Following the success of Euskaltel's IPO, which we mentioned in a previous post, several Basque companies have seen this form of financing as an opportunity for growth. Moreover, 12 of the 15 Basque companies listed on the stock exchange improved their results in 2015. In addition to Euskaltel, the last two Basque companies to go public were Masmovil Ibercom in 2012 and NBI Bearings Europe last March, although both have used the Alternative Stock Market (MAB).

Venture capital bets on energy: Cerberus, ArgoCapital and Magnum Capital.

As we mentioned in a post a few weeks ago, the energy reform is attracting energy investors in our country. Large investors such as Cerverus are betting on our wind farms. On the other hand, large Spanish corporations see this situation as an opportunity and are looking for buyers such as Isolus.

Venture capital activity: Capitana Venture Partners, Cabiedes & Partners and Inveready

According to Javier Ulecia, president of Ascri, investment by venture capital funds in start-ups is increasing steadily. We will reach the weight that this sector should have, because there are an increasing number of interesting projects...

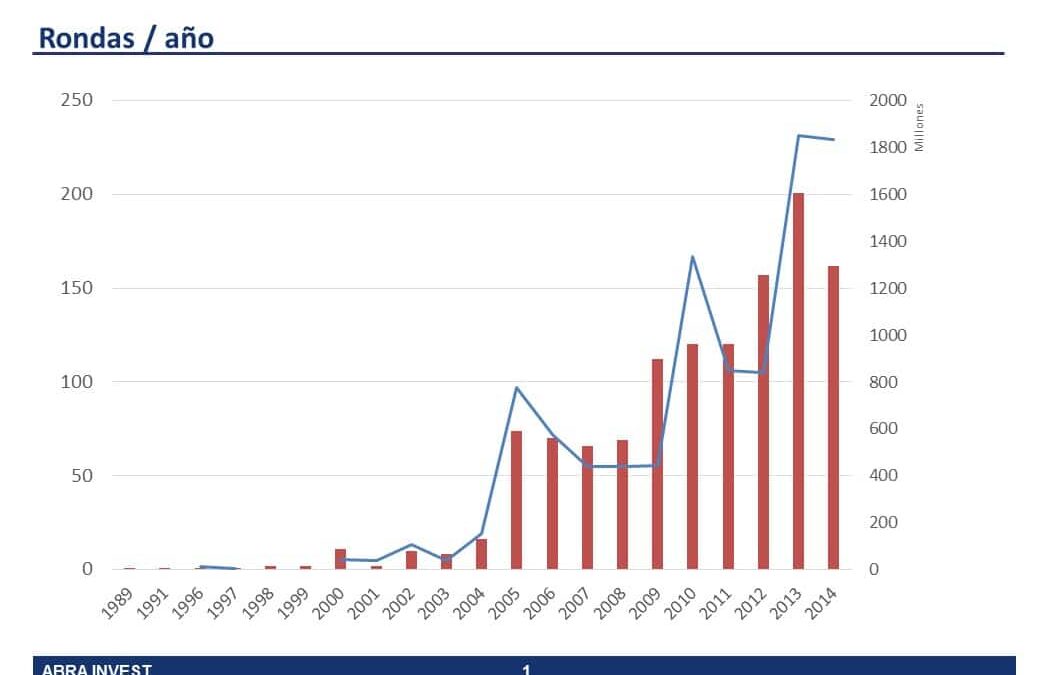

Growing investment in security tics

In recent years, the number of financing rounds in ICT security companies has grown considerably. In 2013, 201 rounds were closed in the sector for a total of 1850M$, which is more than the 838M$ raised the previous year in 157 deals.

Strong growth of technologies in the tourism sector.

The use of new technologies in the tourism sector has many advantages when it comes to saving costs and reaching end customers. In recent years, several companies have been created in the sector that have been able to grow thanks to the support of investors who have seen an opportunity in the sector, and it is expected that this trend will continue to grow in the coming years.

Public funding and R&D&I deduction service

ABRA INVEST has the support of a team of consultants specialised in R&D&I grants and deductions, the only activity that this team has carried out for more than 10 years, reaching a very high level of specialisation and achieving success rates above the market average.

M&A deals in biotech companies in Spain are on the rise

Biotech companies in Spain are becoming more attractive to corporate investors. In some sectors, integration processes are taking place, such as that of Grifols. In other cases, the stock market is becoming an alternative for the biotechnology sector.

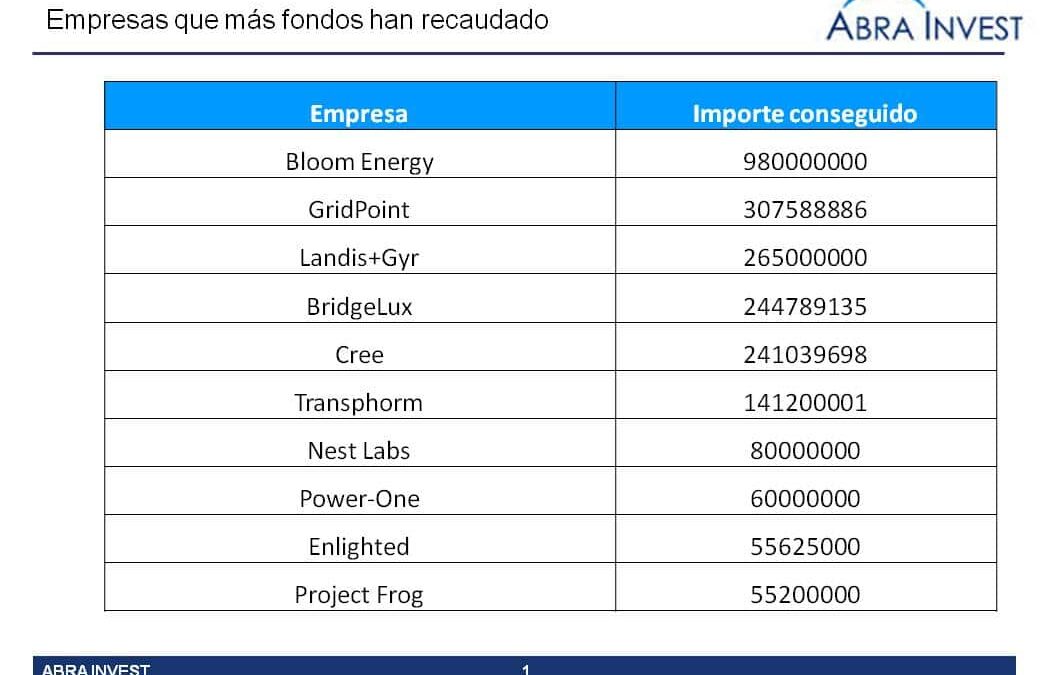

The technologies that make energy efficiency possible

The technologies that make energy efficiency possible A recent study by McKinsey states that, over the next 20 years, at least $37 billion will be invested annually in energy efficiency, using the new technologies available. American investors have been investing in the sector for some years now, with very good results, such as Hannon Armstrong, which last year made its debut on the New York stock exchange, with notable success. In Spain, the first funds focused on this sector are already being created.

Biotechnology in Spain finds investors

One of the main barriers to the growth of Spanish biotech companies is their small size (>95% less than 250 employees), which prevents them from accelerating their entry into foreign markets, for example. The main cause of this small size is due to the scarcity of funding or private investment. Although a specialised national biotech venture capital ecosystem is being generated and more and more deals are being closed with foreign investors, there is still much room for improvement.

Investment analysis in the Machine Learning sector

"Machine learning is attracting a lot of interest from tech giants, who are spending a lot of money and effort to hire the best machine learning researchers. Companies in the sector are aware of this and are making a...

Call for projects related to the Dependency 2014 is open

El pasado 12 de junio se abrió el plazo de solicitud del programa para el 2014, un fondo con cargo a los Presupuestos del Ministerio de Sanidad, que tiene por objeto prestar apoyo financiero a iniciativas empresariales que promuevan y desarrollen proyectos de...

SMEs, how does the government's growth plan affect you?

On 6 June, the Spanish government published the plan of measures for growth, competitiveness and efficiency. This communiqué was published in the same week that the government announced future reductions in both corporate and income taxes and an early repayment of the loan received for the FROB. This all sounds like good news for the Spanish economy, but what is the expected effect on SMEs?