Funding from the Ministry of Industry, Energy and Tourism, for companies that have invested in innovative business projects or growth.

ICF 2014: providing guarantees for startups to get bank financing

Obtaining bank financing for a start-up is often linked to guarantees that are difficult for entrepreneurs to obtain. The ICF helps SMEs operating in Catalonia to solve this problem by granting guarantees of up to 70% for the formalisation of bank loans. The guarantees can be used both to finance working capital and to finance investments.

Venture capital takes advantage of the opportunity that natural language provides.

In recent years, several natural language processing companies have been created that offer advantages for day-to-day business. Venture capital and large corporations have wanted to take advantage of this opportunity, as Inversur Capital has just invested in Inbenta.

Impact of the amendment to the law on debt refinancing and debt restructuring

On 7 March, a series of measures were approved in relation to debt refinancing and restructuring. Among the measures introduced, we would like to analyse those that may have an effect on investment strategies and the sale of mortgage debt assets.

Mergers in the tourism sector

In recent years, the tourism sector has undergone several changes, one of which has been the use of new technologies by customers to find out about the wide variety of offers and organise their trips. This has revolutionised the tourism offer, which has wanted to take advantage of this great opportunity, carrying out numerous purchasing operations to adapt to the technological market or to take advantage of the opportunity that the Internet gives to open up to new geographical markets.

Caixa Capital Risc launches a new fund in the Biotech sector

Caixa Capital Risc, the "la Caixa" group's venture capital manager for early-stage innovative companies, which had 4 investment vehicles specialising in Biotechnology, Industry and ICT, has launched a new Biotech fund together with the CDTI.

Strong activity in the E-learning sector.

Due to the rise of new technologies, learning has become much easier and more fun. Investors have realised that e-learning presents an opportunity for their portfolios and have been very active in this sector, especially in the last 3 years.

Artificial intelligence presents an opportunity for investors

Funding to AI-related companies has tripled in the last 5 years, and this trend seems to be growing. In 2013 alone, $581M was invested in 142 deals.

Healthcare does not feel the impact of the crisis

Healthcare is one of the few sectors that has not been affected by the crisis; in recent years Venture Capital investment in this sector has grown considerably, from 28 deals in 2009 to 37 in 2013.

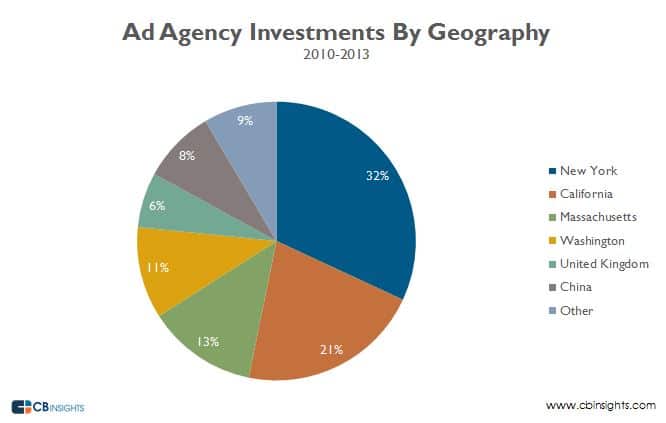

Advertising Agencies Invest over 500M$ in Startups

The boom in advertising and new technologies is increasing investor interest in this sector. Since 2010, 4 advertising agencies, through their funds, have been involved in 52 investment rounds, totalling $500M.

Media Sector USA: VCs Invest $331M in 60 Startups

Media startups raise $33M in 60 deals in 2013, an increase of 117% in funding over the previous year and 30% in the number of deals.

Venture Capital and Venture Capital in Ireland

2014 looks like a promising year for venture capital and Venture Capital in Ireland, Enterprise Ireland, the government agency responsible for supporting Irish companies has done 11 deals in the last 6 months.