The use of big data in the banking sector has numerous applications, such as being able to offer customers solutions that adapt to their needs, to make predictions about a customer's behaviour, or to detect the possibility of fraud, among others. BBVA has realised the importance for its sector and is investing in this area.

What is Datio?

A recently created startup, formed from the union of BBVA and Stratiowhich analyses and manages banking industry data to tailor products to the needs of real customers. To do so, they use Stratio's technology, the core of which is Spark. Thanks to the end-to-end platform, they offer a complete solution that covers the entire data cycle: ingestion, storage, analysis and visualisation.

About Stratio

Founded in 2013 and based in Madrid and Silicon Valley, Stratio is a start-up with its own product. It is an advanced Big Data platform based on Spark and allows the use of any noSQL database.. Stratio allows you to analyse images, videos, e-mails, comments, subscriptions, relevant information, financial events, etc.

It was driven by the founders of Paradigma Tecnologico, a company dedicated primarily to web technologies.

Stratio received an investment round in 2014. You can access more information related to Corporate Finance on our website.

BBVA and Big Data

BBVA is making a great effort to ensure that the Big Data is already a reality, both for internal use and for third parties.

In addition to the Datio project, in 2016 BBVA has participated in other projects related to Big Data. One of them is UN Global PulseThe project will measure the resilience of areas affected by natural disasters through data.

It has also introduced this year Commerce 360: a tool aimed at the digitisation of SMEsThis is a web tool that converts anonymous, aggregated data on purchases made by customers with BBVA physical POS cards into useful information for their customers. It is a web tool that converts anonymous and aggregated data on purchases made by customers with BBVA cards at the physical POS into useful information for their customers' businesses.

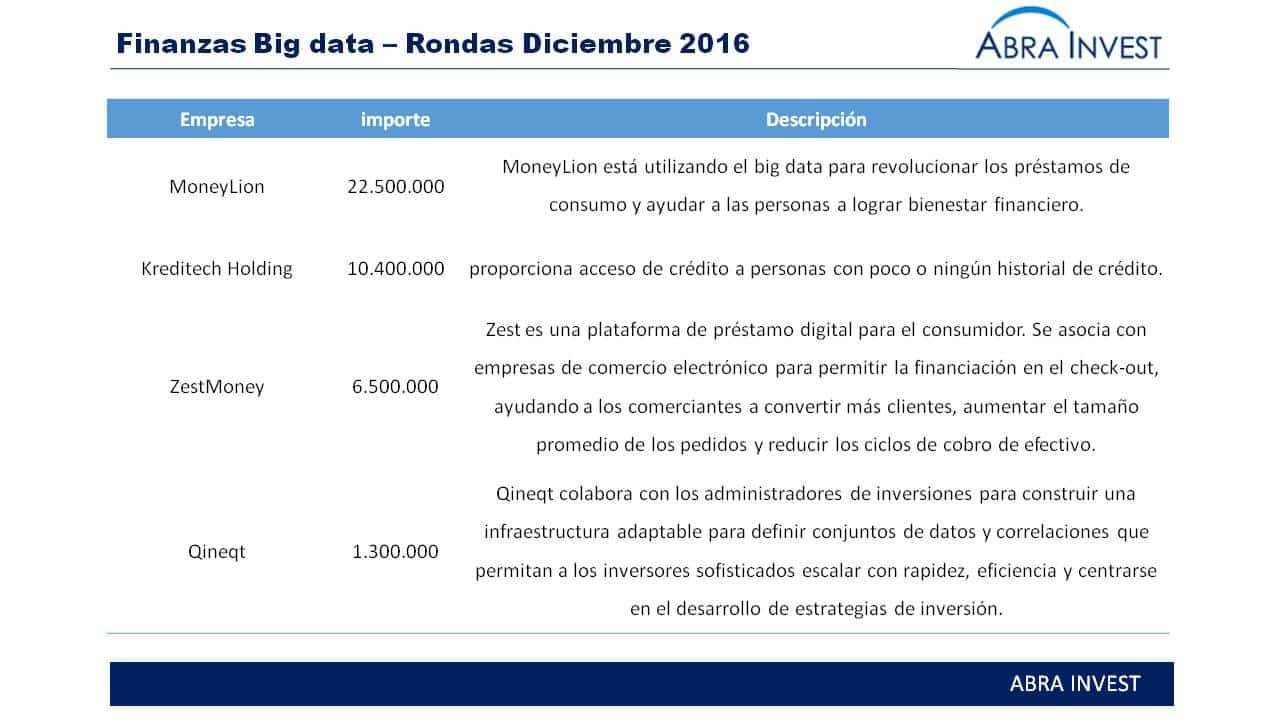

The use of Big Data in the financial sector: Rounds closed in the last month

If you are looking for investors, you want to buy or selling a companyplease contact us. Abra-Invest has a team of experts in each area at your disposal. Call +34 946424142 or fill in the contact form below.