London-based private equity firm Felix Capìtal closes a second €131M investment fund to double its bet on the creative class of digital brands and B2B eCommerce and marketing technologies.

The investment fund Columbus Venture Patners and Asklepios will invest up to €9M in the bio sector in Gipuzkoa.

The venture capital fund Columbus and the US company Asklepios set up the joint venture Viralgen to invest in the opening of a viral vector plant in San Sebastian.

2017 will be the year of a new record for private equity funds in Spain

In recent months, private equity funds have closed deals such as the sale of Mémora to Ontario Teachers' for €500M or the sale of Pronovias by BC Partners. With sales like these, and many others, the year looks set to be exceptional for the sector....

Cybersecurity investment hits new record high in first 5 months of 2017, with companies valued at more than $1B

In the first 5 months of 2017, the number of investments made in the cybersecurity sector has reached a new record high, reaching 190 deals, which is 20% compared to the same period last year. Although we have detected large rounds in the sector, there have also been several seed/angel rounds. This is a sign that new innovative solutions are being created in response to emerging attacks. Which companies are receiving support from investors?

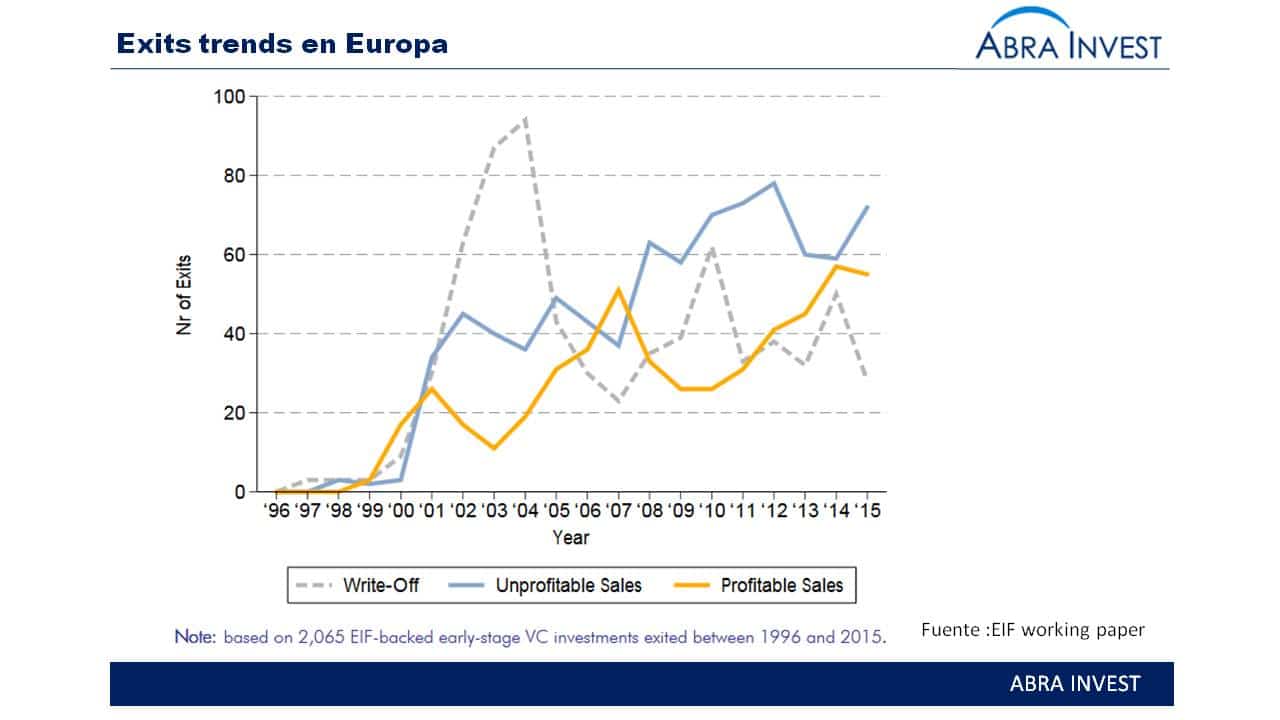

Perspective on the European venture capital scene by the european investment fund

As can be seen in EIF's report on European venture capital divestments, European venture capital investment has grown considerably over the past 10 years. From 2010 onwards, these investors began to make exits, encouraged by the recovery of the technology industry, evidenced by increases in Nasqad and venture capital valuations, while interest rates were low.

MAXCOLCHON Group increases capital to reinforce its expansion advised by Abra- Invest

The MAXCOLCHON group has closed a capital increase subscribed by KEREON PARTNERS. The funds raised will allow the group to meet its ambitious growth plan and make the international leap. MAXCOLCHON has been advised by ABRA INVEST for the successful completion of the transaction.

Infovista buys Tems from Ascom, after being acquired by Apax Partners

InfoVista is a provider of network performance management software solutions for mobile communications service providers, operators and IT companies. In May 2016 Apax Partner acquired the company, which has provided it with the necessary liquidity to be able to make acquisitions. It has already started making acquisitions and plans to make more in the near future.

Venture capital investments Sodena:Innoup Pharma, Davalor Salud, Iden Biotechnology

Sodena es el instrumento financiero del Gobierno de Navarra para impulsar proyectos empresariales en Navarra que contribuyan al desarrollo de la comunidad. Entre los sectores en los que se enfoca se encuentran el sector TIC, la biotecnología, la energía y el sector...

Venture capital invests in investment management software: Efront, MRI Software, Betterment and Indexa Capital

Private equity is investing in companies that provide software solutions for portfolio management. Efront has been bought by Brige point and Gi Partners bought MRI Software, both of which were bought after the technology companies had made buyouts in the sector.

IBM, Orange and Prosegur invest in cybersecurity

Cybersecurity has become a sector of great interest to investors in recent years. Valuable company information is migrating to digital channels and the cloud and companies are experiencing data breaches that can have many consequences for their business. From 2011 to 2015 the number of funding rounds in the cybersecurity space has doubled from 166 to 332 and the volume has increased from $1.1B in 2011 to $3.8B in 2015.

Hotelbeds and Mytwinplace: Tourism sector attracts investors

Last week we learned that Cinven completed the largest Spanish VC deal in recent years by buying Hotelbeds for €1.165M, and Mytwinplace also closed a round led by Inveready.

New Venture Capital Funds: N+1 and Capitana Ventures

In 2016 venture capital and private equity raised €1,481M in new funds. This year 2016 seems to continue to meet the favourable conditions for fundraising: liquidity in the markets, interest from international LPs in VC&PE firms and support for the sector through public funds of funds (Innvierte and Fond-ICO global). We have recently heard about new fundraising: N+1 has raised €400M for its new fund and Capitana Ventures Partners is raising new funds for Capitana Tech Fund.