult than in B2C due to the lower volume of customers and the complexity of reaching the target. More and more companies are taking advantage of these difficulties to offer services aimed at increasing leads. Some of them have received venture capital funding in 2013.

Today, companies not only need to know what happened in the past to understand the present, but also to anticipate the needs of their customers. The "Predictive Enterprise" involves the use of advanced technological tools that make it possible to move from product-focused to customer-focused companies. These types of companies, which are currently growing considerably, have applications in numerous sectors of activity and have received great support from venture capital; in 2013 and so far in 2014 alone, this sector has raised $531M.

New technologies are changing the consumer's behaviour when it comes to making a purchase decision, the mobile phone, for example, is one of the tools that have been incorporated into the decision making process. The customer at the point of sale can compare prices, ask for opinions, look for offers. That is why in recent years companies have been created that provide mobile marketing services for large brands that see the mobile phone as an opportunity to interact with their customers. It seems that the trend for this type of company is on the rise as their effectiveness becomes clearer and investors do not hesitate to bet on them.

The elimination of geographical barriers, as well as new technologies applied to production processes and increased competition, are creating an increasingly demanding customer. Companies face two challenges: to know what their customers' real needs are and to reach them. In order to help in this task, numerous online marketing companies have appeared, many of them driven by venture capital.