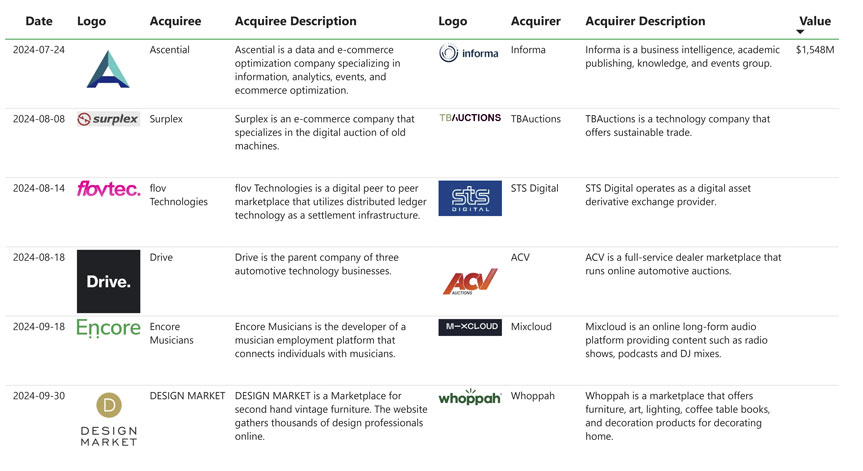

The consumer software sector has recently experienced a dynamic wave of acquisitions, highlighting its evolution toward enhancing user engagement and expanding digital services. Notable transactions include Mixcloud's acquisition of Encore Musicians to integrate live music experiences and ACV's purchase of Drive, underscoring the growth of automotive tech platforms. Other deals, such as the merger of flov Technologies with STS Digital, demonstrate innovations in blockchain-driven markets. Each acquisition reflects the sector's trajectory toward greater integration of technology with consumer experiences, emphasizing the need for adaptability and innovation.

Informa acquires Ascential to strengthen its e-commerce and data optimization capabilities

In July 2024 Informa announced the acquisition of Ascential for $1.548 billion, marking a major step in the business intelligence and e-commerce space. The acquisition combines Informa's expertise in knowledge dissemination and event management with Ascential's advanced data analytics and e-commerce optimization solutions. This strategic move positions Informa as a leader in providing cutting-edge tools to help companies navigate the digital economy.

Informa description

Informa is a global leader in business intelligence, academic publishing and events. Its comprehensive portfolio of products empowers organizations by providing valuable information, fostering innovation and facilitating knowledge sharing through world-class events and solutions.

Ascential description

Ascential specializes in data-driven solutions for e-commerce optimization, providing analytics, events and insights to improve digital retail strategies. Its capabilities are widely recognized for driving growth and efficiency in the e-commerce sector.

Strategic Justification of the Acquisition

This acquisition is designed to create synergies by integrating Ascential's data expertise with Informa's global network and event infrastructure. It enables Informa to offer enhanced digital tools and actionable insights, helping its customers optimize their e-commerce strategies and adapt to a data-driven economy. Informa's acquisition of Ascential underscores the growing demand for integrated data and digital optimization solutions, reinforcing the importance of innovation in business intelligence and e-commerce.

TBAuctions expands its digital auction expertise with acquisition of Surplex

TBAuctions announced the acquisition of Surplex, an e-commerce company specializing in digital auctions of used machinery, in August 2024. This acquisition underscores TBAuctions' commitment to empower sustainable commerce by diversifying its offering and increasing its presence in the industrial equipment market. By combining expertise in technology and auction processes, the union between the two companies aims to streamline access to used machinery, fostering a circular economy.

About TBAuctions

TBAuctions is a leading technology platform that promotes sustainable trade. Known for its innovative approach to auctions, TBAuctions connects buyers and sellers from various sectors, ensuring efficiency and transparency of transactions.

About Surplex

Surplex specializes in online auctions of used industrial machinery. It has built a reputation for providing a seamless platform for companies to buy and sell equipment, combining the convenience of e-commerce with industrial expertise.

Strategic reasons for acquisition

The acquisition enables TBAuctions to strengthen its portfolio by integrating Surplex's expertise in industrial machinery. It supports TBAuctions' mission to promote sustainable commerce by expanding its reach into a critical market segment, enhancing customer value, and facilitating the efficient reuse of machinery.

This acquisition highlights the growing synergy between e-commerce and sustainability, driving innovation in industrial trade and supporting the circular economy.

STS Digital's acquisition of flov Technologies will revolutionize its digital asset settlements

STS Digital ha anunciado la adquisición de flov Technologies, un mercado digital peer-to-peer que aprovecha la tecnología de libro mayor distribuido (DLT) para la infraestructura de liquidación. Este movimiento estratégico resalta la ambición de STS Digital de mejorar su posición de negociación en el mercado de activos digitales mediante la integración de innovadoras capacidades de liquidación basadas en blockchain.

STS Digital description

STS Digital is a leading provider of digital asset derivative exchange services, known for its robust trading platforms and focus on fostering liquidity and accessibility in the digital asset market.

Flov Technologies description

The acquisition allows STS Digital to strengthen its technological foundation by incorporating flov Technologies' cutting-edge settlement infrastructure. This synergy will streamline transaction processes, reduce settlement times, and enhance user trust, aligning with STS Digital's goal of leading the digital asset space.

With the acquisition of flov Technologies in August 2024, STS Digital positions itself at the forefront of blockchain innovation, setting new standards for efficiency and security in digital asset trading.

Explanation of the strategic reasons for the acquisition

The acquisition allows STS Digital to strengthen its technological foundation by incorporating flov Technologies' cutting-edge settlement infrastructure. This synergy will streamline transaction processes, reduce settlement times, and enhance user trust, aligning with STS Digital's goal of leading the digital asset space.

With the acquisition of flov Technologies in August 2024, STS Digital positions itself at the forefront of blockchain innovation, setting new standards for efficiency and security in digital asset trading.

ACV expands its automotive technology offering through acquisition of Drive

In August 2024 ACV announced the acquisition of Drive, parent company of three automotive technology businesses. This move underscores ACV's ongoing commitment to revolutionize the automotive market through technology-driven solutions. The acquisition aligns with ACV's vision to strengthen its offering and bring greater value to its dealer network.

ACV description

ACV is a leading provider of online auto auctions, offering a full-service dealer marketplace. Its innovative platform enables dealers to buy and sell vehicles while leveraging state-of-the-art analytics and insights.

Drive description

Drive oversees three automotive technology businesses focused on improving processes throughout the automotive lifecycle. These businesses specialize in providing tools for inventory management, logistics and retailing.

Strategic Justification of the Acquisition

The acquisition of Drive enables ACV to expand its portfolio by integrating complementary technologies. This move improves operational efficiency, strengthens ACV's logistics capabilities and supports its mission to streamline vehicle trading. In addition, Drive's expertise will help ACV deepen its market inclusion and offer better services to its growing customer base. This acquisition demonstrates ACV's interest in leveraging technology to redefine the automotive market. With the integration of Drive's capabilities, ACV continues to set industry benchmarks in innovation and service.

Mixcloud expands its audio ecosystem with acquisition of Encore Musicians

Mixcloud has announced the acquisition of Encore Musicians, a platform that connects individuals and events with professional musicians, in September 2024. This acquisition represents a strategic move for Mixcloud as it seeks to diversify its offering and strengthen its position in the music and events ecosystem.

About Mixcloud

Mixcloud is a leading platform for long-form audio content, including radio shows, DJ mixes and podcasts. Known for supporting creators and fostering unique audio experiences, Mixcloud has cultivated a loyal audience around the world.

About Encore Musicians

Encore Musicians specializes in matching clients with live artists for events. With an extensive database of musicians and an efficient booking platform, Encore has transformed the live music experience by streamlining the booking process.

Strategic reasons for acquisition

With the integration of Encore Musicians, Mixcloud is able to enhance its technology ecosystem, bridging the digital and live music experiences. This move opens up new opportunities for artists on Mixcloud's platform to expand their audience at live events, while offering Encore customers access to an enriched pool of talent. This acquisition highlights the growing trend of digital platforms embracing live experiences. Mixcloud's strategic move positions it as a leader in the digital and physical music spaces.

The Future of Consumer Software: Trends and Findings from Recent Acquisitions

These transactions highlight a key trend: consumer software is becoming increasingly immersive, with companies leveraging acquisitions to enhance their offerings and diversify revenue streams. The rise of platform integration, blockchain technology, and live experiences reflects a shift toward comprehensive ecosystems that prioritise user engagement. As the sector evolves, collaboration and innovation remain critical drivers of growth and competitiveness.