In the first quarter of 2017, European startups in the fintech sector received 667M from venture capital, which is now almost 60% of the amount raised in the whole of 2016. Among the reasons for this growth are the support being given to early-stage fintech companies in the UK and changes to online payments across the EU.

Top Doctors receives another €3M round, led by a Russian investor.

The round aims to consolidate Top Doctors in the markets in which it operates: Spain, Italy, UK, Chile, Mexico, Colombia and the US, as well as the possibility of opening up markets in Germany and France. The company currently has 120 employees. Forecasts indicate that, when it completes its expansion plan in 2018, the workforce will rise to 160 people.

Dexma, which uses big data for energy efficiency, receives €1M

The company has received a round led by Inveready, with the aim of consolidating its growth in the European market, focusing on countries such as the UK, Italy, France, Belgium and the Scandinavian market. In parallel to its expansion in Europe, the resources will also support the launch of a new energy consumption analysis tool called Energy Grader.

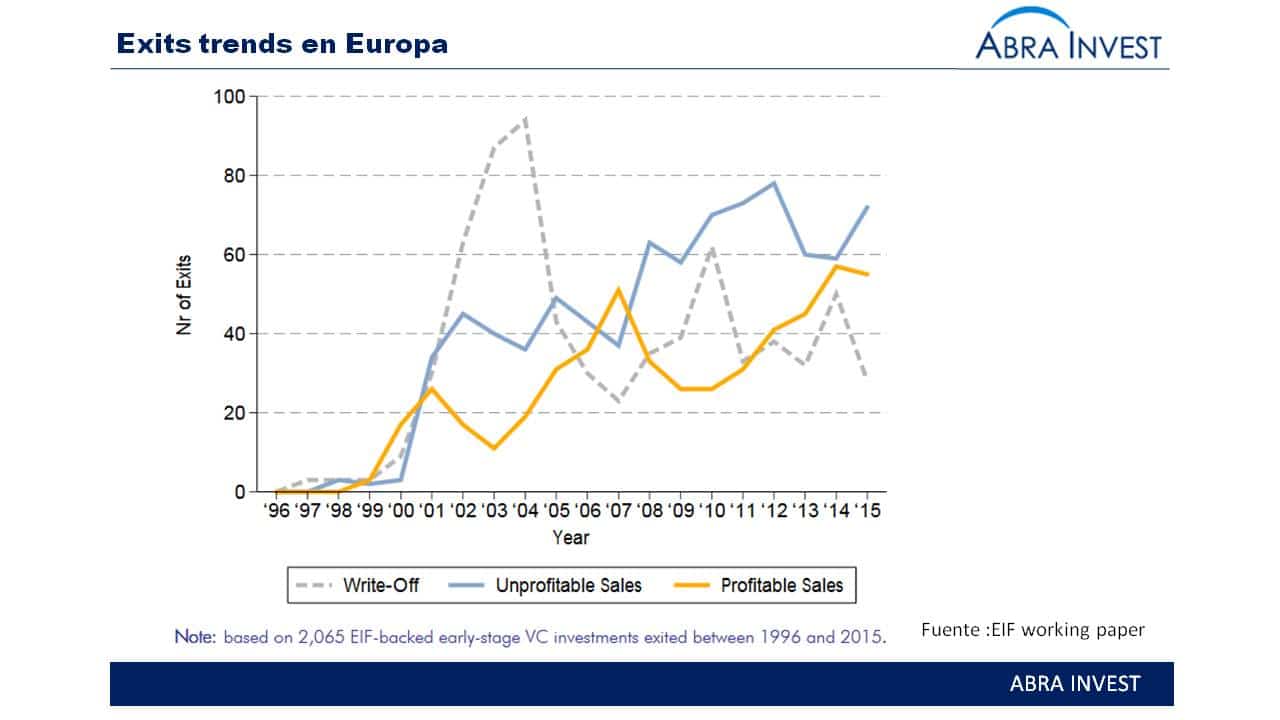

Perspective on the European venture capital scene by the european investment fund

As can be seen in EIF's report on European venture capital divestments, European venture capital investment has grown considerably over the past 10 years. From 2010 onwards, these investors began to make exits, encouraged by the recovery of the technology industry, evidenced by increases in Nasqad and venture capital valuations, while interest rates were low.

New funds March: Trea ,Telegraph capital and Nexxus Iberia

In March, new funds have come to light with different purposes: internationalisation towards Latin America, promotion of new technologies and direct lending. This shows that venture capital activity in Spain continues its positive trend.

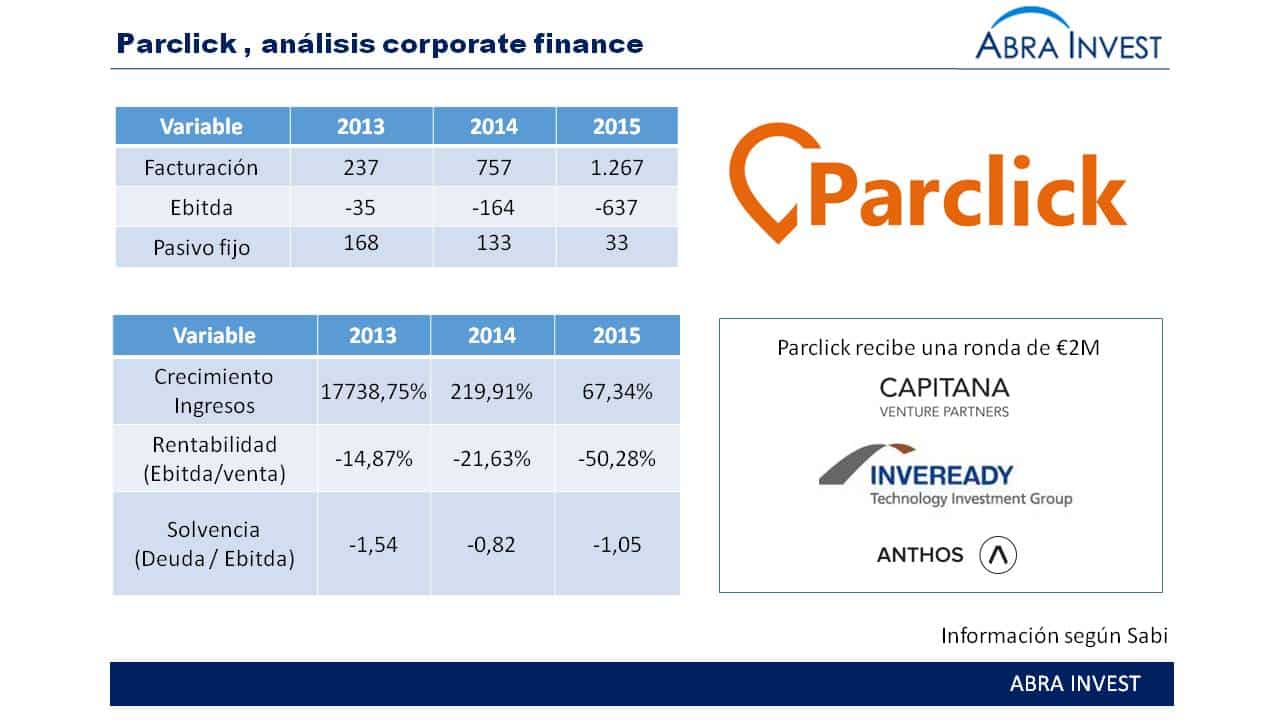

Parclick, a Spanish parking reservation company, closes €2M round

Parclick, the Spanish online parking booking app, closes a €2M round to strengthen its presence in the 170 cities where it is present in France, Italy, Portugal and Spain, and to open up to new markets, with a special focus on Central European countries.

Hundredrooms, the holiday accommodation search engine, raises €4M in a €4M round

The round, which was led by Seaya Ventures, will serve to consolidate the international expansion and product development of this holiday accommodation metasearch engine.

MedLumics, Spanish medical device company closes €34M round

This financing round is the largest financing round in the history of medical technology in Spain and is one of the largest rounds in Europe in the last year. Among the investors who have backed the company are Ysios Capital and Caixa...

Nauta leads a round in Cloud.IQ, a company that optimises the conversion of visits into actual sales.

The Spanish-based venture capital firm has made its first investment of 2017 in a London-based company that uses artificial intelligence for conversion rate optimisation (CRO) in the online retail sector.

Gamelearn, a video games company applied to education, closes a €2 million round led by Kibo ventures.

According to Ibrahim Jabary, CEO of Gamelearn, the entry of Kibo Ventures brings to the project "a wealth of experience and a deep knowledge of international markets" and represents "the boost we needed to achieve the strategic objectives set by the company". With this investment, Gamelearn aims to double its turnover again in 2017 with the clear objective of "continuing to be the world reference in the development of video games and training simulators".

New funds: Atomico , Intellectium and Mediterranea capital.

"We are very optimistic about the Spanish market and it is growing very fast; we see that many Spaniards with experience in technology are returning to Spain from other countries and that makes for a very promising future for the country" are the words of Brochado, partner at Atomico.

Odilo, a Spanish digital content management company for libraries, raises €6M

Odilo receives its third round of investment with the aim of improving its technology. The digital content management company was founded in 2011 in Cartagena and is currently present in Europe, Latin America, Oceania, North America and Asia. Last October, Odilo became the first company outside the United States to sign global distribution agreements for lending with the five largest publishing groups in the world.