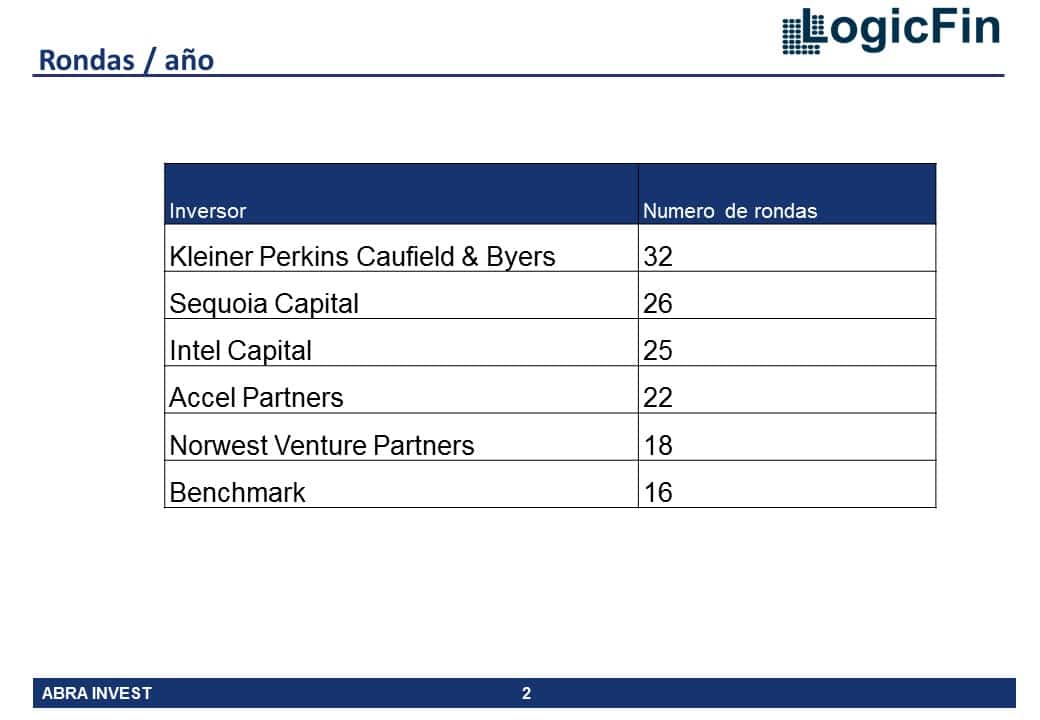

Big US tech funds bet on the sector

Among the investors The most active are large US funds specialising in the technology sector. Kleiner Perkins Caufield & Byersis the inverter which has carried out the most operations in the sector, with a total of 32 operations. It made its first investment in 2005, in the company Good Technologywhich provides mobile security solutions , participating in a $95M round together with Crosslink Capital, Advanced Equities and Benchmark and since then he has become increasingly interested in the sector.

Sequoia Capital is the second inverter more active, it also started investing in the sector in 2005. Sequoia has been involved in several rounds of funding large size. Last year it participated in the FireEyeleading the way in stopping threats such as the attacks APT, in which $50M were raised and this year 2014 it has participated in the round of $40M closed by Skyhigh Networks.

Operations highlights 2014

Apart from those made by FireEye for $739M and Good Technology for $80M, companies I have already mentioned above, Verafina financial crime detection company, has closed a financing round of $60M in which it has participated Spectrum Equity.

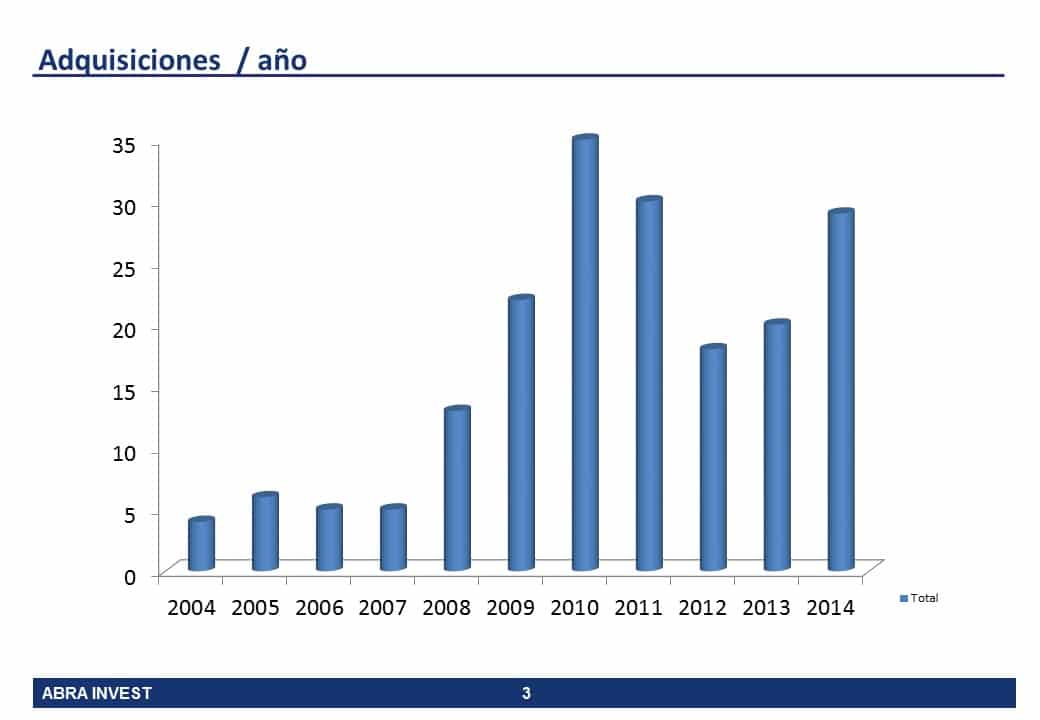

Acquisitions in the sector

El año 2014 ha sido protagonista de varias mergers and acquisitions en el sector. Después de dos años en el que las mergers and acquisitions had declined considerably, in 2014 they have been reactivated with 30 purchase operations. Among this year's highlights was the acquisition by the giant FireEye of Mandiant, computer forensic specialist by $1050M.

Other posts that may interest you

List of tics security investors

List of tics security companies

mergers and acquisitions-seguridad-tics/»>List of ICT Security Procurement

If you would like to receive all the graphics of this study, please contact us.