Emprendetur R&D&I is the programme that supports research, development and innovation applied to products and services in the tourism sector. The 2014-2015 call for applications will open soon, which is why we have decided to make an analysis of the beneficiaries in 2013.

Fiware programme, towards the city of the future.

80 million to companies and entrepreneurs developing applications based on FI-WARE, a platform that represents an open option for the development and global deployment of applications in the Future Internet.

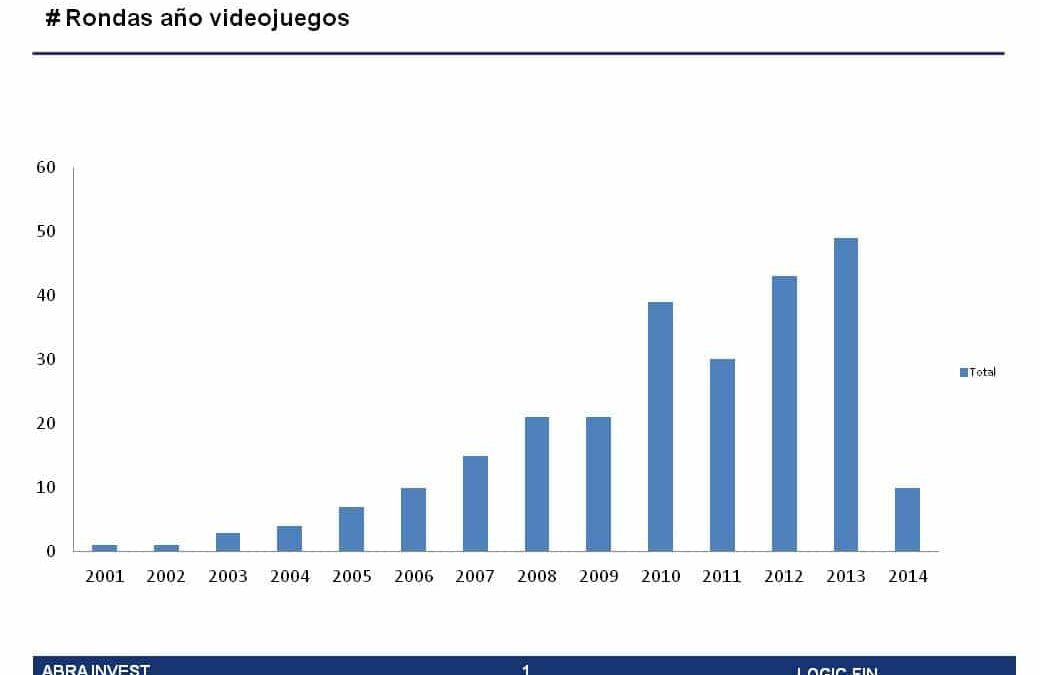

Investment in video game companies is growing

In the last five years, the number of rounds of investment in video game companies has grown steadily, reaching 49 rounds of investment last year for a total of €177,797,781 worldwide. Although Spanish companies have traditionally received little investment, they are gradually getting investors and universities to provide them with the help they need to develop video games.

Analysis of Spanish venture capital fundraising at Capcorp 2014

La semana pasada asistimos desde Abra Invest al congreso anual del Capital Riesgo en España – Capcorp2014. Una de las cuestiones que más creemos puede influir en el futuro próximo del sector es el levantamiento de nuevos fondos para inyectar liquidez r impulsar el...

Fondico selects 9 female managers in its third call for proposals

FOND-ICO Global, the venture capital fund of funds managed by AXIS, the ICO's venture capital company, has announced the 9 venture capital managers chosen in this 3rd call, in which it will invest €194M.

Venture capital analysis at CapCorp 2014

Esta semana desde ABRA INVEST hemos asistido en Madrid al congreso anual de capital riesgo organizado por Capital & Corporate. Una de las conclusiones ha sido el crecimiento del ecosistema español del venture capital que todavía tiene mucho que hacer para llegar...

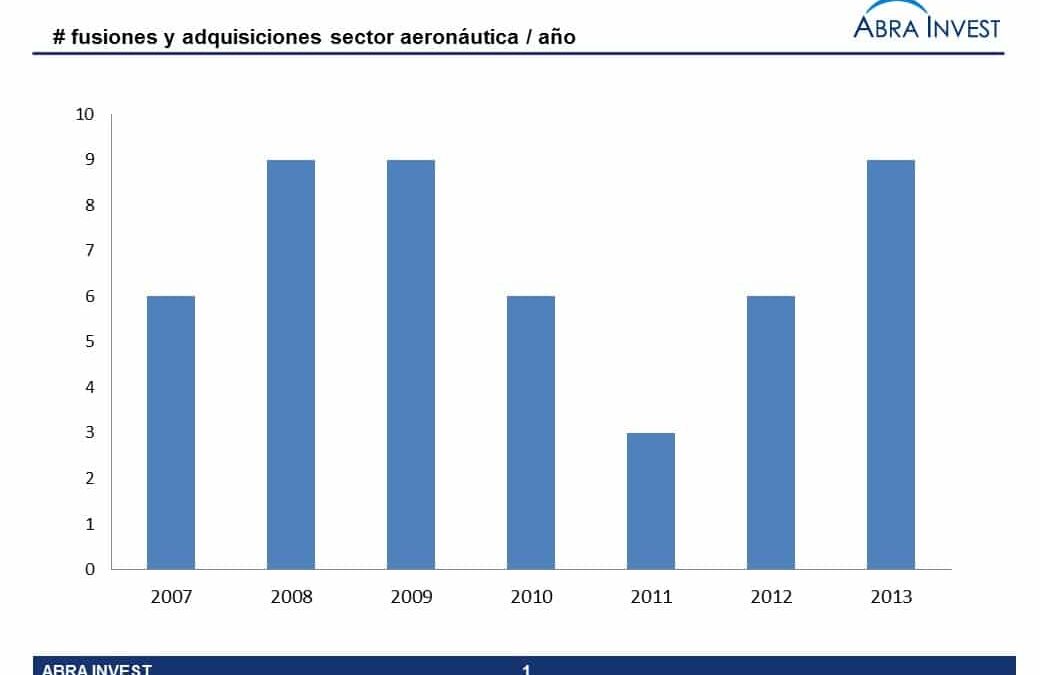

Recovery of mergers and acquisitions in the aeronautics sector

After several years of little movement in the Spanish aeronautical sector caused mainly by the crisis, 2013 saw a slight recovery. Nine purchase operations were carried out in our country, a number that triples the 3 operations carried out in 2011. In addition, the operations carried out last year were for quite high amounts.

Venture capital in the aeronautics industry

It seems that the aeronautics sector is slowly recovering and after a few years in which the participation of private equity in the sector had dropped considerably, this year 2014, although the participation is still low, two deals have been closed for an amount of €150M, a figure that far exceeds the amount raised by private equity in 2014.

Analysis of crowd equity platforms in Spain

Crowd equity platforms in Spain are growing, in 2013 they represented 20.7% of crowdfunding platforms and this year several companies have raised a significant amount of money thanks to this modality. In addition, foreign platforms have decided to come to Spain.

New Profactory plus call for proposals under the Eureka grants scheme

The deadline has opened for the submission of projects to Profactory plus, a call within the framework of the Eureka grants, to help European companies in the development of innovative products in the field of sustainable and intelligent manufacturing technologies.

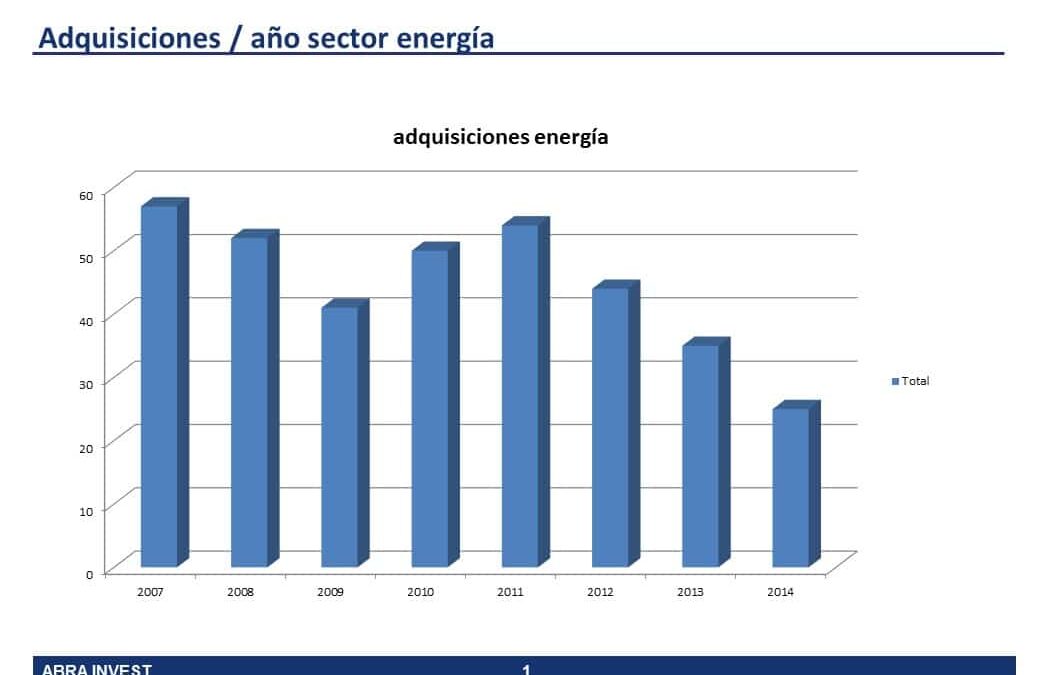

Mergers and acquisitions energy sector

In recent years, due to the energy reform, the number of company acquisitions in the energy sector has gradually decreased. Although in the last year there have been several transactions involving large energy companies interested in foreign companies.

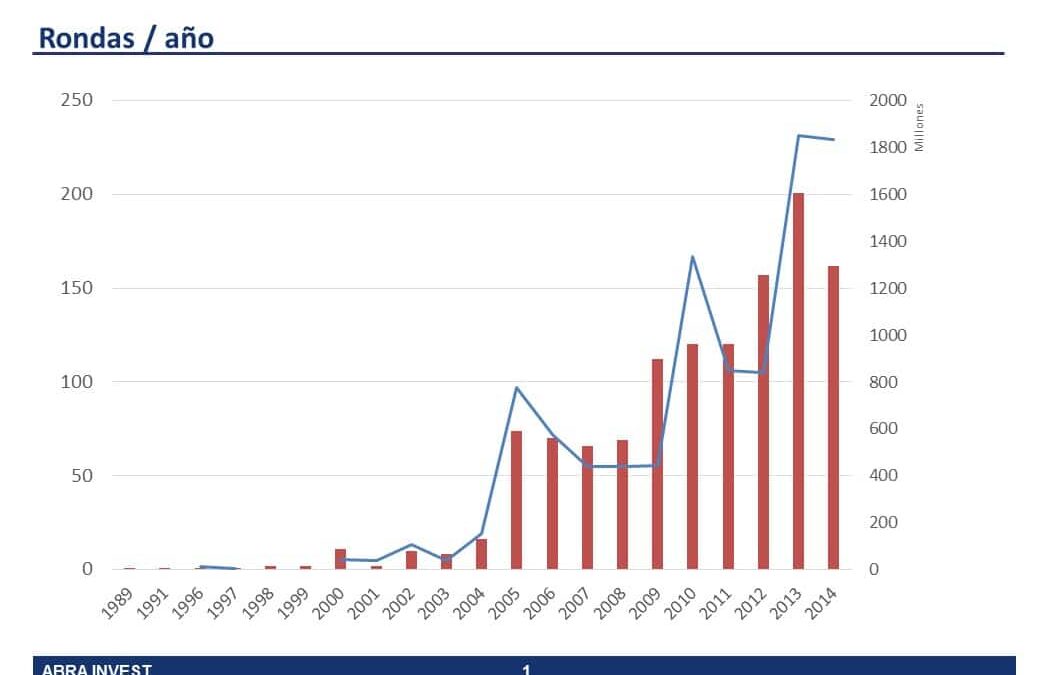

Growing investment in security tics

In recent years, the number of financing rounds in ICT security companies has grown considerably. In 2013, 201 rounds were closed in the sector for a total of 1850M$, which is more than the 838M$ raised the previous year in 157 deals.