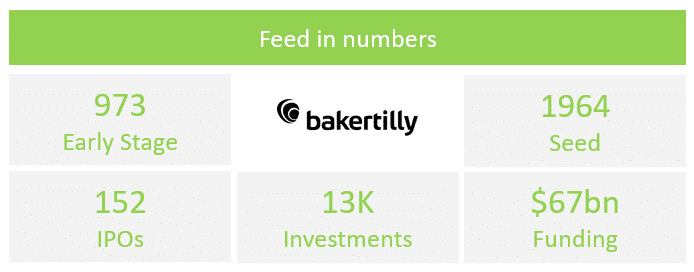

As has been seen in the Investment Analysis by the experts at Baker TillyThe Cloud Computing sector presents a positive projection for the coming years, showing continuous growth and providing data on the most active Venture Capital to date. Analysing the data globally, we observe that a large number of operations have been carried out, in addition to being a sector with stable funding. Therefore, a ranking focused on the most active Venture Capital may be of great interest today.

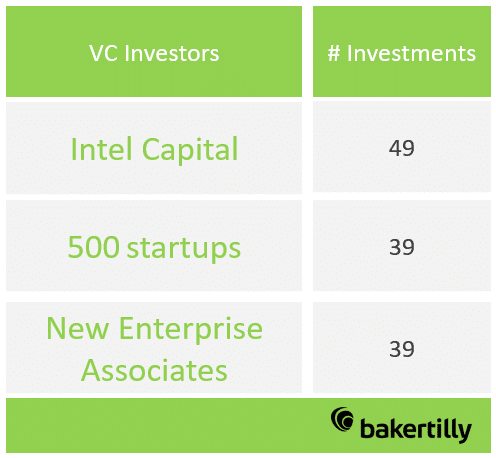

In this post, we will present the main investors in the Cloud Computing sector, analysing the top 3 Venture Capital firms by number of investments in the sector. The resulting investors are Intel Capital, 500 startups and New Enterprise Associates. And finally, the main ones in the Spanish sector will be shown.

1st - Intel Capital: the first of the most active Venture Capital firmss

Intel Capital is the sub-organisation of the well-known US company Intel. It is mainly dedicated to transforming its clients' businesses by offering specific technological solutions for each company, in order to achieve a competitive advantage in its sector. On the other hand, Intel Capital is dedicated to investing in companies dedicated to the cloud, artificial intelligence or cybersecurity, i.e. it is focused on technology companies.

This venture capital has realised 49 investments in the Cloud Computing sector, investing a total amount of 2.6 billionThe number of investments in this case coincides with the number of companies invested in. The most recognised company in which he has invested is Clouderathe US enterprise data platform. In that transaction Intel Capital invested 740 millionmaking it Intel Capital's largest investment in the data centre sector. The investment was aimed at securing a 18% stake, valued at approximately $4.1 billion.

2nd - 500 startups

This US venture capital firm, based in California, ranks as the second most active Venture Capital. It focuses on financing early-stage companies. For this reason, it is normal that it has made a high number of investments, a total of 2,543 investments in different sectors, all of them technological.

On the other hand, it has made 10 fewer investments than Intel Capital, a total of 39 in the Cloud sector, and has also invested a smaller amount, although by no means negligible: $68 million. Koding is the Cloud company in which it invested the most money. In 2015, together with four other investors, it carried out a 10 million dollar operation.

2nd - New Enterprise Associates (NEA)

This US firm operates in technology sectors such as Software and also in the healthcare sectors such as Biopharma. They aim to help their clients grow by focusing on start-up companies.

New Enterprise Associates has made the same investments as 500 Startups, 39, but unlike the previous firm, it has invested more than 3.5 billion dollars in the sector. We highlight the investment made in Collective Health, a company that presents innovation in the healthcare sector through cloud platforms. This company has received a total of $749 million through 10 rounds of financing, rounds in which NEA has participated, along with other investors.

Investors in Spain: Cabiedes as most active Venture Capital in the Cloud Computing

To finalise this ranking, Baker Tilly has identified Cabiedes & Partners as the most active Venture Capital in the Spanish Cloud Computing market. It has made the most investments in the sector at national level. This Spanish venture capital firm offers financing, above all, to early-stage companies. It has made 6 investments in two Spanish companies in the Cloud sector: GIGAS and Zyncro. The first of these, already mentioned in our article "Global Financing of the Cloud Computing Sector"is the only Spanish Cloud company listed on the stock exchange.