Capgemini, French technology consultancy, has recently acquired Altran. In this post we look at Altran, its history and financial statements, from a corporate finance perspective and analyse the valuation that Capgemini has given it.

WHAT IS ALTRAN

Altran es una empresa de consultoría europea fundada en Francia en 1982. Actualmente es considerado como líder global en servicios de ingeniería e I+D (ER&D), ofreciendo a sus clientes una nueva forma de innovar desarrollando productos y servicios del mañana.

During their first years they helped clients such as TGV or Airbus by taking advantage of the high demand for engineers with expertise in high-tech solutions that existed at the time.

With only 5 years of history, it had already managed to multiply its business tenfold and began to diversify its activities into other sectors such as the automotive and energy sectors.

In the 1990s, it began its international expansion reaching countries in Europe and America with more than 6,100 consultants in 12 markets.

After overcoming the difficulties of the dotcom bubble, Altran restructured itself around five industries: automotive, infrastructure and transportation; aerospace and defence; energy and industry; financial services; and telecommunications.

Subsequently, through various mergers and acquisitionsThrough strategic agreements and partnerships with other companies, Altran was able to strengthen its position in the sector, operating in more than 30 countries.

June 2019, Capgemini acquired Altran in a corporate transaction worth around €4.1 billion.

ALTRAN RATING

The following lines analyse the economic and financial situation of the company in order to understand the valuation of the operation.

FINANCIAL ANALYSIS

Before starting the analysis, it is worth mentioning the latest acquisition that Altran made at the end of 2017. The purchase of Aricent, a US engineering and IT services company, for €1.7 billion was a major boost to Altran's growth plans.

Clearly, this acquisition affected its financial statements. On the one hand, the revenues of € 700 million from Aricent together with the synergies created will have their effects over the next three years. In addition, the costs related to the restructuring of the group will be assumed in the first year. In addition, the transaction was financed by third party resources and a capital increase.

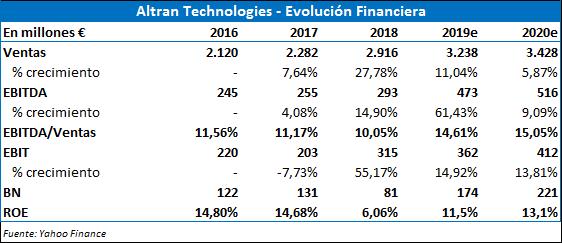

Overall, Altran's financial statements reflect the good situation of the company. Growth in sales and EBITDA has seen a significant boost in the past year thanks to the synergies generated by the acquisition of Aricent.

On the other hand, the operating margin shows no signs of deterioration and is even expected to increase in the coming years.

In terms of net profit, it is worth highlighting its significant decline in 2018. Explained by the extraordinary costs generated in its recent acquisition, this should not cause any concern since, as can be seen in the projections, this situation will be reversed.

ROE, affected by the decline in net profit, will return to pre-2018 levels, which indicate good profitability in line with the sector and even somewhat higher than its competitors.

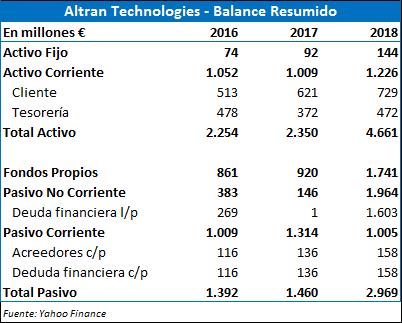

The balance sheet shows a strong increase in assets due to the integration of Aricent, as well as a strong increase in long-term debt and equity to finance the operation.

The rest of the line items are largely unchanged and remain stable, indicating the good health of Altran's business model.

CONCLUSION

In order to gain perspective on the price agreed in the transaction, multiples of other transactions in the consulting, audit and engineering sector have been taken. As these data correspond to unlisted companies, an adjustment for illiquidity of 30% has been made in order to make the figures comparable.

Based on these figures, it can be seen that Capgemini's acquisition of Altran is not too far from those that have occurred in the sector, and is in line with the results of the transaction analysed.

Altran's €5 billion valuation is therefore reasonable and in line with industry trends.

Altran's share price is currently around $14 per share, the price at which the Capgemini takeover bid was announced.