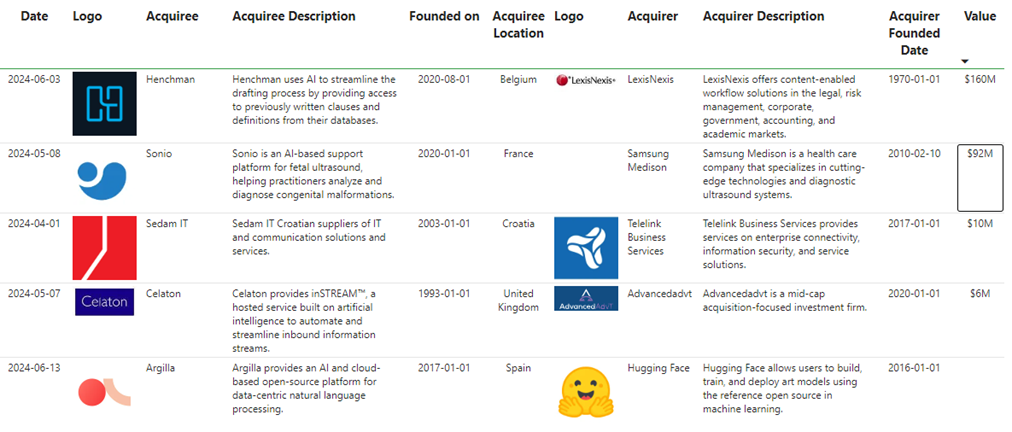

In this article, we will look at the latest transactions in the AI, data and machile learning sector. We will look at how these mergers and acquisitions are transforming the business landscape and creating new opportunities in the global marketplace.

Maximising Synergies: The strategic acquisition of LexisNexis by Henchman Corp.

In a bold move that redefines the business landscape, Henchman Corp. has announced in June 2024 the acquisition of LexisNexis, a global leader in legal and business information solutions. This merger promises not only to strenghten the operational capabilities of both entities, but also to open up new opportunities in the global marketplace.

LexisNexis description

LexisNexis, renowned for its comprehensive legal database and advanced data analytics technology, provides critical tools for legal and corporate professionals worldwide. Its ability to deliver accurate information and predictive analytics is unsurpassed in the industry.

Henchman Corp. description

Known for its innovative approach to technology and logistics solutions, Henchman Corp. has been known for its agility and adaptability in a dynamic business environment. This acquisition will not only expand its service offerings, but also consolidate its position as a leader in data integration and enterprise solutions.

Explanation of the strategic reasons for the acquisition

The acquisition of LexisNexis by Henchman Corp. is part of a strategy to diversify and strengthen capabilities. By integrating LexisNexis' data analytics expertise with Henchman's operational agility, the new entity will be positioned to offer more robust and customised solutions to its clients, as well as explore synergies in research and development. This union will drive innovation in service delivery, ensuring significant added value for all stakeholders involved.

Samsung Medison acquires French ultrasound AI startup for $92 million

In a strategic move, Samsung Medison has closed in May 2024 the full acquisition of Sonio, a promising French startup specialising in artificial intelligence applied to foetal ultrasound, for $92 million. Sonio will continue to operate independently following the acquisition.

Sonio description

Sonio, founded four years ago, has revolutionised the field of obstetrics and gynaecology with IT solutions that automate the documentation and evaluation of ultrasound examinations. Its software, Sonio Detect, obtained 510(k) clearance from the US FDA, making it the first machine-agnostic AI assistant that monitors image quality and automates reporting.

Samsung Medison description

Samsung Medison, based in Seoul, is renowned for its innovation in medical equipment. The acquisition of Sonio strengthens its position in the ultrasound market, enhancing its ability to offer advanced technology in prenatal diagnostics.

Explanation of the strategic reasons for transactions in the AI sector

By joining with Sonio, Samsung Medison integrates cutting-edge AI technology and advanced reporting capabilities into its ultrasound systems. This acquisition not only broadens their product offering, but also allows them to compete in a growing global market where healthcare technology innovation is key. In addition, maintaining Sonio as an independent entity preserves its agility to innovate and expand globally, benefiting underserved areas of healthcare.

Huggin Face acquires Argilla for more than $9 million

US startup Hugging Face, known for its open source platform for artificial intelligence models, has acquired Spain's Argilla in June 2024 for more than $9 million. This purchase represents the unicorn's fourth acquisition, consolidating its presence in the global AI market.

Argilla description

Founded in 2017 by Daniel Vila Suero, Francisco Aranda and Amélie Viallet, Argilla develops a collaborative platform for AI engineers. Specialising in data tagging for natural language processing solutions, the company operates with a US-based parent structure, backed by investments from funds such as Criteria Venture Tech and Eniac Ventures.

Hugging Face description

Valued at $4.5 billion last year, Hugging Face offers a GitHub-like platform for AI developers, facilitating the creation and deployment of models and datasets. The company has attracted significant investment from giants such as Amazon, Google, IBM and Nvidia.

Explanation of the strategic reasons for the acquisition

Integrating Argilla allows Hugging Face to strengthen its natural language processing capabilities, broadening its offering and attracting key data engineering talent. By keeping Argilla operating independently, Hugging Face seeks to consolidate its position in a competitive market, leveraging synergies and expanding its portfolio of solutions for AI developers globally.

Bulgaria's TBS Group closes purchase of Croatia's Sedam IT

On 1 April, TBS Group, a leading IT and communication services provider in Bulgaria, announced the completion of the acquisition of Sedam IT, a Croatian software solutions provider, for EUR 9 million.

Sedam IT description

Founded in 2003 and based in Zagreb, Sedam IT has completed more than 400 projects in key sectors such as telecommunications, finance, retail and public companies. Its experience and capabilities in implementing robust technology solutions position it as a major player in the Croatian market.

Telelink Business Services Group description

Telelink Business Services Group is a leading Bulgarian IT and communication services company. Its focus is on providing comprehensive and customised solutions that optimise business processes and empower digital transformation.

Strategic reasons for the acquisition

The acquisition of Sedam IT is part of TBS Group's growth strategy in Eastern Europe. This expansion seeks to leverage economies of scale and shared expertise, thereby strengthening its position in the regional market. The transaction, valued at EUR 9 million, will be paid for in stages, adjusted for Sedam IT's financial results for 2024 and 2025. This strategic move will allow TBS Group to expand its portfolio of services and enhance its innovation capabilities, consolidating its leadership in the technology sector.

AdvT strengthens its position with acquisition of Celaton

AdvancedAdvT Limited announced in May 2024 the acquisition of Celaton in a £5 million net deal, seeking to enhance its portfolio of enterprise software and solutions.

AdvancedAdvT description

AdvancedAdvT, a FTSE AIM All-Share listed company, specialises in enterprise software and technology solutions. The company has shown strong financial performance, driven by recurring revenues and robust adjusted EBITDA. At the end of February, it had cash and net investments totalling £102.9 million.

Celaton description

Celaton operates ‘inSTREAM’, an intelligent document processing platform that uses AI for data recognition, classification, validation and enrichment. Celaton has invested £2.3 million in the development of its platform, enhancing its AI capabilities and multilingual support. Customers include TalkTalk, Currys and Capgemini.

Strategic reasons for the acquisition

The acquisition aligns with AdvT's focus on automation and AI, benefiting customers who need end-to-end business process automation. This integration comes at an opportune time, as a major alternative provider is exiting the market, providing immediate growth opportunities. The integration of Celaton's technology is expected to enhance AdvT's service offerings and increase revenue, positioning the company strongly in a growing market.

These AI sector transactions are not only redefining business strategies, but also driving innovation and growth in the field of artificial intelligence. Stay on top of future AI sector transactions to understand how these AI sector transactions can impact your business and offer new opportunities. AI sector transactions continue to be a crucial driver of technology and business evolution - don't miss our upcoming updates on these exciting AI sector transactions!