The Advertising sector continues to showcase its dynamism with recent transactions highlighting its importance in the Media Entertainment and advertising domains. These operations, many involving international players, reflect shared strategic objectives: expanding service portfolios and creating commercial and structural synergies. Through these acquisitions, companies aim to adapt to an ever-evolving market, optimizing their ability to deliver innovative and competitive solutions.

Liberty Media Expands Its Sports Dominance with the Acquisition of Dorna Sports

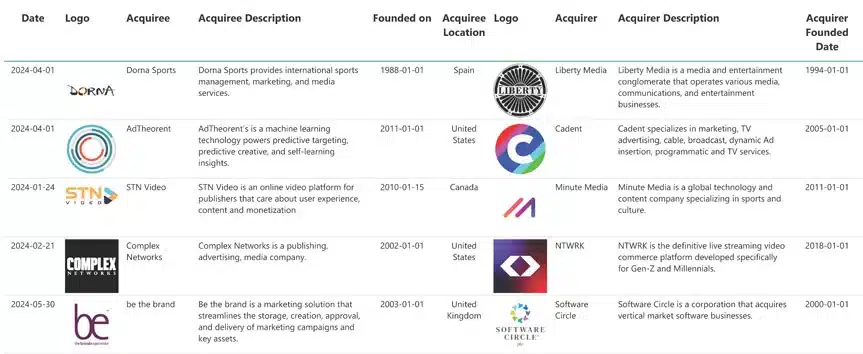

Liberty Media announced in April 2024 the acquisition of Dorna Sports, consolidating its position as a leader in the field of global sports event management.

Dorna Sports description

Dorna Sports is a Spanish company known for being the exclusive promoter of the MotoGP World Championship. Its expertise in sports management, marketing and media has been a pillar for the growth of motorcycling as a global sport.

Liberty Media description

Liberty Media is an American conglomerate based in Colorado, famous for owning the rights to Formula 1, along with a broad portfolio of media and entertainment assets.

Strategic Reasons for the Acquisition

This acquisition strengthens Liberty Media's diversification strategy by reducing its reliance on Formula 1 while exploring new commercial and geographic synergies. Dorna Sports, with a significant presence in Europe and Asia, perfectly complements Liberty Media's expansion goals in strategic regions. This combination creates a unique platform for technological innovations and expansions. Through this deal, Liberty Media is positioned to transform sports marketing and fan experiences with technological innovation and global engagement strategies.

Cadent acquires AdTheorent to drive omnichannel expansion

Cadent's $324 million acquisition of AdTheorent marks a strategic milestone in the advertising industry, positioning Cadent as a leader in omnichannel solutions.

Cadent about

It is a company specialized in programmatic television advertising that offers dynamic ad insertion and tools to maximize advertising efficiency in cable television and streaming, among others.

Sobre AdTheorent

AdTheorent es reconocida por su tecnología de aprendizaje automático predictivo, la cual permite optimizar campañas mediante datos en tiempo real y el aprendizaje continuo.

Explanation of the strategic reasons for the acquisition

The transaction took place in April 2024 and addresses Cadent's need to diversify its offerings beyond television by integrating advanced digital capabilities. AdTheorent enhances Cadent's targeting capabilities and improves advertising campaign results across online, display, and streaming media. Furthermore, AdTheorent's technology will enable Cadent to deliver more efficient campaigns aligned with advertisers' business objectives.

The transaction represents a key step for Cadent in its mission to be the preferred partner for omnichannel advertising solutions, maximizing return on investment for its clients. This acquisition reinforces its ability to lead the market in an increasingly complex and competitive media environment.

Minute Media expands its sports leadership with acquisition of STN Video

Minute Media's recent acquisition of STN Video strengthens Minute Media's position as a global leader in sports content and technology. With this transaction, Minute Media expands its content offering and enhances its video technology infrastructure.

Minute Media description

Minute Media is a global technology and content company focused on sports and culture, known for platforms like 90min and FanSided. Its approach combines innovative technology and compelling storytelling to connect global audiences.

STN Video description

STN Video provides an online video platform designed to optimize user experience, content, and monetization. Its catalog features premium rights such as the NFL and MLB, alongside an award-winning technological infrastructure.

Strategic Justification of the Acquisition

The deal seeks to enrich Minute Media's premium sports content library, integrate STN Video's advanced video technology and offer more complete solutions to partners and advertisers. By combining content from athletes, teams and leagues, this acquisition positions Minute Media as a benchmark in a growing segment, including the e-sports.

The transaction, completed in January 2024, highlights Minute Media's strategy to lead the industry with comprehensive solutions in sports and entertainment.

Software Circle strengthens its position with the acquisition of Be the Brand

Software Circle acquired Be the Brand in May 2024, marking a milestone in its strategic expansion into financial services. The integration strengthens Software Circle's capabilities and diversifies its portfolio in key vertical markets.

About Software Circle

Software Circle is a company that acquires and optimizes software companies focused on vertical markets. Its mission is to drive sustainable growth through innovation and strategic integration.

It is essential to understand the differences between a strategic partner and a financial investor when undertaking a purchase transaction. If you want to learn about the various reasons for acquiring a company, such as vertical integration, check out our article on the 10 key factors that impact transaction outcomes based on the type of investor.

About Be the Brand

Be the Brand is a marketing platform that simplifies campaign management by centralizing the storage, creation, approval and delivery of assets. It is especially relevant for highly regulated industries such as finance.

Strategic Reasons for the Acquisition

This acquisition will allow Software Circle to enter the financial sector with a proven solution, expanding its reach and complementing its technology offering. It further solidifies its commitment to sustainable growth and innovation, providing clients with a robust and efficient platform to optimize their campaigns. The transaction positions Software Circle to capture new opportunities in a dynamic and evolving market.

Spanish market movements in the Advertising sector

In Spain, the advertising sector has registered a remarkable dynamism, with around 15 recent transactions. Companies such as Samy Alliance, MIO Group and Making Science are leading these deals, driven by the desire to expand both locally and internationally. Highlights include Samy Alliance's acquisition of a social media firm in Colombia and MIO Group's expansion in the US with the purchase of Beachfront, reflecting a strategic focus on key markets.

Recent transactions in the Advertising sector highlight a clear trend towards diversification and international expansion. These operations not only allow companies to strengthen their capabilities and services, but also underline the importance of innovation and synergies to ensure sustainable growth in a competitive global environment.

At Baker Tilly Tech M&A Advisors, we are specialized in the buying and selling of technology sector companies. Contact our expert advisors for a valuation of your company or to request information about the buying and selling of businesses.