Icontainers joins the waves of rounds in the logistics sector and receives an injection of $6M, the second largest investment so far this year in a Catalan startup.

About Icontainers

iContainers is an online platform for contracting containers of goods over the Internet, which began operating in Barcelona, is now also present in Miami, Florida (United States) and Ahmedabab (India), where it began operating a year ago and plans to open offices in northern Europe, in Holland and Germany.

Its model is based on improving communications and process management between the multiple actors involved in the world of international logistics: the exporter, the importer, shipping lines, consolidators and airlines, as well as providers of additional services such as warehousing, customs or international transport insurance.

IContainers continues to receive support from investors and receives €6M injection

The Catalan company has received its third round of funding amounting to €6M, which is unusual for a B2B company.

The round was led by Serena Capital, a French equity fund specialised in investing in technology companies, which has injected around €5M, in addition to the Spanish fund Vitamin K and Kibo Ventures.

For Serena Capital this investment was its first in Spain, but it has already announced that it intends to make more.

Icontainers has previously raised €2M in two rounds, most recently in 2015.

The rise of internet logistics financing

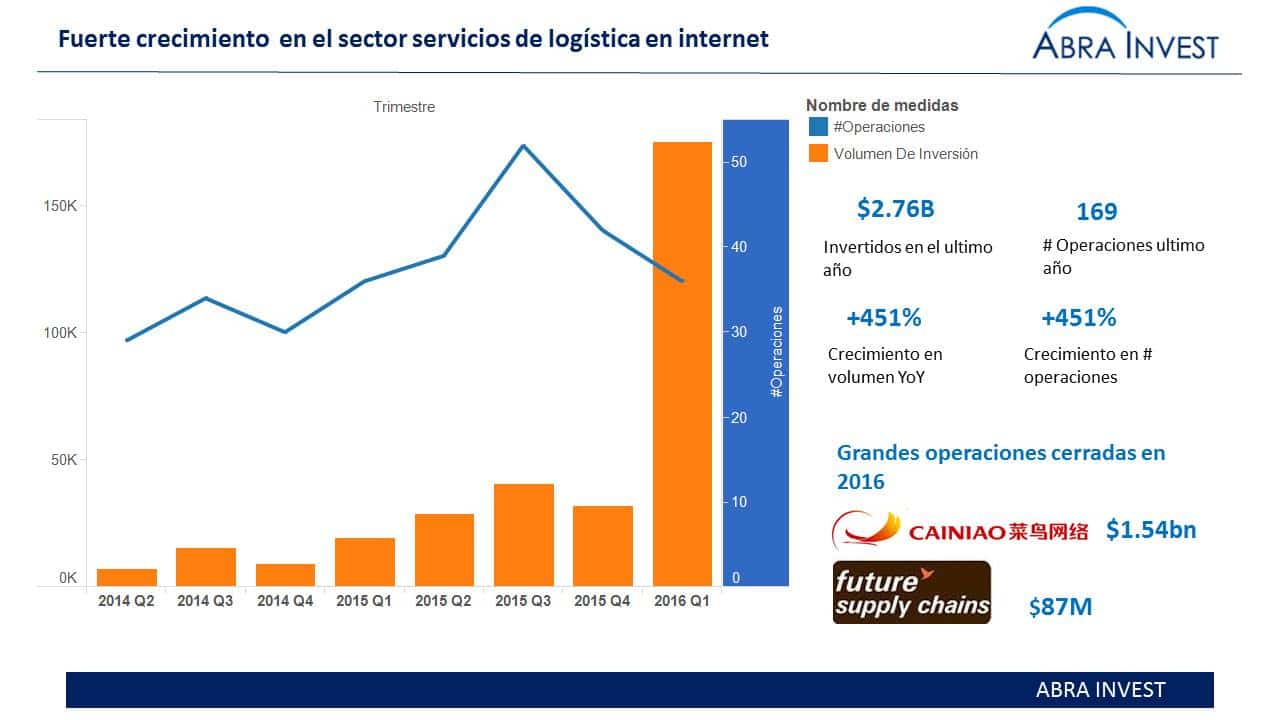

Software and online services for logistics-focused companies are receiving support from investors. Investment in the sector in 2015 grew by 451% compared to 2014, reaching a total of $2.75B.

In the first four months of 2016, rounds were closed for a very high amount, with the volume invested growing by 500% compared to the last four months of 2015.

Among the major operations that have been concluded are the following Cainiao Logistics, Alibaba's logistics business. This company, founded in 2013, closed its first round of financing in March for $1.54M.

Among the investors who invested the most in logistics in 2015 were Accel Partners (5), 500 Accelerator(4) and Sequoia Capital(4).

If you are looking for financing, contact us, Abra-Invest has an expert team in alternative financing at your disposal, call + 34 946424142 or fill in the contact form.

Other posts that may interest you

Wallapop, Letgo and HallStreet: M&A Spanish companies to gain strength in international market

Diversion of venture capital in Spanish companies: Tyba and Otogami