Biotech deals: corporate finance, M&A, investor search, funding, biotech venture capital

Biotech deals: corporate finance, M&A, investor search, funding, biotech venture capital

We analyse some references in the Energy sector and you can check them in the following table. Econova or Corsica Partners make up this ranking.

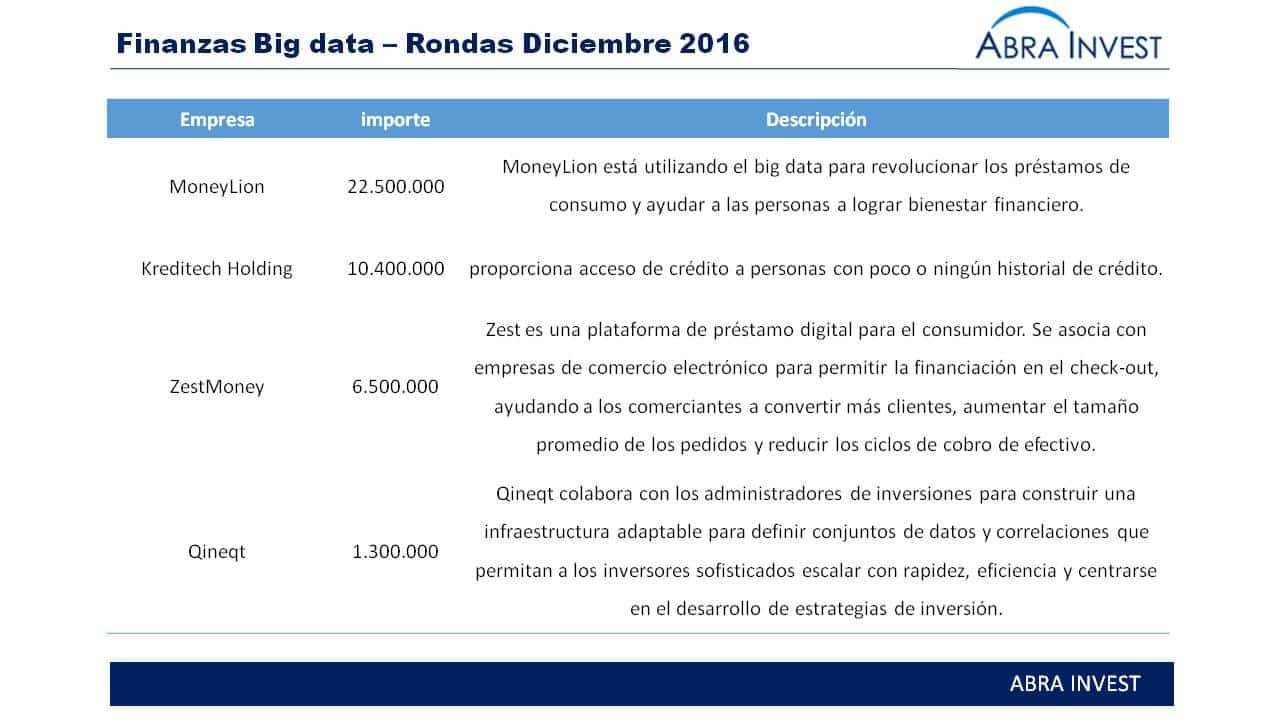

The use of big data in the banking sector has numerous applications, such as being able to offer customers solutions that adapt to their needs, predict customer behaviour, detect the possibility of fraud, etc. BBVA has realised the importance of big data for its sector and is investing in this area.

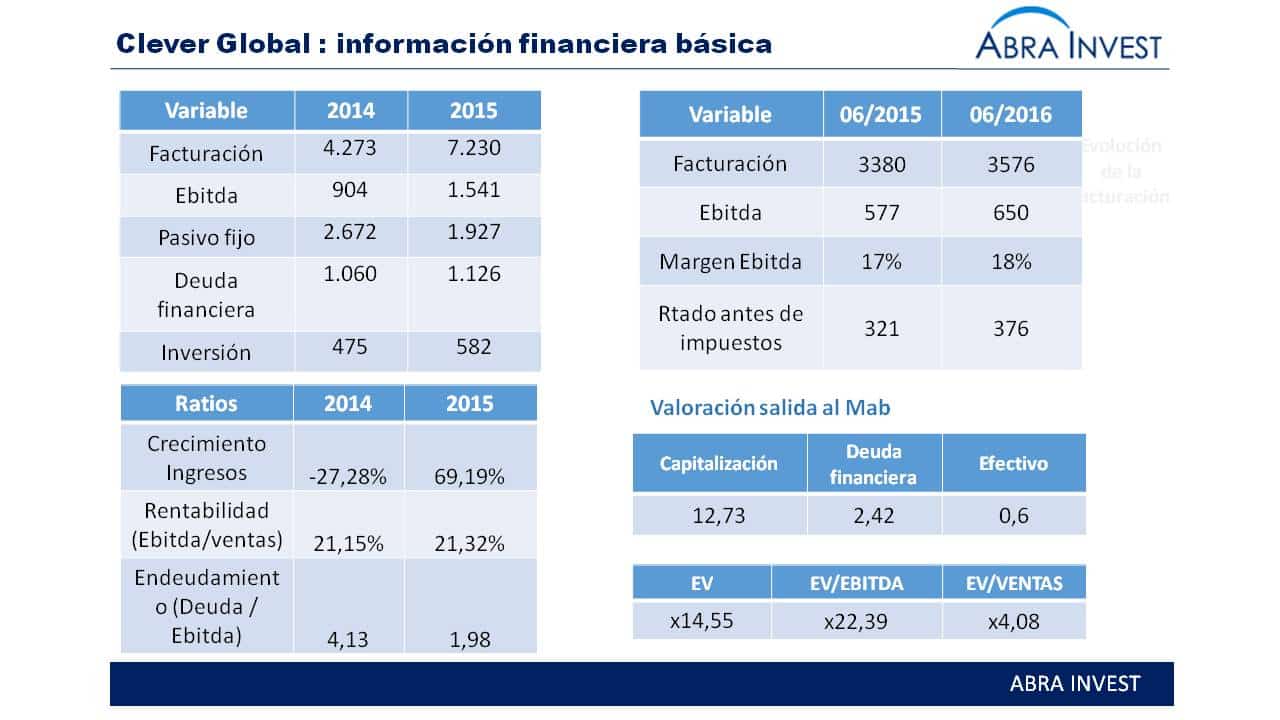

CLEVER Global is a technology services and outsourcing company specialising in global management of suppliers and contractors, coordinating in real time all the elements (companies, workers, vehicles and machinery) involved. This company has gone public on the Mab with the aim of making its growth strategy a reality.

Internet marketing is a substantial business. Process a small fortune. It has advantages and cons too. Purchase deal with this you will in a right way, celebrate you a huge success. Also, if you don’t can see this business, this could eat up all of the money you invested into it. Internet marketing and affiliate marketing are undergo many cpa affiliate networks mobile affiliate marketing http://adwool.com/ market risks and problems. Most likely it’s not products along with the services you are offering meant for clients that having problem. The most common problem I have noticed is with those marketers who realize their valued clientele.

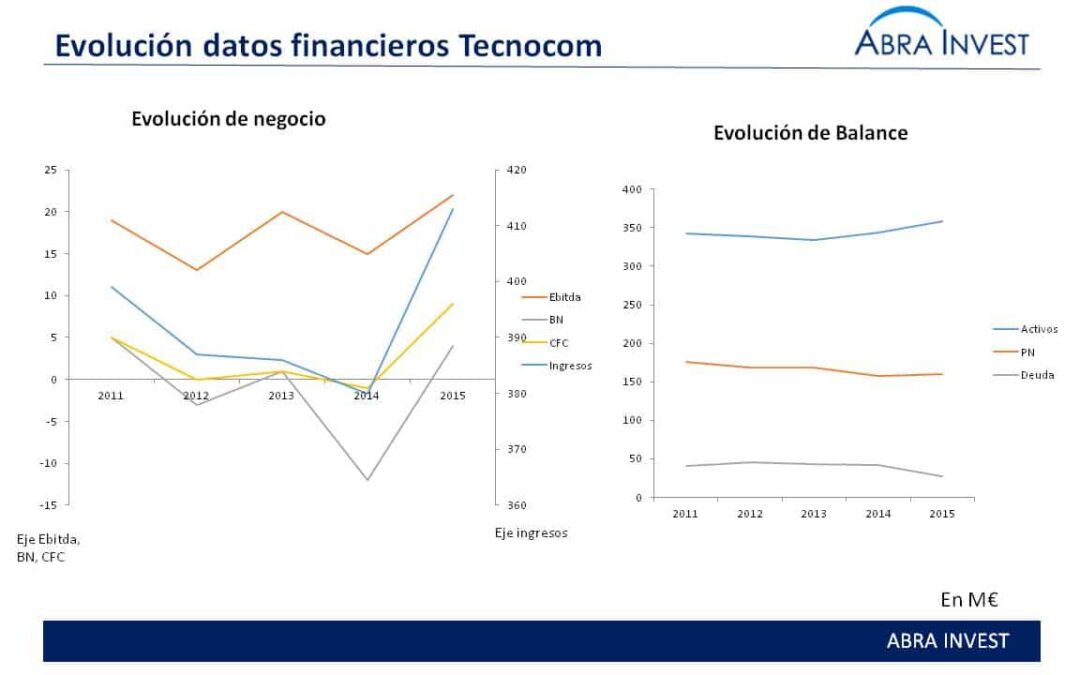

Indra buys 52.7% of Tecnocom and launches a takeover bid for the remaining shares, valuing the company at €305M.

In September Isp, which was already an Antevenio shareholder, bought 11% of the company, and then launched a takeover bid. ISP now controls 83.09% of Antevenio's capital, whose profit has grown by 58% between January and June 2016.

After growing in mobility and Open Source, thanks to the purchase of two companies in the summer, in September Accenture bets on cloud solutions, a sector it already leads in Spain, and buys New Energy Group, a company specialised in Salesforce solutions.....

Mab-listed audiovisual media companies Agile and Secuoya want to grow, either through acquisitions or new projects. To do so, Agile and Secuoya have decided to raise capital in order to do so.

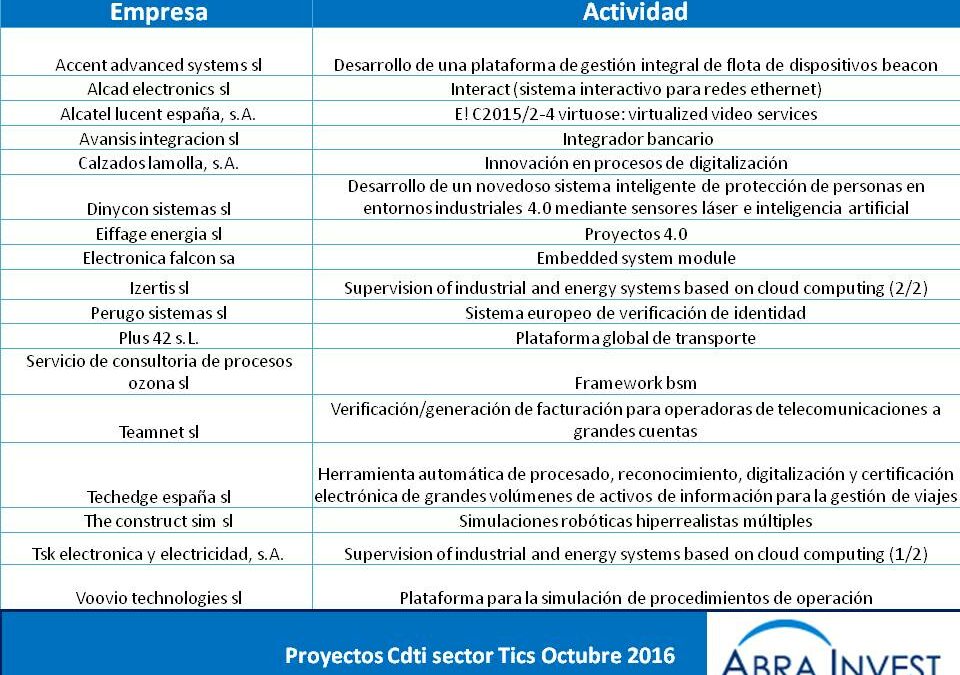

17 Spanish companies in the ICT sector received funding from the Cdti in October. Among the subsectors in which they operate, energy and industry 4.0 stand out. The Cdti, which depends on the Ministry of Economy, finances innovation and technological development of Spanish companies, with a budget of 1,792 million euros for 2016.

Tecnocom is a Spanish technology company listed on the Madrid Stock Exchange since 1987. In 2006, Tecnocom began a corporate expansion process with the aim of becoming a leader in the Spanish information technology market. It currently offers consultancy and outsourcing services for the development, maintenance and support of computer applications for different sectors such as banking, insurance, public administration and industry. Although it operates in the international market, 80% of its sales come from national clients.

26 funds in 3 different categories: Expansion Capital, Venture Capital and Incubation, participated in the 7th Fondico call. Of these 26 funds, 9 have been selected, three in each category. Fondico will distribute €157M among these funds. Given the multiplier effect generated by this instrument, the funds participating thanks to this call will invest a minimum of €660M in Spain, which is 4.2 times the amount of €157M committed by FOND-ICO Global.