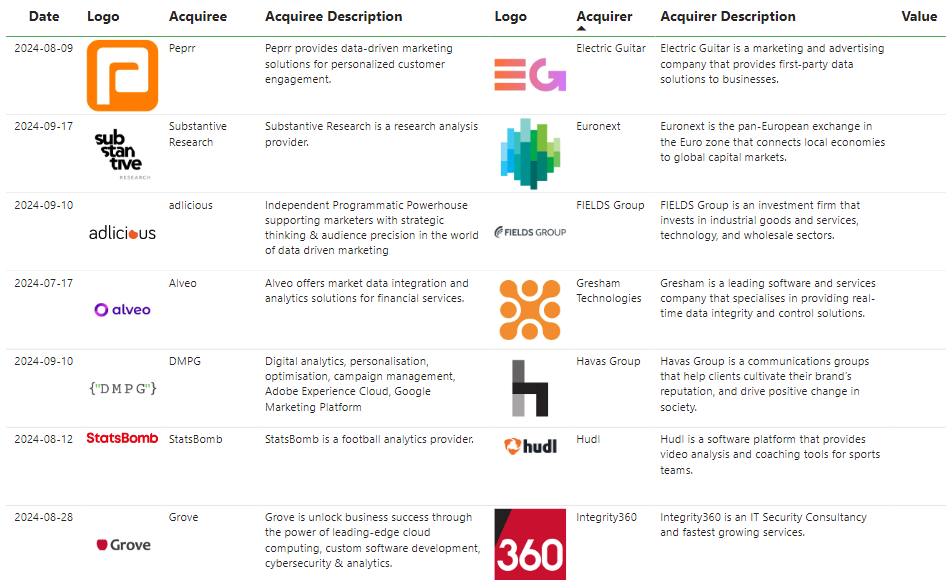

Se han realizado diferentes adquisiciones estratégicas de empresas del sector de Data Analysis en los últimos meses, lo que pone de relieve el creciente énfasis en soluciones innovadoras y capacidades mejoradas. Las empresas recurren cada vez más a las adquisiciones para ampliar su oferta de servicios, integrar conocimientos basados en IA y consolidar su posición en el mercado. Las operaciones recientes incluyen adquisiciones clave como la compra de StatsBomb por parte de Hudl para reforzar la analítica deportiva, y la adquisición de Substantive Research por parte de Euronext, que potencia las capacidades de investigación financiera. Estas transacciones muestran una tendencia más amplia a aprovechar los datos especializados y las herramientas analíticas para impulsar el crecimiento y la innovación.

Euronext strengthens investor services with acquisition of Substantive Research

Euronext acquired Substantive Research in September 2024, marking a strategic move to expand its Investor Services division. The acquisition comes at a time when financial exchanges are increasingly looking to enhance their offering amid growing competition in fragmented markets. This acquisition will help Euronext consolidate its position in the data and research space, as exchanges aim to offer comprehensive services beyond trading.

About Euronext

Euronext, the leading pan-European exchange, is known for connecting local economies with global capital markets through various platforms and services.

About Substantive Research

Substantive Research is a company specialising in research analysis and benchmarking of market data, serving more than 100 clients in Europe and North America.

Strategic Reasons for the Acquisition

This acquisition not only diversifies Euronext's portfolio, but also positions it to remain competitive in a rapidly evolving financial landscape. As markets become increasingly data-driven, Euronext's commitment to improving financial market research and analysis becomes ever more apparent.

The acquisition consolidates Euronext's strategy to diversify its portfolio of investor services, leveraging Substantive's expertise to offer broader solutions in a competitive environment. This move underlines Euronext's commitment to remain at the forefront of the data and analytics space.

FIELDS Group acquires Adlicious to expand digital marketing in Europe

In a strategic move, the FIELDS Group has acquired Adlicious to enhance its presence in the digital marketing sector. This acquisition aligns with the FIELDS Group's objective to invest in leading technology companies in their sectors.

FIELDS Group Description

FIELDS Group is an investment firm focused on industrial goods, technology and services. It aims to drive growth by investing in companies with significant market potential.

You can read more about how to drive business growth in this post on Mergers and Acquisitions: Drivers of Business Growth and Competitiveness .

Adlicious Description

Adlicious is a programmatic advertising powerhouse known for its strategic thinking and audience-driven solutions in data-driven marketing.

Strategic Explanation of the Acquisition

The acquisition strengthens the FIELDS Group's portfolio by adding a specialist player in data-driven marketing. Adlicious' expertise in precision audience targeting and digital strategy will enable FIELDS to support its existing investments and expand its presence in the fast-growing digital marketing sector.

The acquisition of Adlicious was completed in September 2024 and is intended to further the FIELDS Group's strategy of investing in technology and services companies, establishing a stronger position in the digital marketing space to deliver impactful solutions to its clients.

Gresham Technologies acquires Alveo to enhance its financial data solutions

Gresham Technologies has announced the acquisition of Alveo, a leading provider of market data integration and analytics solutions for the financial services industry. This strategic move aligns with Gresham's objective to strengthen its real-time data integrity and monitoring offering.

Gresham Technologies Description

Gresham Technologies specialises in software solutions for data integrity and financial control. The acquisition of Alveo enhances its market position by integrating Alveo's expertise in market data management.

Alveo Description

Alveo offers market data integration and analytics solutions for financial services. Its comprehensive capabilities enable financial institutions to streamline data workflows and gain valuable insights. This acquisition allows Gresham to broaden its market presence and expand its portfolio of services.

Strategic Reasons for the Acquisition

The acquisition is a strategic response to the growing demand for unified data integration and financial analytics in a competitive financial landscape. By combining their strengths, Gresham and Alveo can offer clients end-to-end solutions to ensure data integrity, accuracy and a complete view of the market.

The deal was completed in July 2024, marking an important milestone for Gresham Technologies, accelerating its growth strategy and enhancing its product offering, creating additional value for clients and stakeholders in the financial services industry.

Havas Group acquires DMPG to strengthen its digital analytics capabilities

Havas Group acquired DMPG in September 2024, a digital analytics consultancy specialising in personalisation, campaign management and optimisation services. The move is intended to strengthen Havas' capabilities in delivering data-driven marketing solutions.

About Havas Group

Havas Group is a leading communications network known for helping its clients build brand reputations and drive meaningful change in society. The acquisition aligns with its strategy to expand its digital services.

About DMPG

DMPG is known for its expertise in Adobe Experience Cloud and Google Marketing Platform. It helps brands leverage advanced digital tools to enhance customer experiences and optimise marketing campaigns.

Strategic Explanation of the Acquisition

The acquisition will enable Havas to deepen its digital offering and analytics capabilities, combining DMPG's technical expertise with Havas' global reach. This integration supports Havas' mission to deliver end-to-end marketing solutions focused on measurable results and client growth.

Overall, the acquisition of DMPG is a strategic step for Havas to enhance its digital and data-driven approach, offering personalised and impactful services to brands around the world.

Hudl strengthens its sports data and analytics competency with acquisition of StatsBomb

Last August Hudl acquired StatsBomb, a leading football analytics provider, to strengthen its suite of performance analytics tools for sports teams. This acquisition aligns with Hudl's mission to deliver more comprehensive insights and data to teams and coaches.

Hudl Description

Hudl is a software platform known for its video analytics and coaching tools, providing sports teams with customised information to improve player performance and strategy.

Description of StatsBomb

StatsBomb specialises in advanced football data and analytics, providing accurate metrics on player and team performance.

Strategic Reasons for the Acquisition

By combining Hudl's video analytics capabilities with StatsBomb's rich data insights, this acquisition aims to provide sports teams with a more integrated, data-driven approach to coaching and strategy formulation. This synergy will revolutionise the way teams evaluate their performance and plan their tactics.

Overall, Hudl's acquisition of StatsBomb is a strategic move to deepen its impact on the sports industry by offering a more holistic solution to its customers.

Explanation of transactions and trends in the Data Analytics industry

The wave of acquisitions in the data and analytics sector reflects a significant shift towards deeper insights and value creation through strategic partnerships. With an increasing reliance on AI-based tools, companies are focusing on acquiring capabilities that improve accuracy, personalisation and real-time analytics. This trend signals a broader evolution towards data-driven decision making, enabling businesses across a variety of industries to achieve greater efficiency and customer insight in an increasingly competitive market landscape.

At Baker Tilly Tech M&A we specialise in advising on the sale and purchase of companies in the technology sector. We can help you in the profitable growth of your company or we can help you in the search for investment and capital increase if your company is in a growth phase.