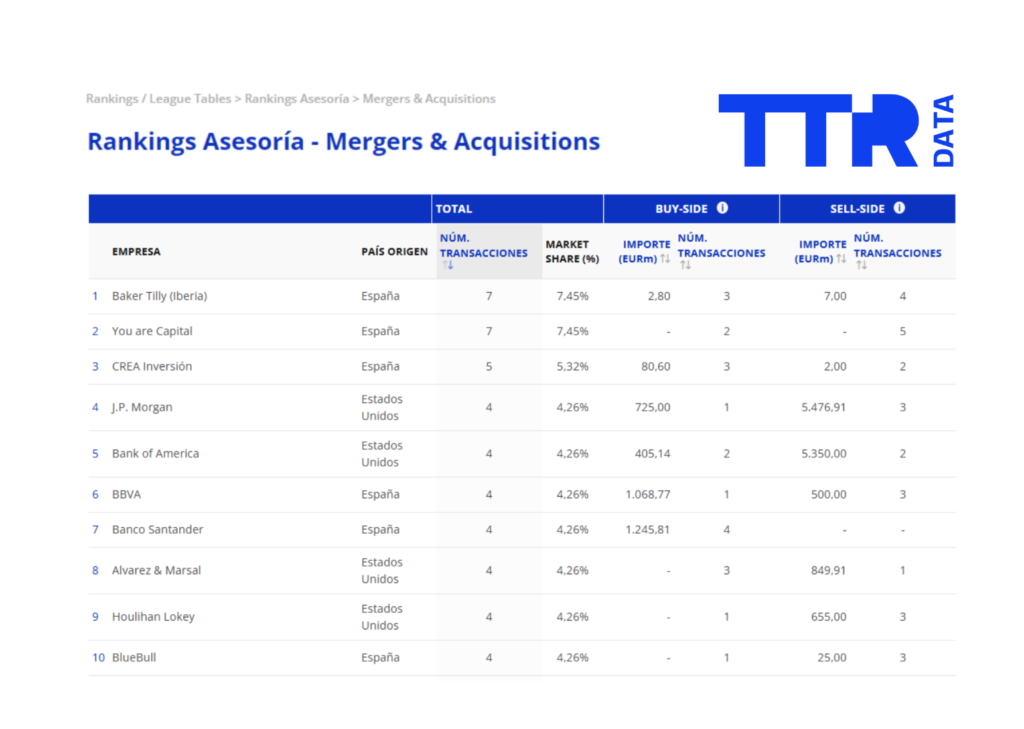

The year 2025 has been decisive for Baker Tilly’s Tech M&A practice. According to data based on the Transactional Track Record (TTR), the firm has consolidated its position as the leading advisor in technology mergers and acquisitions in the mid-market in the Iberian market by number of transactions advised in the TMT sector. This is the third consecutive year that Baker Tilly Tech M&A has achieved this position.

This progress is also reflected in the leading rankings of transactional activity in Spain, where LSEG places Baker Tilly among the most active advisors in the country, with 22 transactions advised in 2025 across all sectors. This figure confirms the positioning of the Tech M&A practice as a benchmark in the national and international market.

What is driving leadership in technology M&A

The technology market rewards real traction: origination, specialized advice, and effective closings. In an environment where value depends on the product, recurrence, installed base, or intellectual property, the role of the advisor is critical.

In 2025, Baker Tilly Tech M&A has excelled in:

- Balance between buy-side and sell-side mandates, demonstrating versatility.

- Sector expertise, key to articulating the value of software, digital services, and technology infrastructure companies.

- Experience in complex transactions, including integrations, multi-geography processes, and transactions in regulated sectors.

2025: a year marked by technological consolidation and mission-critical niches

The trends that have defined the Tech M&A market in 2025 are clear:

- Software platforms driving buy & build strategies and acquiring verticals with an established customer base.

- Digital infrastructure for public services, especially in smart metering, analytics, and operational efficiency.

- Digital services specialized in regulated sectors, such as healthcare, with strong appeal to European groups.

- Integration of creativity, data, and technology in the field of digital marketing.

Transactions advised by Baker Tilly Tech M&A in 2025

Business Software Group integrates Extra Software

Strengthening its consolidation strategy through the acquisition of a company with over 1,100 active clients. A case where the value lies in the product, the installed base, and the technical capabilities. In this article, we discuss the acquisition of Extra Software by BSG.

Business Software Group buys Copermática

Entry into the professional services software segment, a highly recurring niche with strong customer loyalty. Access all the details of this transaction here.

Arson Metering joins the Netmore Group

Transaction focused on water and gas digitalization solutions, with cross-border complexity and relevance for the modernization of public services. We explain Baker Tilly’s role as advisor in the integration of Arson Metering into Netmore Group.

FBA Consulting is sold to Hawk Infinity

Strategic transaction in digital health, a regulated sector with high barriers to entry and strong recurrence. Discover all the details of the transaction.

Distrimel Rioja joins the Novelec Group

Example of convergence between technology and industry, impacting energy, HVAC, and renewables. We explain the role Baker Tilly played as exclusive financial advisor to Distrimel Rioja.

t2ó ONE buys Fly Me to the Moon

Integration of creative and technological capabilities, with synergies that boost operating margin. In this article, we discuss the details of the acquisition of Fly Me to the Moon by t2ó ONE.

Vanture ESS joins knowmad mood

Transaction that strengthens capabilities around ERP platforms such as SAP and Odoo, key for medium and large enterprises. Access the details of the transaction here.

Why this track record positions us as one of the top technology M&A advisors

The growth of Baker Tilly Tech M&A in 2025 can be explained by:

- Complete coverage of the technology ecosystem: enterprise software, digital services, infrastructure, and marketing.

- Balance between buy-side and sell-side transactions, demonstrating versatility and understanding of both dynamics.

- Mastery of value creation patterns: consolidation, platforms, recurrence, and specialization.

- Recognition in generalist rankings, such as LSEG, which highlights Baker Tilly among the most active advisors in the country.

Forecasts for 2026: more consolidation, more technology, and more operations

Market forecasts point to:

- Higher trading volume buy & build en software vertical.

- More international transactions in digital infrastructure.

- Increasing consolidation in specialized digital services, especially in regulated sectors.

- An environment where execution capability will be more decisive than ever.

Visibility in rankings is no longer just a recognition; it is a direct reflection of the ability to execute and close transactions consistently.

Baker Tilly Tech M&A's positioning in 2025 is no coincidence; it is the result of an exceptional team of technology experts with a deep understanding of the product, recurrence, and operational dynamics that truly drive value in technology M&A.

Our advisors have repeatedly demonstrated their ability to lead complex processes, build trust, and maximize value for our clients.

In 2025, we have demonstrated that we are, without a doubt, one of the best technology M&A teams in the market.

At Baker Tilly Tech M&A, we don’t just advise on transactions: we deliver results.