In the competitive world of technology, enterprise software transactions are critical to driving growth and innovation. These enterprise software transactions enable companies to strengthen their position in the global marketplace. The increasing frequency of enterprise software transactions highlights their crucial role in digital transformation and the expansion of advanced technology solutions.

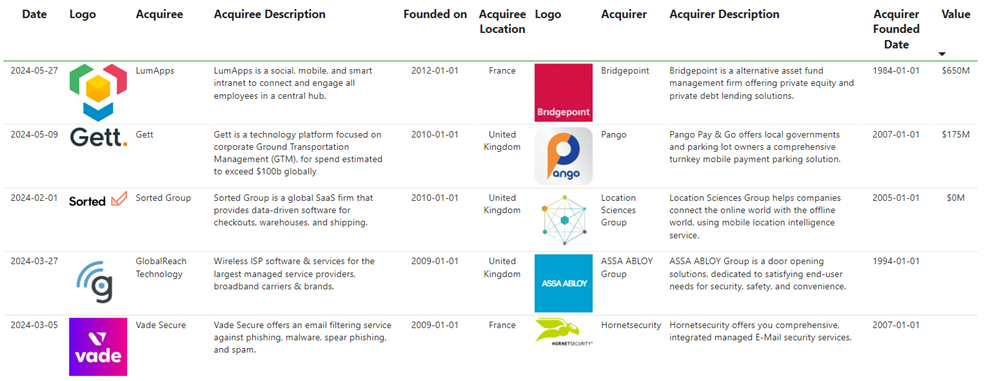

Bridgepoint Acquires Majority Stake in Intranet Startup LumApps for $650 Million

Bridgepoint, a private equity firm, has acquired a majority stake in LumApps SAS, a French startup whose intranet platform is used by approximately 5 million workers. This transaction, valued at $650 million, marks a significant milestone for both companies.

About Bridgepoint

Bridgepoint is an internationally renowned private equity firm, known for its strategic investments in high-growth companies. With a diversified portfolio and a focus on creating long-term value, Bridgepoint has driven the development and expansion of numerous organisations across a range of sectors.

About LumApps

LumApps offers an intranet platform that facilitates internal communication and collaboration in organisations. Features include personalised new feeds, analytics tools for marketing, content creation by employees, and department-specific hubs. In addition, the platform incorporates automation tools for new employee onboarding and micro-learning modules.

Strategic reasons for the acquisition

Bridgepoint's acquisition of LumApps has several strategic drivers. Firstly, the investment will enable LumApps to expand its micro-learning and artificial intelligence, key areas for the future of internal communication and training. In addition, the capital injection will facilitate LumApps' internation expansion, with a particular focus on increasing its market share in the United States. This partnership also represents a logical evolution for LumApps, which has shown profitable growth and has successfully completed previous funding rounds. With Bridgepoint's support, LumApps is well positioned to accelerate its innovation and growth in global markets.

This strategic move reinforces the Enterprise Software sector's commitment to innovation and expansion, while Bridgepoint strengthens its portfolio with a leading internal communications technology company.

Pango acquires Gett for $175 Million: A transformational strategy

Pango has acquired 100% of taxi and transportation services company Gett for $175 millionin May 2024. The deal, signed after several months of negotiations, reflects a significant change in the digital transport services landscape.

Gett Description

Gett, founded in 2010, has raised $900 million over the years, reaching a peak valuation of $1.5 billion four years ago. However, the company struggled to find a buyer, leading to a significant decline in its valuation. Gett shareholders, including major investor VNV Global, will receive around $175 million, along with an additional $40 million from Gett's cash reserves. While VNV will recoup much of its $107 million investment, other investors may incur losses.

Pango Description

For Pango, known for its highly profitable digital parking services, this acquisition represents a strategic expansion in the transport sector. Despite having lower revenues than Gett, Pango's exceptional profitability and dominant market share in parking payments make this an opportune time for such a merger.

Explanation of the strategic reasons for the acquisition

The integration of Gett's B2B corporate transportation platform with Pango's digital services promises to create a robust and diversified service provider, increasing initial combined revenues and ensuring profitability. The merger, pending approval from the Israel Competition Authority, is set to redefine the digital services ecosystem in Israel, creating a powerhouse with extensive reach in parking and transportation services.

Location Sciences acquires Sorted to solve historic problems and drive growth

Location Sciences Group, a leading location intelligence company, has announced in February 2024 its intention to acquire Sorted, a parcel delivery comparison platform, with the aim of solving historical problems and accelerating business growth.

Location Sciences Group description

Location Sciences Group is a location intelligence technology company that provides accurate and verifiable data to optimise marketing strategies and logistics operations. The company excels at transforming location data into actionable insights, improving efficiency and effectiveness across a variety of industries.

Sorted description

Founded in 2010 as My Parcel Delivery, Sorted rebranded in 2017 with a mission to simplify the complex logistics sector through an intuitive parcel delivery comparison platform. Despite its innovative potential, the company has struggled to meet its growth expectations and has recorded ongoing losses.

Strategic reasons for the acquisition

The acquisition of Sorted by Location Sciences accresses several strategic objectives. First, Location Sciences plans to address the historical issues that have impeded Sorted's growth by integrating its advanced location data technology to optimise operational efficiencies. Second, this merger will allow Location Sciences to expand its service offerings, leveraging Sorted's platform to provide more comprehensive logistics solutions. Finally, this acquisition is expected to drive the long-term growth of both companies by combining theis complementary strengths and enhancing their competitiveness in the marketplace.

ASSA ABLOY acquires Global Reach in the US and the United Kingdom

ASSA ABLOY has signed an agreement in March 2024 to acquire Global Reach, a leading provider of Wi-Fi access and engagement platform solutions for the hospitality and commercial real estate industries in the US and UK. This acquisition strengthens ASSA ABLOY's position as a global leader in access solutions and opens up new growth opportunities in key sectors.

ASSA ABLOY description

ASSA ABLOY is the global leader in access solutions, operating worldwide with 61,000 employees and sales of SEK 121 billion. The company holds leading positions in efficient door openings, trusted identities and entrance automation. ASSA ABLOY's innovations enable safe and convenient access to physical and digital places, providing millions of people with a more open and secure experience every day.

Global Reach description

Global Reach, based in London, is a leading provider of Wi-Fi access and engagement platforms for the hospitaloty and commercial real estate industries. Founden in 1998, it employs approximately 120 people and is recognised for its advanced technology solutions that facilitate customer and device connectivity and engagement over secure Wi-Fi networks.

Explanation of the strategic reasons for the acquisitions

ASSA ABLOY's acquisition of Global Reach is part of a strategy to strengthen and diversify its portfolio in the hospitality sector. Nico Delvaux, President and CEO of ASSA ABLOY, noted that this technology addition complements existing solutions and opens up new opportunities for growth. Stephanie Ordan, Executive Vice President, notes that Global Reach's technical expertise will expand the comprehensive offering of the Global Solutions business unit, enhancing the value proposition for customers in multiple sectors. This strategic move, which is expected to close in the second quarter of 2024, will be immediately accretive to earnings per share, reflecting a positive financial impact from the outset.

Hornetsecurity acquires Vade, creating an European Leader in Cybersecurity

Hornetsecurity's recent acquisition of Vade marks a significant milestone in the European cybersecurity landscape. This strategic union promises to strengthen the cloud services offering and consolidate the position of both companies as leaders in digital protection and compliance.

Hornetsecurity description

Hornetsecurity is a leading global provider of cloud security, compliance, backup and security awareness solutions. Its flagship product, 365 Total Protection, offers the most comprehensive cloud security solution for Microsoft 365 on the market. With a presence in more than 30 countries and an international distribution network of more than 8,000 channel partners and MSPs, Hornetsecurity protects more than 50,000 customers worldwide.

Vace Secure description

Vade is a leading cybersecurity company based in France, known for its SaaS email security solution for Microsoft 365. It scans more than 2.5 billion messages daily and offers API-based email filtering technology, especially efficient for large telcos and OEMs worldwide. Vade is distinguished by its innovative approach and robust network of MSP and MSSP partners.

Explanation of the strategic reasons for the acquisitions

Hornetsecurity's acquisition of Vade represents a key strategic step to consolidate its position as a European leader in cloud-based cyber security services. Combining Vade's services with Hornetsecurity's offering significantly broadens the product portfolio and strengthens the company's position in the European and international market. This not only enriches the value proposition for customers and partners, but also enhances the company's innovation capability and global presence, aligning with the growing demand for adaptive, cloud-centric security solutions.

In short, Vade's integration into Hornetsecurity promises to deliver more robust and diversified solutions, reinforcing its position as a global benchmark in cyber security for Microsoft 365 and other digital collaboration environments.

Explanation of transactions in the Enterprise Software sector

Recent mergers and acquisitions underline the dynamism and competitiveness of the technology sector. Enterprise software transactions, such as those between Bridgepoint and Hornetsecurity, drive innovation and strengthen global expansion. This strategic approach not only benefits the companies involved, but also redefines the landscape of enterprise software transactions, underlining their importance for technology growth and development.