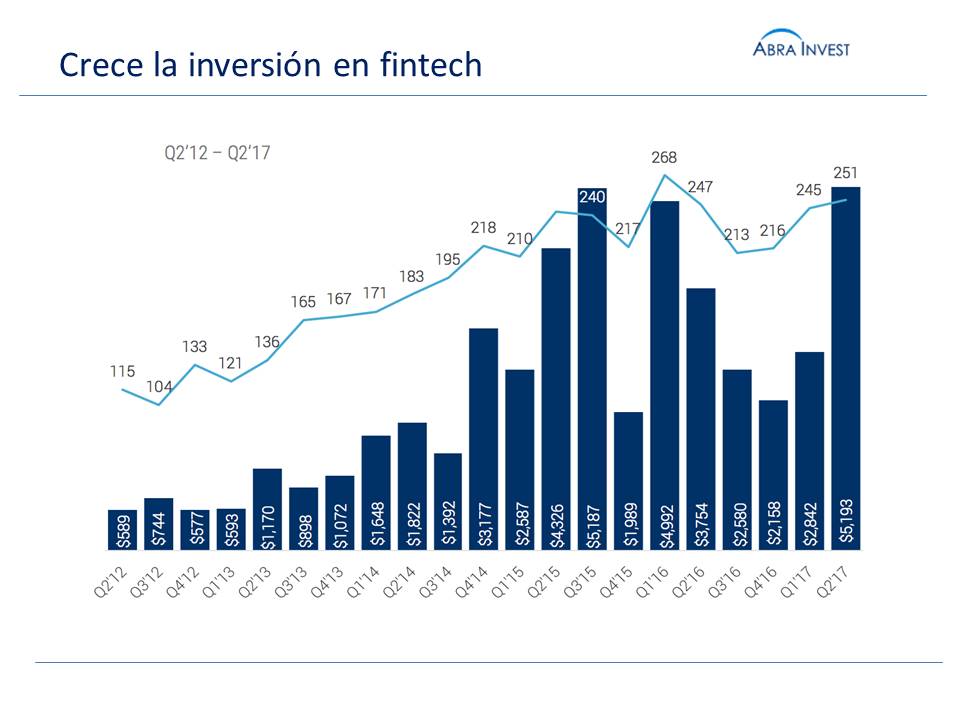

Spain's Besepa, a company that offers solutions to automate banking management for small and large companies, has been sold to Enxendra Technologies. We note that financial technology continues to gain market share and more and more companies are specialising in this sector. To support this statement, we have conducted an analysis of the sales of companies in the FinTech sector for SMEs globally.