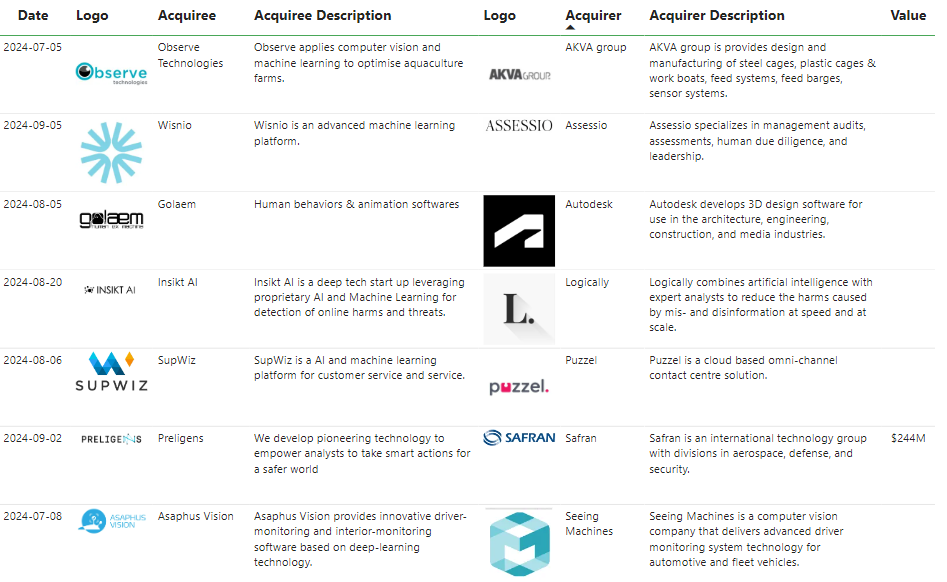

Recent acquisitions in the Machine learning sector highlight the growing strategic importance of AI-driven innovation. Companies are investing heavily in advanced analytics and data platforms, focusing on integrating cutting-edge solutions to strengthen their competitive positions. Notable deals include Safran's $244 million purchase of Preligens, leveraging AI to bolster defence capabilities, and Assessio's acquisition of Wisnio to enhance its human capital assessments with advanced machine learning. These transactions demonstrate a clear drive towards technological sophistication across all sectors, optimising decision-making and operational efficiency.

AKVA Group completes acquisition of Observe Technologies

The recent acquisition of Observe Technologies by AKVA Group is a strategic step towards advancing digitalisation in aquaculture. AKVA, a leader in the design and manufacture of aquaculture equipment, aims to integrate advanced technology into its offering.

About Observe Technologies

Observe Technologies specialises in leveraging computer vision and machine learning to optimise aquaculture farm management. Its solutions enable fish farmers to improve feed efficiency and monitor fish health with real-time analytics.

About AKVA Group

This business group specialises in the design and manufacture of steel cages, as well as feeding systems and sensor systems, among others. The acquisition allows AKVA to combine its expertise in aquaculture systems with Observe's data-driven technology. This synergy aims to improve the production efficiency and sustainability of aquaculture farms, supporting the growth of the industry to meet global food demand.

Strategic reasons for acquisition

With this strategic move that took place in July 2024, AKVA Group strengthens its position as a end-to-end solutions provider, enabling farmers to optimise operations and embrace digital transformation. This acquisition reflects AKVA's commitment to sustainability and innovation in the aquaculture industry.

Autodesk acquires Golaem to enhance 3D animation capabilities

Autodesk acquired Golaem in August 2024 to strengthen its 3D design toolset. This transaction aligns with Autodesk's vision to expand its media and entertainment portfolio by integrating Golaem's competencies into its ecosystem.

Autodesk Description

Autodesk is known for its innovative software used in the architecture, engineering, construction and media industries to create high-quality 3D designs and animations.

Golaem Description

Golaem is a company specialising in crowd and human behaviour simulation software, offering sophisticated animation tools for realistic human interactions. Its technology is widely used in film, gaming and virtual reality applications.

Strategic Justification of the Acquisition

The combination will enable users to create more realistic and dynamic 3D animations, enhancing creative workflows in entertainment and beyond. This acquisition marks Autodesk's commitment to push the boundaries of digital design and animation, cementing its leadership in the 3D software market.

Logically expands its AI competencies with the acquisition of Insikt AI

Logically's acquisition of Insikt AI underlines its commitment to combat disinformation with advanced technology. At the same time, Logically will now provide its customers with a competitive information advantage.

Logically Description

Logically, a leader in AI-powered solutions to counter misinformation, leverages a combination of artificial intelligence and human expertise to tackle online threats at scale.

Inskit AI Description

Insikt AI, a deep tech startup, specialises in developing proprietary AI and machine learning tools focused on identifying online harms and threats. Its technology enables rapid detection and understanding of malicious online activities.

Strategic Reasons for the Acquisition

This acquisition strategically enhances Logically's existing capabilities by integrating Insikt AI's advanced threat detection technology. The merger aims to strengthen Logically's ability to identify, analyse and mitigate the risks posed by misinformation and harmful online behaviour.

In conclusion, the acquisition of Insikt AI was completed in August 2024 and reinforces Logically's mission to create a safer digital environment by leveraging cutting-edge AI and machine learning technologies. This move positions Logically as a comprehensive leader in the fight against digital disinformation and online threats.

Assessio acquires Wisnio to strengthen its technological capabilities

Assessio's acquisition of Wisnio is an important step in the expansion of its technology offering. This acquisition not only strengthens Assessio's position in the HR technology sector, but also demonstrates its commitment to combining human expertise with advanced technology for better leadership results.

About Assessio

Assessio, known for its expertise in management audits, assessments and leadership development, aims to enhance its service delivery through strategic integration with Wisnio's advanced machine learning platform.

About Wisnio

Wisnio brings cutting-edge machine learning capabilities that build data analytics and predictive models. This acquisition aims to deepen Assessio's data-driven expertise in human resources, enhancing talent management and human due diligence processes.

Strategic Justification of the Acquisition

The rationale for this acquisition, which took place in September 2024, is clear: by incorporating Wisnio's AI capabilities, Assessio aims to offer more sophisticated assessments and predictive analytics, enhancing its ability to identify high-potential leaders and optimise organisational performance.

Safran acquires AI company Preligens to strengthen its security competencies

In September 2024, Safran announced the acquisition of Preligens for $244 million, underscoring its commitment to improving intelligence and security operations. Safran's investment in Preligens is expected to drive innovation in the defence sector, supporting smarter and safer decision-making processes for its customers.

Safran Description

Safran, a global technology leader in aerospace, defence and security, intends to integrate Preligens' advanced technology solutions into its portfolio.

Preligens Description

Preligens specialises in developing pioneering technologies that enable analysts to make informed decisions. Its AI-based analytical tools and platforms are designed to process large amounts of data, providing actionable insights to improve safety.

Strategic Reasons for the Acquisition

This acquisition is strategically aligned with Safran's vision to enhance its defence and intelligence offering. By incorporating Preligens' technology, Safran aims to enhance its data-driven intelligence services, improve operational efficiency and strengthen its position in the global defence market.

Our specialist advisors in mergers and acquisitions analyse market trends in different technology sectors. If you want to keep up to date with the latest news on the sale and purchase of companies, don't hesitate to subscribe to our newsletter.

If, on the other hand, you are looking for advice on this matter, do not hesitate to contact us.