Meridia Capital and Closa Gordon, two companies familiar with investment, have decided to move into private equity and are setting up funds to invest in Spanish SMEs.

Meridia Capital and Closa Gordon, two companies familiar with investment, have decided to move into private equity and are setting up funds to invest in Spanish SMEs.

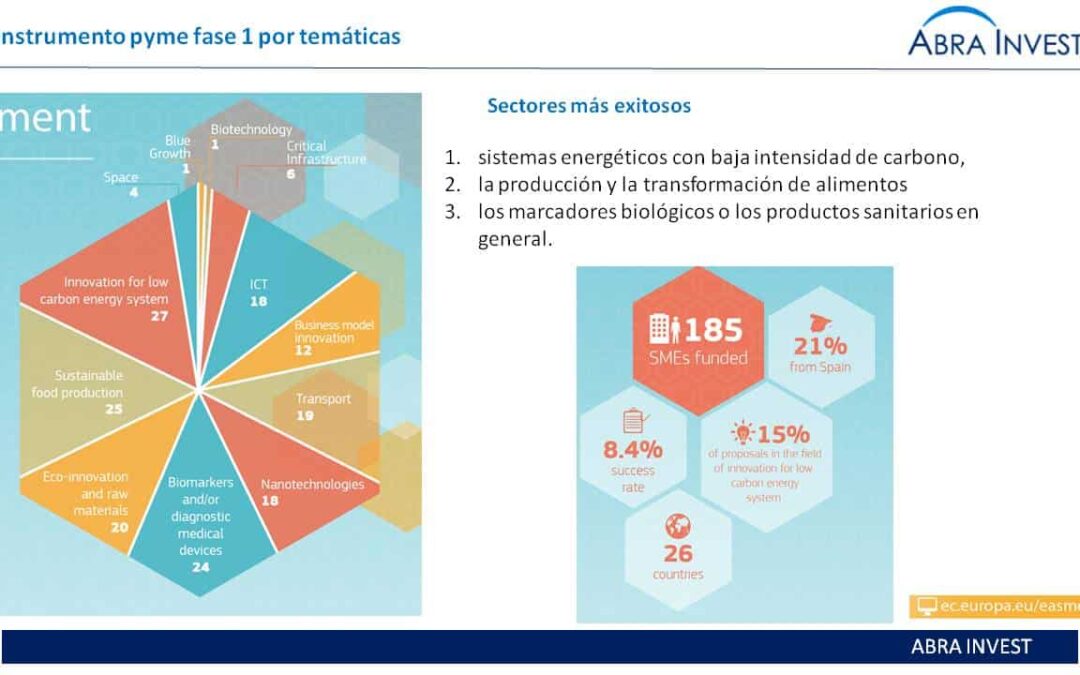

From the last SME instrument phase 1 call, with cut-off date November 2015, 185 companies have been selected out of the 2057 proposals submitted. The projects come from 22 different countries, Spain with a participation of 22%, which means 39 projects, is the country where more projects have been selected. These companies will receive €50,000 in funding.

In the last year we have seen how large funds have realised the opportunity presented by the European outsourcing market and have decided to invest in the sector. In Spain in particular, yesterday we learned about the purchase of Digitex by Carlyle, but already last September the French fund PAI Partners bought Konecta.

The German Gfk Group, one of the international references in the field of market research, and author of dozens of studies of great relevance every year, has bought the Spanish company Netquest, which focuses its activity on digital panels.

Carlos Blanco starts a new stage, puts an end to Grupo Itnet and founds Nuclio Venture Builder, a company builder of digital and disruptive businesses from which he will promote all his projects from now on.

Andalucía ya ha abierto las ayudas «incentivos a pymes para el desarrollo industrial y la creación de empleo en andalucía» aprovechando que ya han salido las primeras, hemos querido hacer un repaso de las ayudas regionales a la innovación que se prevé que saldrán este año.

Inveready has started the year with a strong commitment to biotechnology. A few weeks ago we announced that it had invested in Oncostellae, and recently we have learned that it has invested in two more companies, in Ab-BIOTICS through its debt fund and in Cuantum through its Inveready Biotech II fund.

The fashion sector has become one of the main drivers of transaction and M&A activity in the last two years. The existence of an attractive fabric of medium-sized internationalised companies with growth potential and the existence of firms that have had to undertake restructuring or needed funds to launch an internationalisation project, have paved the way for the entry of new partners in some of our best-known national players. In 2016, we have seen MCH invest in Jeanlogía.

From our business unit Logic-fin, we have detected that the use of the internet of things in the manufacturing sector is a market that is growing considerably and presents many opportunities that are now coming to light and that is why we have carried out a study of the sector.

After Jobantalent's large €23M funding round in 2015, a wave of rounds has begun in companies that make it possible to better unite the parties involved in the labour market. In the words of Felipe Navío, co-founder of jobandtalent, "the employment market needs more dynamism and this transformation cannot only come from regulatory changes that boost employment. It must also come from an improvement in the information and communication of the job offers that exist at any given time". So far this year we have heard of 3 technology companies that have received funding in this area.

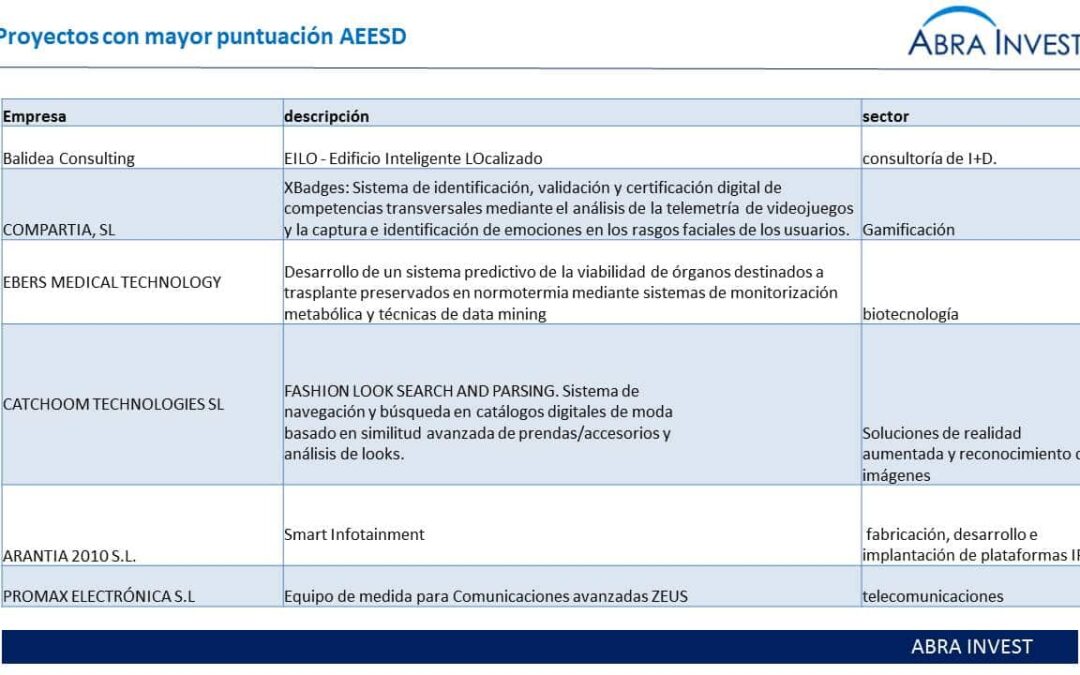

The AEESD is a programme within the Plan for Scientific and Technical Research and Innovation 2013-2016, to finance industrial research or experimental development projects in the field of ICTs. Last year's novelty was the increase of the % grant, which can reach 50% for SMEs depending on the qualification. Below are some of the projects from last year's call that received the highest scores.

BBVA had already invested in the Fintech sector in recent years as part of its transformation strategy to become the world's leading international digital bank. It has started 2016 strongly and has expanded its BBVA Ventures fund from $100M to $250M and has reached a management agreement with the US firm Propel Venture Partners.