This Catalan company founded a year ago has received a €3M round for its consolidation in Spain and international expansion. The round was led by Samaipata Ventures and also participated 360 Capital Partners, Sabadell Venture Capital, Sputnik, VenturCap, Mediaset and Breega Capital.

What is private equity investing in and what prospects do we expect for 2017?

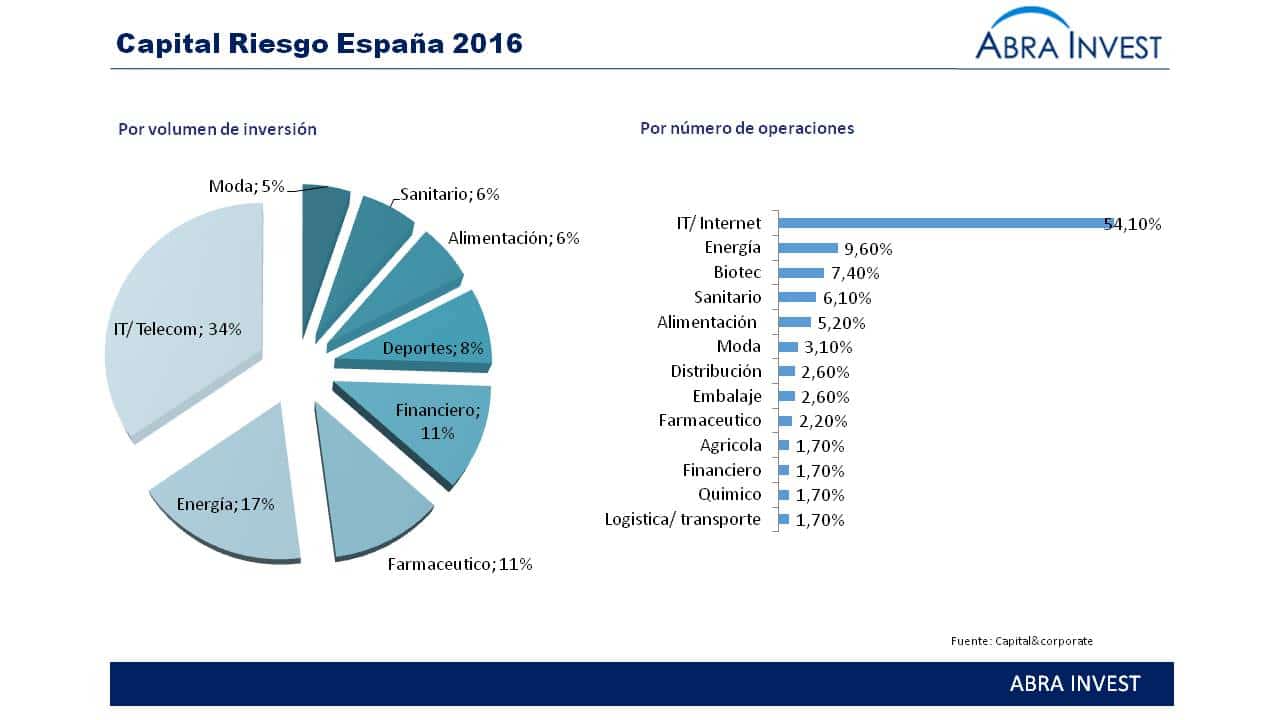

Venture capital investment in Spain in 2016 totalled €3,100M, an increase of 5% compared to 2015. Two deals (Hotelbeds and Renovalia) for more than €1,000M of deal value and 6 for more than €100M contributed to this result. In terms of the most active sectors, the IT/Telecom/Internet sector is in first place.

Barcelona-based FinTech ID Finance raises $50M to grow in Latin America

The company will use the funding raised for its expansion programme in Latin America following the launch of its online financing service MoneyMan last year in Brazil.

Ec2ce, a Spanish company applying big data to agriculture, receives €1M

In this round, they have brought in a large number of prestigious professionals in various fields to support an expansion plan that includes as a priority its commercial landing in the United States. It also maintains its strategies and operations in Spain and Europe.

Kuaderno, a Spanish startup for children to learn English, receives its first investment from Cabiedes

Founded in 2015, Kuaderno is a leading Spanish independent digital platform for learning English for students aged 5 to 15. The objective of the round is to finance the main avenues of growth; improving products and strengthening the intelligent content generation algorithm. In addition to boosting its international growth.

New funds in 2017: Sabadell, Alta life sciences and announcement of upcoming funds such as Finaves.

We start the year with the announcement of new funds for technology and healthcare companies. Altai Startups, an American fund, has launched its first fund outside the US and has decided to do so in Barcelona, with expectations of being the largest life sciences investment vehicle created in Spain.

Which European identity management companies have received funding in 2016?

Although the major identity management technologies are American, in 2016 we have detected several European operations in the sector. The application we have detected that is growing the most is related to online banking.

European cybersecurity attracts investors: Darktrace and Silent Circle

European companies in the field of cybersecurity, such as Darktrace and Silentcircle, have raised more than $50M in 2016. Investors include major international investors such as KKR, but also European investors such as Santander.

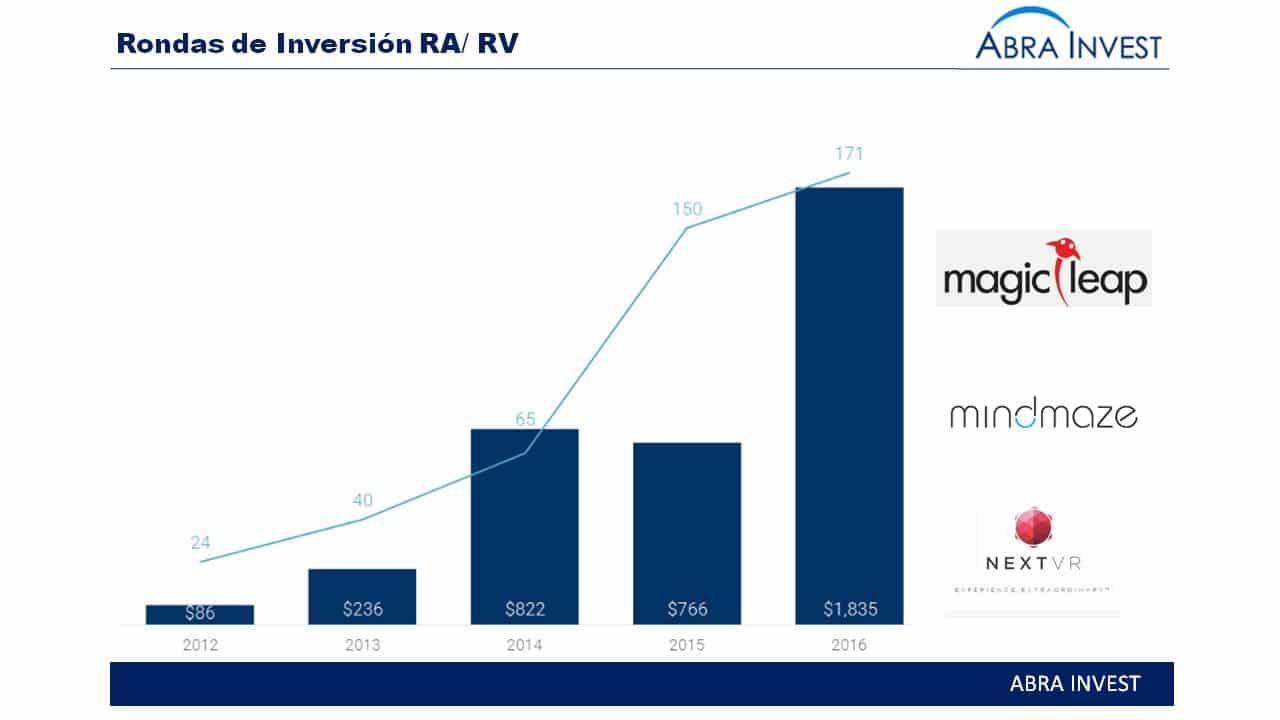

Virtual and augmented reality, a market with potential that received $1.8B in 2016

In 2016, virtual reality and augmented reality companies attracted $$1.8B from investors. If in 2015 we saw the beginning of a wave of investment rounds in the sector, doubling the number of operations, in 2016 the number of operations has continued to grow, reaching 171 rounds, and the average amount of the rounds has doubled in 2016.

Software testing company Tricentis receives $165M round of funding

Tricentis, a global leader in enterprise software testing, enabling companies to achieve high automation rates and minimise risk, has received a $165M round led by Insight Venture Partners.

GMV invests in Spain's space technology company PLD Space

GMV will take a stake in the company and will participate in the development of its launchers, with this investment it unlocks a €6M financing.

Logtrust, a Spanish big data company, receives a $11M round of investment

Logtrust, a Spanish company specialising in real-time Big Data solutions, has received a round of funding in order to continue growing globally. Investors include Kibo Ventures, Investing Profit Wisely and Atlantic Bridge.