Within the framework of the Spanish National Integral Tourism Plan (PNIT), the Secretary of State for Tourism has announced the Emprendetur R&D Programme, aimed at financing R&D projects related to technological innovation and tourism with the objective of supporting research and development applied to products in the tourism sector.

New call for applications for the Emprendetur Programme for young entrepreneurs

Within the framework of the Spanish National Integral Tourism Plan (PNIT), the Secretary of State for Tourism announced the Emprendetur Programme for young entrepreneurs, focused on financing R&D projects related to technological innovation and tourism with the aim of supporting research and development applied to products in the tourism sector. It seems that this November 2014 a new call will be opened in similar terms to the previous one.

M&A deals in biotech companies in Spain are on the rise

Biotech companies in Spain are becoming more attractive to corporate investors. In some sectors, integration processes are taking place, such as that of Grifols. In other cases, the stock market is becoming an alternative for the biotechnology sector.

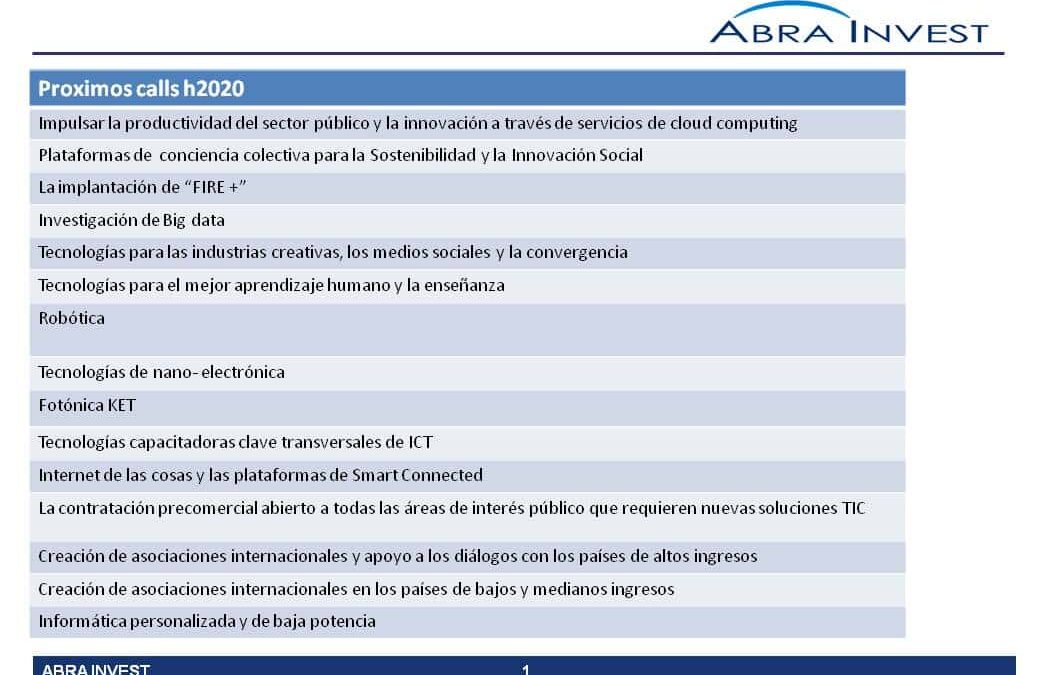

H2020 upcoming calls for the ICT sector in April 2015

Horizon 2020 (H2020), the European Union's public funding programme for research and innovation for the period 2014-2020, presents its new calls for April 2015 in the field of "Information & Communication Technologies" with a budget of € 561M.

The technologies that make energy efficiency possible

The technologies that make energy efficiency possible A recent study by McKinsey states that, over the next 20 years, at least $37 billion will be invested annually in energy efficiency, using the new technologies available. American investors have been investing in the sector for some years now, with very good results, such as Hannon Armstrong, which last year made its debut on the New York stock exchange, with notable success. In Spain, the first funds focused on this sector are already being created.

In which sectors does European venture capital invest?

Since 2012, the biotechnology sector has received the most investment with 1.85Bn$ in 126 deals, accounting for 18% of total venture capital investment. However, investments in ICT-related companies are currently gaining momentum, especially in sectors such as analytics, fintech and online food and hotel services, where large deals have been made.

Biotechnology in Spain finds investors

One of the main barriers to the growth of Spanish biotech companies is their small size (>95% less than 250 employees), which prevents them from accelerating their entry into foreign markets, for example. The main cause of this small size is due to the scarcity of funding or private investment. Although a specialised national biotech venture capital ecosystem is being generated and more and more deals are being closed with foreign investors, there is still much room for improvement.

The Basque Government supports new entrepreneurial SME initiatives

The Basque Government and the Provincial Councils have launched a plan to support entrepreneurship with the aim of fostering the culture of entrepreneurship, increasing new business ideas and focusing on intra-entrepreneurship, as well as complementing the support plans for entrepreneurs and encouraging the emergence of new entrepreneurs.

Investment analysis in the Machine Learning sector

"Machine learning is attracting a lot of interest from tech giants, who are spending a lot of money and effort to hire the best machine learning researchers. Companies in the sector are aware of this and are making a...

The Basque Government's priorities: advanced manufacturing, energy and biosciences, to gain competitiveness in Europe.

The Basque Government has begun to explain to Basque companies the priorities for specialisation in certain fields in which to carry out a large part of the public funding in R&D in which three meta-priorities are set: Advanced Manufacturing, Energy and Micro-bio-nano Convergence for Health. The development of a smart specialisation strategy is already a prerequisite for any country or region to be able to access the funding offered by major European projects.

1 S 2014: Acquisitions in technology companies on the rise

Los inversores corporativos mejoran su confianza en Europa y optan por el crecimiento vía fusiones y adquisiciones de empresas tecnológicas alcanzando el máximo desde el 2012. El primer semestre de 2014 con 94 operaciones presenta la mayor cifra de fusiones y...

Investment analysis of the natural language industry

Natural language processing (NLP) is a field of ICT that studies the interactions between computers and human language. The level of performance has improved substantially in recent years. As an effect of this phenomenon, during the last few...