What is the mHealth sector?

The mHealth sector is the practice of mobile devices in medicine,detecting or monitoring the different biological changes we may suffer. From a mobile app that maps out an exercise routine, to a device that allows your doctor to track you remotely, to a machine that monitors your entire physical development, mobile health apps improve the patient's experience and engagement with their healthcare by making their information and contact with their doctor more accessible.

During the pandemic, this sector has boomed as many apps in the sector have been crucial to the care and monitoring of numerous patients. As shown in the investment analysis, the pandemic has been crucial for the development and deployment of mHealth applications, providing a promising future for these companies.

Sector opportunities

As mentioned, the pandemic has played a very important role in the use of this type of applications, obtaining, for example, very favorable government policies for their development. In addition, the mobile market is a niche with a promising future as more and more people have their own mobile device and even, in some cases, more than one, achieving a large number of potential customers.

This is positively creating a great opportunity for both investors and companies from other sectors that want to invest in companies related to mobile health. The trend indicates that more and more Software or Artificial Intelligencetechnology companies, hand in hand with the Blockchain, will enter the sector and play a crucial role in its development.

Funding received

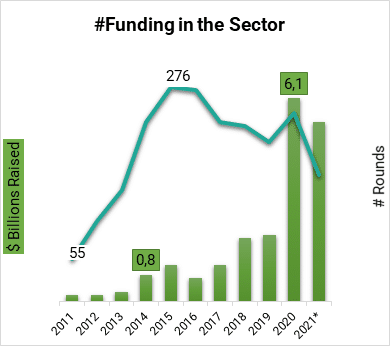

In terms of funding received in the sector, 2020 is the year with the highest amount raised. Through 242 rounds, more than $6 million was raised. Highlight the year 2015, in which the largest number of operations were carried out in investment issues, 276 rounds of financing. This is due to the boom of 2013 in terms of companies created, so they are the first rounds of those companies.

At the same time, it should be noted that, even though the year 2021 is not yet over, this year is almost at the same level as the previous one in terms of money raised, with a much lower number of operations. This indicates the gradual consolidation of the market, as the rounds are of higher value.

Investments

With regard to the type of investors in the sector, as we have seen, the companies financed have been mostly young companies, since mHealth is a recently exploited sector. For this reason, the number of VC investors with expertise in startups and in early stages is much higher than in other sectors.

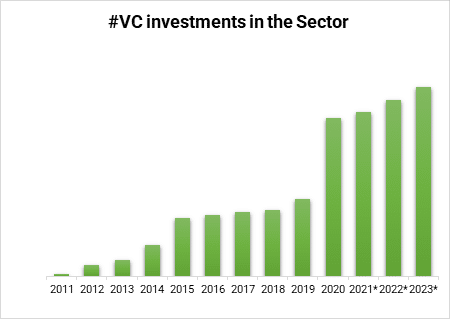

The projection of investments by VCs, as shown in the graph, is very positive for the coming years since, as indicated in the investment analysis, startups in these years have been maintained and are expected to grow for the following years. In addition to that, there is still a large number of unfunded mHealth companies, giving an opportunity for many VCs to enter the sector.

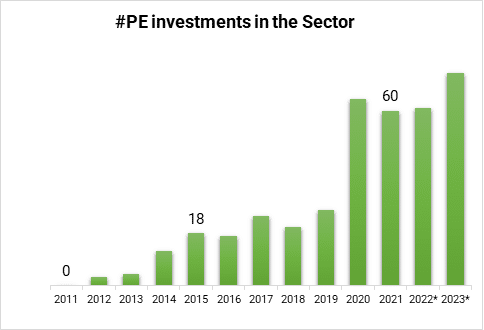

Regarding later stage investments, the projection is also positive. As usual, the numbers are lower, but the projection maintains almost the same figure as for earlier stage investors. To date in 2021, 60 investments have been made by Private Equities, almost surpassing the previous year.

Private Equity and Venture Capital currently investing in the sector are investors with expertise in Software or Information Technology, demonstrating the disruption of these sectors in mHealth.

Acquisitions and IPOs

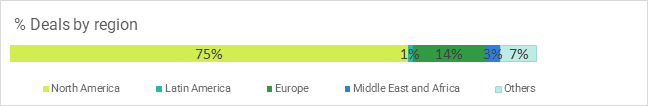

On the other hand, the number of acquisitions in the sector is small, with the United States being the country with the largest number of operations. This is normal since it is the country with the largest number of mHealth companies in the world. In second place is Europe. This region expects to have a growth in terms of number of operations as the number of existing companies is growing. Only 8% of companies in the sector have been acquired. At the same time, 12% of mHealth companies have been acquired.

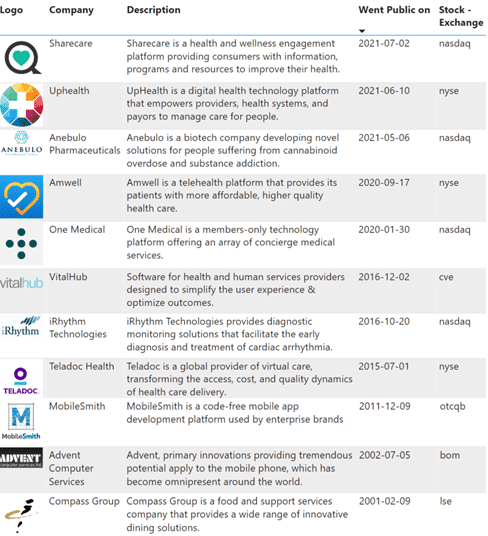

On the other hand, only 11 companies have gone public. Most of them are American companies. The most notable is Compass Group, a company that conducted a macro Post-IPO Equity round last year, as demonstrated in the report.

Overview in Spain

Artificial Intelligence for the management of personalized data for the treatment or control of nutrition or physical activity (Nire iHealth) or in online therapies for busy people(Oliva Therapy).

Of those 25 companies, 11 have received funding and only one has been acquired: Salumedia Labs bought by Adhera health in March 2021. On the other hand, none of these companies have made any acquisitions.