What is the “Cloud Computing” sector?

As described by Salesforce, cloud computing, simply defined, is a technology that enables remote access to software, file storage and data processing over the Internet as an alternative to running on a personal computer or local server. In the cloud model, applications do not need to be installed locally on computers. In other words, it could be defined as offering services through the connectivity and scale of the Internet via the cloud.

As well described by OpenSistemas, with Cloud Computing it is not necessary to install any application on the computer itself, and yet the computer will have access to the different services required. A very clear example of Cloud Computing is email. We use e-mail and we have not had to download any application, that is Cloud Computing; a fast, on-demand and secure alternative.

There are three types of cloud computing: public, private and hybrid cloud. The first of these occurs when a third party offers a service to different customers who share the same infrastructure and share the costs between them (server, administration, security, communications, etc.). The private cloud is used by companies, generally large ones, which consume a lot of resources and need specific adaptations ("customisation"). The hybrid cloud, finally, is the combination of solutions on the Internet and hosted on the customer's premises.

Scope and coverage of the study

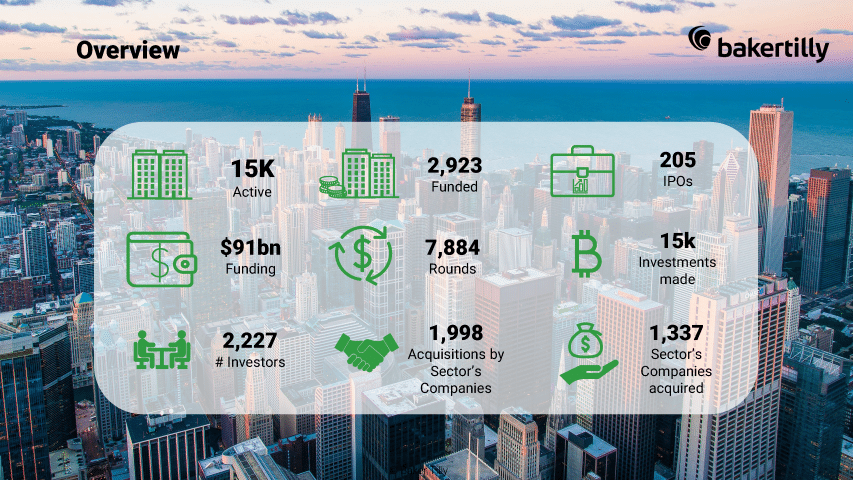

This industry analysis covers more than 15,000 companies worldwide labelled within the "Cloud Computing" category.

All data on companies, acquisitions and founding rounds were extracted on 2 January 2023. Deals, rounds and companies founded after this date have not been included.

Principal investment trends

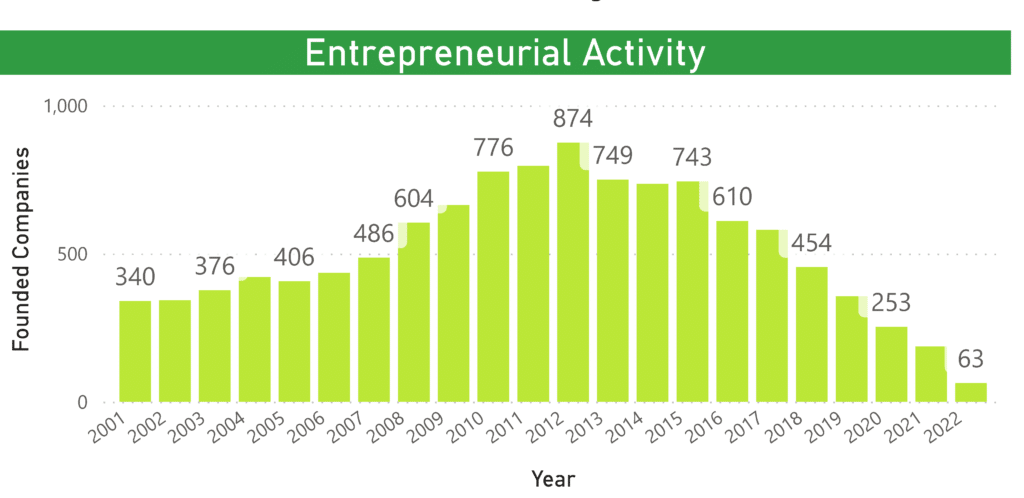

Analysing the number of companies created over the last 15 years, it can be seen that the sector boomed, reaching a maximum of 621 companies created in a single year, 2012. Since then, there has been a notable and quite aggressive decrease, reaching only 63 companies founded in 2022, although it is true that some records for the year are probably missing, as the data are from 2 January 2023.

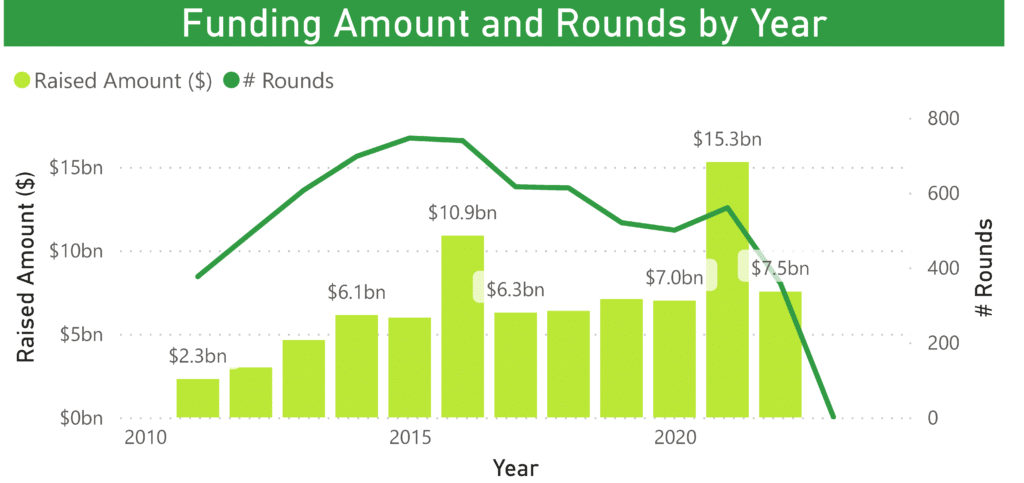

On the other hand, looking at the funding received in the sector, we see something much more stable. Apart from 2016 and 2021, years in which almost 11 billion and 15 billion dollars were raised, thanks to giant rounds by Inspur Cloud (almost 3 billion dollars raised that year), Spotify (1 billion dollars) and in 2021 more than 15 rounds with between 200 and 800 million dollars each. In the other years, the fundraising has remained constant at around $6.5 billion.

In terms of the number of rounds, there has not been a significant drop in the number of rounds, as the collection has not been affected. At the same time, it should be noted that it is possible that data for the year 2022 are still missing and have not been recorded in the databases. Finally, note the trend lines. These show an increase in the number of rounds and a decrease in the number of rounds, indicating that the sector is entering a stage of maturity.

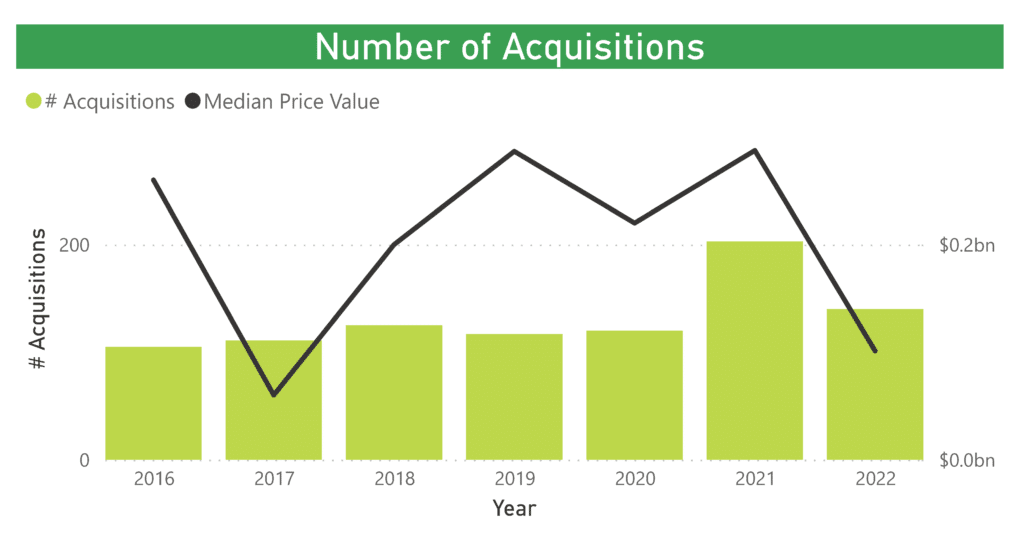

In terms of the acquisitions that have taken place in the sector, with the acquiring company belonging to the Cloud Computing sector, the visual shows a fairly marked growth, as the trend line makes clear. With a peak of 153 purchase operations in 2017. Finally, we should mention 2020, which, despite having been an abnormal year due to the pandemic, has maintained its values quite well, reaching 110 operations, and in 2021 we can see that everything that could have been paralysed due to the pandemic has recovered.