The Marketplace is a booming sector in continuous movement as we defined in the articles Marketplace Leaders and Adevinta acquires eBay Cassifieds Group. In this article we will focus on the most prominent funding rounds in the Marketplace sector for various reasons. These are the Seed and Late Stage rounds. Funding rounds can be simply defined as processes by which companies raise new capital through different types of investments.

Funding rounds in the Marketplace sector: Rounds Seed

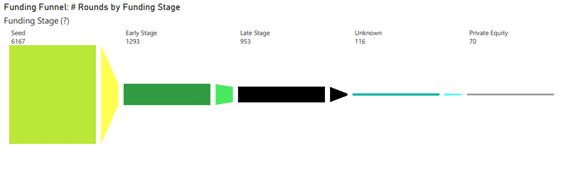

Looking at the figure "Funding Funnel: # Rounds by Funding Stage" taken from BT's analysis of the sector, it is clear that today the funding rounds in the Marketplace sector that stand out for their predominance are the Seed rounds, better known as Seed rounds. They are characterised by the fact that they are the first rounds of funding received by companies, usually start-ups. The funds raised in these rounds are usually earmarked, among other things, for the development of the company's product or service, or for the structural development of the company. Incubators or Business Angels are the types of funds that most often invest in these seed rounds.

In the Funding Funnel shows that, as of today, 68% of the funding rounds in the Marketplace sector, i.e. 6167 rounds, are Seed rounds. The graph shows a very staggered figure, especially on the left-hand side, which is indicative of the fact that the sector is experiencing strong growth. The number of Seed rounds, as we can see, often serves as an indicator of growth, stagnation or decline in a sector, since the more new companies there are in the sector, the more Seed rounds there will be in proportion to the others. This explains the great movement in the sector.

Funding rounds in the Marketplace sector: Rounds Late Stage

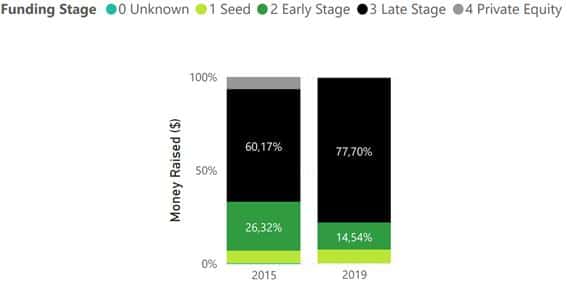

On the other hand, it is important to highlight the amount raised in Late Stage rounds of financing in the Marketplace sector, especially those that took place in 2015 and 2019. Late Stage rounds are usually Growth rounds, i.e. rounds aimed exclusively at the growth or expansion of the company. These are for companies already established in the sector, so the rounds usually raise a much larger amount of money than Seed rounds, for example.

In terms of funding rounds in the Late Stage Marketplace sector in 2015, the total amount of money raised in the Late Stage Marketplace sector accounted for just over 60% of the total money received in all rounds that year. This percentage, representing $5.1bn, is largely due to a massive round by one of the industry leaders, Airbnb, a popular marketplace that enables people to discover and book accommodation online, which raised $1.5bn in a single round, in addition to a smaller round in which it received $100m.

This amount raised ($1.6 billion) represents one third of the total amount raised in the Late Stage rounds that year, which is not insignificant.

On the other hand, Late Stage collections in 2019 represent almost 80% of the total (totalling more than $9.137 billion).

That year was MercadoLibre which raised a massive round compared to the rest, raising USD 1,800M, representing about 20% of the total raised in such rounds. MercadoLibre is one of the world's largest marketplaces, with a major presence in the South American market, offering primarily an automated online commerce service that allows businesses and individuals to list items and make their sales and purchases online in a fixed price or auction-based format, just like eBay (the second largest company in the sector).

The image below shows the percentage of money raised from each type of funding round out of the total raised, defined by colour.