Techstars, 235 FinTech investments

The famous US Venture Capital is the investor with the most companies invested in the FinTech sector, no less than 235 companies. Techstars is a global platform that offers investment and innovation through its more than 3,200 investments. Its mission is to change the world through the thousands of entrepreneurs in its many markets. In addition, they work closely with their clients because they believe that collaboration leads to innovation.

As we have seen, Techstars has made more than 200 Fintech investments in companies in the sector, a market that we at BakerTilly have analysed using the Investment Analysis 2021 FinTech. In this analysis you will be able to see unpublished information about the most active investors free of charge, mergers and acquisitionstrends in the sector, etc.

The Fintech sector could be defined as the combination of technology and finance, which has led it to become one of the markets with the highest number of transactions in terms of investments and mergers and acquisitions. In this way, it has managed to keep the market completely buoyant and to outperform year after year.

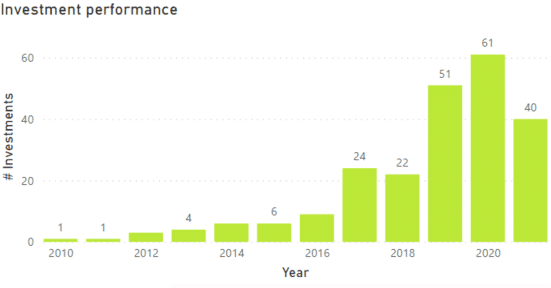

Investment performance

Techstars did not want to be left behind and has demonstrated this by being the leading Venture Capital firm in the sector, making almost all of the FinTech investments in the sector over the last 5 years. In fact, last year, 2020, it made 25% of the total investments, and this year it looks set to exceed this figure, having invested in 40 companies so far.

FinTech investment strategy

The graph shows Techstars' strong growth in investments in the sector, which it expects to grow year on year. In the last year it has been investing in FinTech companies focused on different segments:

- Companies Software dedicated to improving financial processes: One example is Pilot, a US company that offers a platform with solutions for various financial services such as accounting, tax and CFO, only for growing companies.

- Companies within the segment of the CryptocurrenciesOf the last 10 investments made, 4 have been in FinTech companies focused on cryptocurrencies. One example is the investment in the French company Dfns, dedicated to the security of cryptocurrency processing.

- Businesses specialising in Methods of paymentCompanies dedicated to improving mobile payment processes, such as the American company Banch, or directly improving payment processes to make them simpler, faster and more secure, such as Facenote, also an American company that offers biometric payments and access through facial recognition in a private, secure and compliant way.

In conclusion, it can be said that the trend in this Top 1 Venture Capital is to look for companies in the FinTech sector that are purely innovative, whether dedicated to new trends such as cryptocurrencies or companies seeking innovation in processes as common as a transfer, as we have seen with Facenote.