After growing in mobility and Open Source, thanks to the purchase of two companies in the summer, in September Accenture bets on cloud solutions, a sector it already leads in Spain, and buys New Energy Group, a company specialised in Salesforce solutions.....

Palacios buys Quijote and Fuentetaja

Less than a year has passed since the international private equity group Carlyle took control of Palacios and it has already begun to make acquisitions to fulfil its strategy of expansion and diversification.

Miura has invested +€650M in 26 companies since 2008

Miura has just joined Tekman Books, a leading company in Spain in the development and marketing of innovative educational programmes for infant, primary and secondary school students. We analyse the investments made in the last year.

Iproteos and Oryzon: Spanish biotechs with the support of investors and progressing towards the market

Good news for Spanish biotech, Iproteos has received a €1.5M round. Oryzon, which has been receiving venture capital backing since 2009, was able to go public last year and this week, after the good results published for its product, its share price has risen by 40%.

Canada's Enghouse Systems buys Presence Technology for €15.8M

Enghouse, with the acquisition of the company Presence, is another in a wave of acquisitions in the software technology sector with the aim of growing in the Spanish-speaking market.

New funds in the tech ecosystem: Uninvest, 4Founders Capital and Inveready

In the first half of November, new funds for the technology sector were announced and will come to the market in early 2017.

Mab companies increase capital: Agile and Secuoya

Mab-listed audiovisual media companies Agile and Secuoya want to grow, either through acquisitions or new projects. To do so, Agile and Secuoya have decided to raise capital in order to do so.

Swiss company Acutronic Robotics buys Bilbao-based Erle Robotics

Basque company Erle Robotics, which develops drones and other robotic devices, has just been acquired by Swiss company Acutronic, which will allow it to 'play in a new global league and drive the next generation of robotic solutions for industry' according to its founders.

Verse, Satlantis, Untruck young Spanish companies receive investment for growth

In the last month we have seen Spanish technology companies in potential niche markets that have decided to count on the support of venture capital to grow and be able to compete internationally. From fintech applications such as Verse, to space imaging companies such as Satlantis.

GfI buys Spanish BPO specialist Efron Consulting

The French multinational is seeking to enter the Latin American market and strengthen its position in the banking and insurance sector.

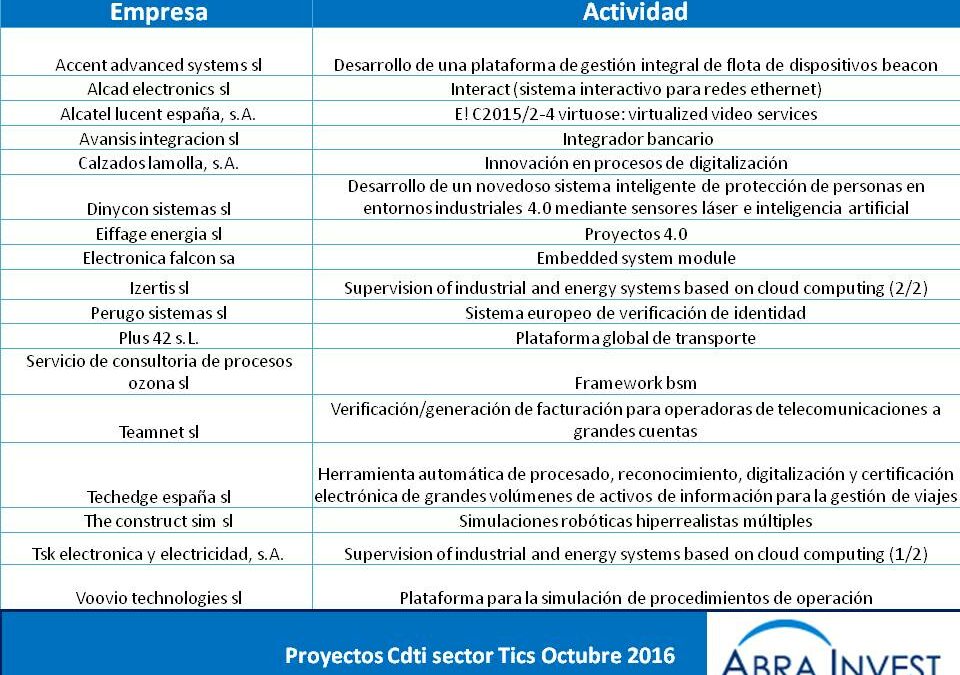

Cdti approves 17 projects in the ICT sector in October

17 Spanish companies in the ICT sector received funding from the Cdti in October. Among the subsectors in which they operate, energy and industry 4.0 stand out. The Cdti, which depends on the Ministry of Economy, finances innovation and technological development of Spanish companies, with a budget of 1,792 million euros for 2016.

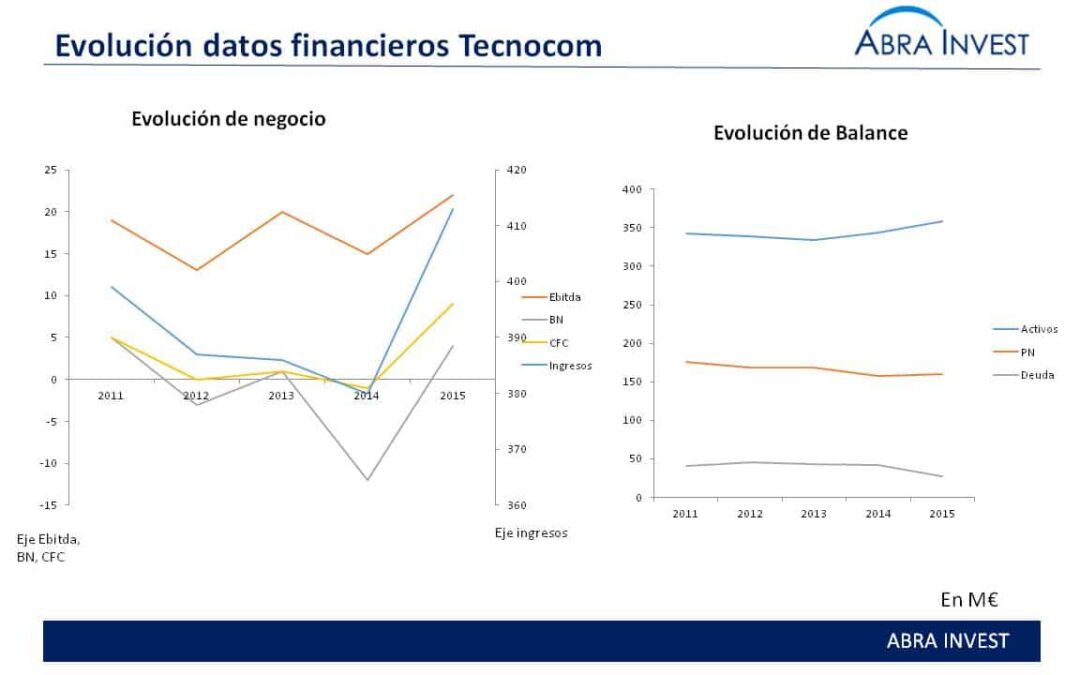

Tecnocom's turnover has grown by 5% so far this year and its shares have appreciated by 197%.

Tecnocom is a Spanish technology company listed on the Madrid Stock Exchange since 1987. In 2006, Tecnocom began a corporate expansion process with the aim of becoming a leader in the Spanish information technology market. It currently offers consultancy and outsourcing services for the development, maintenance and support of computer applications for different sectors such as banking, insurance, public administration and industry. Although it operates in the international market, 80% of its sales come from national clients.