SOSV is one of the world's leading Venture Capital Method in the Health Diagnosticswith a total of 17 investments since 2013.

Its objective is clear: to acquire shareholding in the sector.

This is clear from the Baker Tilly study.

Baker Tilly has produced a study covering 1733 companies from around the world, labelled within the category "...".Diagnostics".

In particular, in the category "Health Diagnostics1043 "The number of roundsand has funds valued at $12.78B.

It is worth noting that due to the characteristics of the sector, Venture Capital firms are common in the sector.

TOP COMPANIES IN HEALTH DIAGNOSTICS

ROCHE

It is a Swiss company, pioneer in providing specific treatments to patients.

Roche provides automated instruments, software, consumables and informatics solutions for in vitro diagnostics and research.

BIOMERIEUX

Biomerieux is a French company, which designs, develops, manufactures and markets in vitro diagnostic systems for clinical and industrial applications..

These include the diagnosis of infectious diseases, cardiovascular diseases and specific cancers.

QUIDEL

Quidel is an American company dedicated to the development, manufacturing and commercialisation of diagnostic solutions for POC (Ponit of Care).

In particular, for infectious diseases and women's reproductive health.

In the following, we will analyse SOSVone of the leading investment firms in Venture Capital Method in the sector Health Diagnostics.

SOSV

It is a investment firm of Venture Capital Method which provides multi-stage funding, especially early-stage funding to start-up companies with rounds seed.

It helps develop and scale great ideas from new founders, through financial and intellectual capital.

To date, SOSV has financed more than 900 start-ups.

IDEOLOGY AND VALUES

For SOSV, building a better future means empowering the next generation of entrepreneurs.

Only in this way will they be able to solve the major challenges of today's world.

Notably, almost half of the firm's portfolio is aligned with the United Nations Sustainable Development Goals.

In addition, SOSV is proud to be one of the leading investors in companies founded by women.

INVESTMENTS MADE IN THE SECTOR

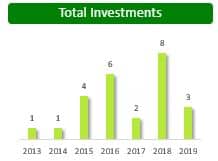

As can be seen from the data shown above, from 2013 to the recently ended 2019, SOSV has made a total of 25 investments, thanks to which has acquired numerous actions by companies in the Health Diagnostics.

2018 was the most productive year, with 8.

As a good firm of Venture Capital MethodOf those, 25 investments, 17 were in the seedwhile the remaining 8 took place in Late Stage.

The US is the country that has benefited most from them.